137

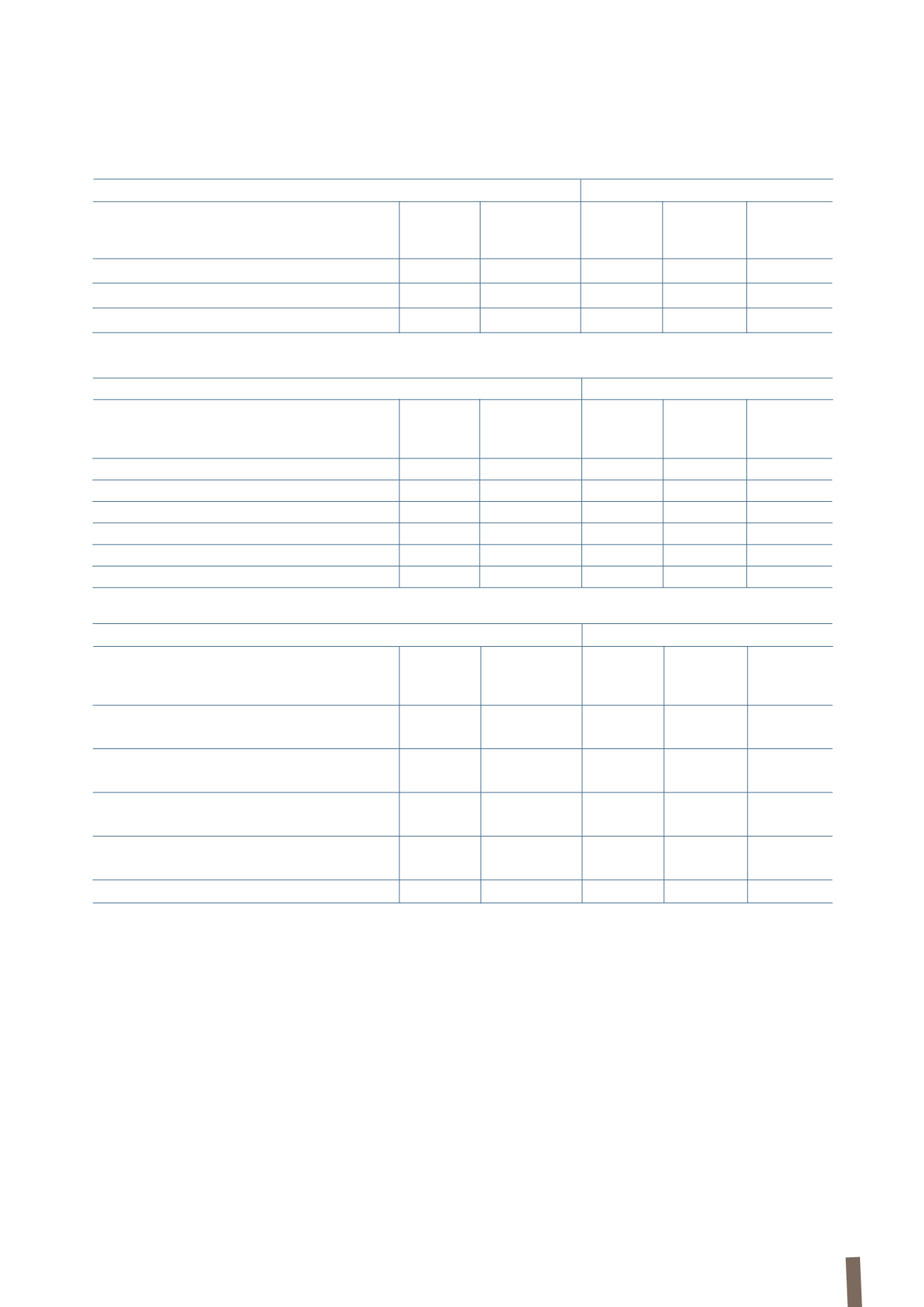

(in millions of Euro)

2013

2012

CONSOLIDATED INCOME STATEMENT

Published (*)

Effects

Restated Published (*)

Effects

Restated

application

application

IFRS 10 & 11

IFRS 10 & 11

Sales of goods and services

7,273

(275)

6,998

7,848

(274)

7,574

Profit/(loss) before taxes

222

(4)

218

242

(3)

239

Net profit/(loss) for the year

154

(2)

152

169

(1)

168

(in millions of Euro)

31 December 2013

31 December 2012

CONSOLIDATED STATEMENT

Published (*)

Effects

Restated Published (*)

Effects

Restated

OF FINANCIAL POSITION

application

application

IFRS 10 & 11

IFRS 10 & 11

Non-current assets

2,343

14

2,357

2,467

(2)

2,465

Current assets

3,347

(185)

3,162

3,539

(149)

3,390

Assets held for sale

12

-

12

4

-

4

Equity

1,195

(11)

1,184

1,159

(12)

1,147

Non-current liabilities

1,645

(44)

1,601

2,016

(15)

2,001

Current liabilities

2,862

(116)

2,746

2,835

(124)

2,711

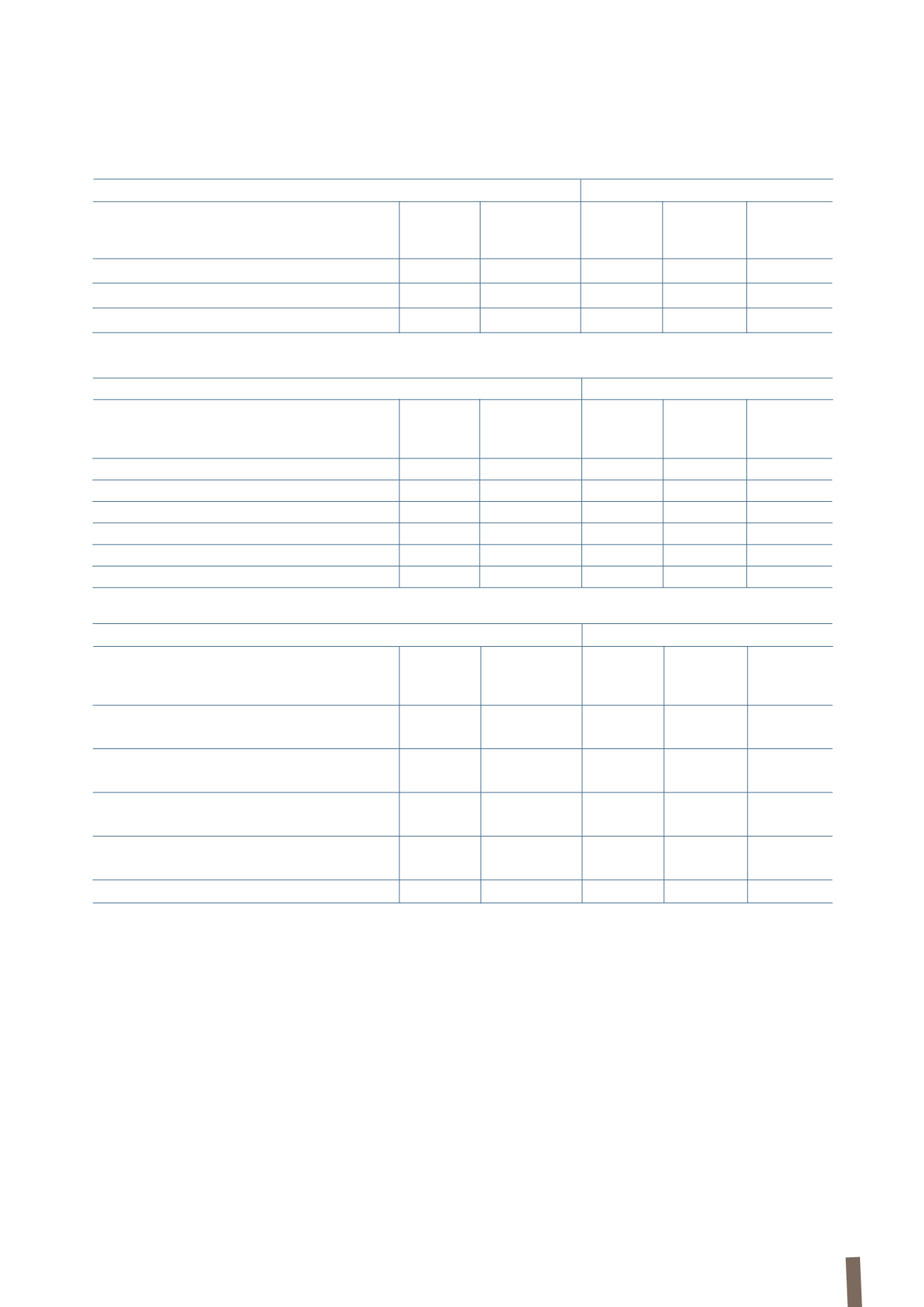

(in millions of Euro)

2013

2102

CONSOLIDATED STATEMENT

Published (*)

Effects

Restated Published (*)

Effects

Restated

OF CASH FLOWS

application

application

IFRS 10 & 11

IFRS 10 & 11

Net cash flow provided by/(used in)

operating activities

399

4

403

546

(15)

531

Net cash flow provided by/(used in)

investing activities

(147)

7

(140)

(227)

5

(222)

Net cash flow provided by/(used in)

financing activities

(472)

(36)

(508)

(238)

14

(224)

Currency translation gains/(losses)

on cash and cash equivalents

(31)

(1)

(32)

4

-

4

Total cash flow provided/(used) in the year

(251)

(26)

(277)

85

4

89

The numbers presented above are the result of a preliminary

evaluation exercise and could differ from the final ones.

In November 2013, “

Investment Entities (Amendments to IFRS

10, IFRS 12 and IAS 27)

”, a document issued by the IASB on

31 October 2012, was published in the Official Journal of the

European Union. These amendments are intended to provide

an exception from the consolidation obligations of

IFRS 10

for

companies that manage and measure their investments on

a fair value basis. These amendments will apply to financial

years beginning on or after 1 January 2014 and will not entail

any significant effects for the Group.

On 16 December 2011, the IASB published amendments to

IAS

32: Financial Instruments: Presentation

to clarify the criteria

for offsetting financial assets and liabilities.

The amendments clarify that:

• the right of set-off between financial assets and liabilities

must be available at the financial reporting date and not

contingent on a future event;

• this right must be enforceable by all counterparties both in

the normal course of business and in the event of insol-

vency or bankruptcy.

The document was published in the Official Journal of the

European Union on 29 December 2012. The amendments are

(*) The published amounts refer to the Consolidated Financial Statements presented in this Annual Report.

The principal effects of the changes described above are as follows: