Consolidated Financial Report |

DIRECTORS’ REPORT

2014 Annual Report

Prysmian Group

56

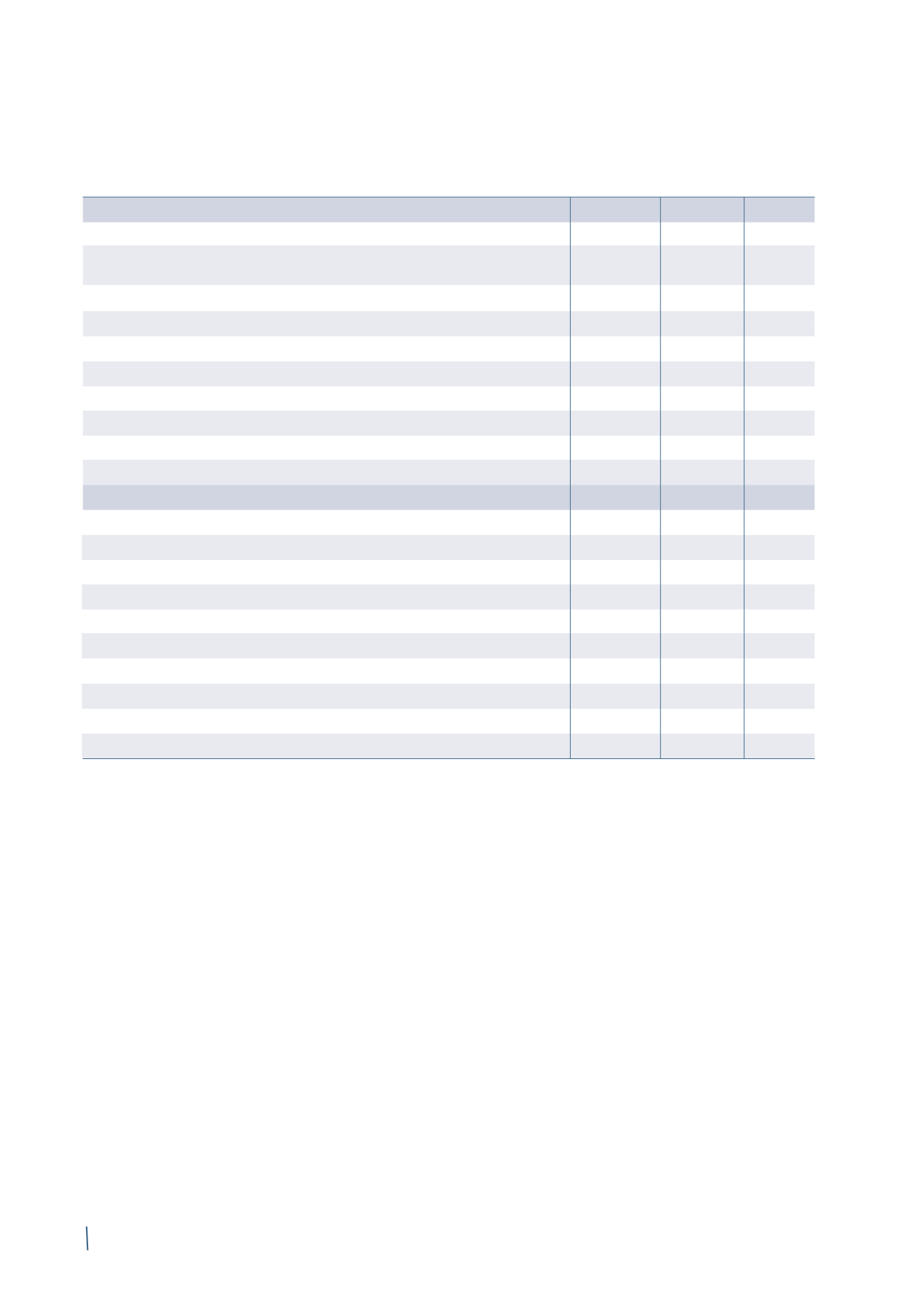

2014

2013 (*)

Change %

2012 (*)

Sales

4,491

4,649

-3.4% 5,122

Adjusted EBITDA before share of net profit/(loss)

of equity-accounted companies

221

259

-15.0% 289

% of sales

4.9%

5.6%

5.6%

Adjusted EBITDA

239

276

-13.6% 304

% of sales

5.3%

5.9%

5.9%

EBITDA

195

250

-22.0% 235

% of sales

4.3%

5.4%

4.6%

Amortisation and depreciation

(62)

(66)

(72)

Adjusted operating income

177

210

-16.2% 232

% of sales

3.9%

4.5%

4.5%

Reconciliation of Operating Income / EBITDA to Adjusted Operating Income / Adjusted EBITDA

EBITDA (A)

195

250

-22.0% 235

Non-recurring expenses/(income):

Company reorganisation

38

29

50

Draka integration costs

-

-

4

Tax inspections

-

-

1

Environmental remediation and other costs

-

(3)

3

Gains on asset disposals

-

(2)

(1)

Other net non-recurring expenses

6

2

11

Total non-recurring expenses/(income) (B)

44

26

69

Adjusted EBITDA (A+B)

239

276

-13.6% 304

(*) The previously published prior year comparative figures have been restated following the introduction of IFRS 10 and IFRS 11 and a new method of classifying

the share of net profit (loss) of associates and joint ventures.

The Energy Products Operating Segment, covering the busi-

nesses offering a complete and innovative product portfolio

for a variety of industries, is organised into the businesses of

Energy & Infrastructure (including Power Distribution, Trade &

Installers) and Industrial & Network Components (comprising

Specialties & OEM, Oil & Gas, Elevators, Automotive and

Network Components).

Sales to third parties by the Energy Products operating

segment amounted to Euro 4,491 million in 2014, compared

with Euro 4,649 million in 2013, posting a negative change of

Euro 158 million (-3.4%), due to the combined effect of the

following main factors:

• increase of Euro 65 million (+1.4%) due to organic sales

growth, reflecting volume recovery in Northern and

Eastern Europe and growth in Asian countries, as partially

offset by negative organic growth in South America;

• reduction of Euro 130 million (-2.0%) for exchange rate

fluctuations;

• sales price reduction of Euro 93 million (-2.8%) for metal

price fluctuations.

Adjusted EBITDA for 2014 came to Euro 239 million, down

Euro 37 million (-13.6%) from Euro 276 million in 2013.

The following paragraphs describe market trends and

financial performance in each of the business areas of the

Energy Products operating segment.

REVIEW OF ENERGY PRODUCTS OPERATING SEGMENT

(in millions of Euro)