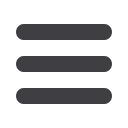

29

140

120

100

80

60

40

20

0

Prysmian

FTSE MIB

EURO STOXX Industrials

PERFORMANCE OF PRYSMIAN STOCK VERSUS BENCHMARKS SINCE IPO

May-07

Jul-07

Sept-07

Nov-07

Jan-08

Mar-08

May-08

Jul-08

Sept-08

Nov-08

Jan-09

Mar-09

May-09

Jul-09

Sept-09

Nov-09

Jan-10

Mar-10

May-10

Jul-10

Sept-10

Nov-10

Jan-11

Mar-11

May-11

Jul-11

Sept-11

Nov-11

Jan-12

Mar-12

May-12

Jul-12

Sept-12

Nov-12

Jan-13

Mar-13

May-13

Jul-13

Sept-13

Nov-13

Jan-14

Mar-14

May-14

Jul-14

Sept-14

Nov-14

Jan-15

Mar-15

Continuously in contact

with the market

PRYSMIAN STOCK VERSUS BENCHMARKS SINCE IPO

“In 2014, our Group has shown a resilient

performance, despite the challenges of

the global macro-economic environment,

creating the conditions for a more robust

performance in 2015”

. - Cristina Bifulco,

Director of Investors Relations at Prysmian,

makes an upbeat assessment as many

brokers agree on a positive outlook for 2015.

Bifulco added that

“The financial markets

expects Prysmian to continue to create

value and to be perfectly positioned to

benefit from the positive impacts of the

quantitative easing in Europe.”

According

to Cristina,

“The company is perceived as

one of the best managed in the capital

goods sector and the best-in-class among its

peers”

.

In 2014, brokers’ coverage, of Prysmian

remained very high and geographically

diversified, with 23 regularly following

the stock: Banca Akros, Banca Aletti,

Banca IMI, Banca Profilo, Barclays Capital,

Berenberg, BofA Merrill Lynch, Citi, Credit

Suisse, Equita, Espirito Santo, Exane

BNP Paribas, Fidentiis, Goldman Sachs,

Hammer Partners, HSBC, Intermonte, JP

Morgan, Kepler Cheuvreux, Mediobanca,

Morgan Stanley, Natixis and UBS. The

Investor Relations office maintained regular

contacts with investors through the website

www.prysmiangroup.com ,with its updated

graphics and content, corporate documents,

press releases and all other information

concerning the Group, in Italian and English.

IR Director

on upbeat note