243

Unless specifically indicated below, the reasons behind

the more significant changes in individual items within

the Prysmian S.p.A. statement of financial position

are described in the Explanatory Notes to the Financial

Statements of Prysmian S.p.A., to which reference should be

made.

Net fixed assets basically comprise the controlling interests

in Prysmian Cavi e Sistemi S.r.l., Draka Holding N.V. and in

the Group’s Italian companies.

The increase in investments in subsidiaries of Euro 67,538

thousand since 2012 is due to Euro 25,757 thousand for a

capital increase by the subsidiary Prysmian Treasury S.r.l.,

Euro 40,000 thousand in capital contributions paid to the

Other income of Euro 102,068 thousand (Euro 111,038

thousand in 2012) mostly refers to amounts charged back

by Prysmian S.p.A. to Group companies for coordination

activities, for services provided by headquarters functions and

for royalties relating to patents and know-how.

Operating costs of Euro 501,444 thousand in 2013 versus Euro

53,484 thousand in 2012, refer to the purchase of strategic

materials and other consumables (Euro 453,015 thousand

in 2013 versus Euro 2,017 thousand in 2012), to the fair value

change in metal derivatives ( a positive Euro 38 thousand in

2013) and to personnel costs (Euro 48,467 thousand in 2013

versus Euro 51,467 thousand in 2012).

Net finance costs amount to Euro 38,775 thousand (Euro

35,408 thousand in 2012), mainly relating to interest accruing

on the bonds and to interest payable under the Credit

Agreement 2010 and Credit Agreement 2011.

Net income from investments amounts to Euro 219,861

subsidiary Fibre Ottiche Sud – F.O.S. S.r.l. and to a total

of Euro 1,781 thousand in increases for the pay-related

component of stock option plans, with underlying Prysmian

S.p.A. shares, for employees of other Group companies to

which no costs are recharged.

Investments in “Property, plant and equipment” and

“Intangible assets” amount to Euro 24,094 thousand in

2013 (Euro 11,573 thousand in 2012). The main investments

relate to the finance lease taken over on the Ansaldo 16

building, Research and Development function headquarters

(Euro 13,093 thousand) and to software costs (Euro 5,838

thousand), chiefly in connection with the SAP Consolidation

project. More details can be found in Note 1. Property, plant

thousand, compared with Euro 150,000 thousand in the prior

year, and mainly refers to dividends paid by the subsidiaries

Prysmian Cavi e Sistemi S.r.l. and Prysmian PowerLink S.r.l..

Income taxes are a positive Euro 28,244 thousand (Euro 21,216

thousand in 2012) and comprise the recognition of a negative

Euro 2,847 thousand for deferred tax liabilities and a positive

Euro 31,091 thousand for current taxes. The latter mainly

reflect the net positive effects of the relief provided by tax

losses transferred from some Italian companies under the

rules of the group tax consolidation.

More details about the Italian companies which have elected

to file for tax on a group basis with Prysmian S.p.A. can be

found in Note 22. Taxes, contained in the Explanatory Notes to

the Parent Company Financial Statements.

Research and development costs are fully expensed to income

as incurred; more details can be found in Note 32. Research

and development, contained in the Explanatory Notes to the

Parent Company Financial Statements.

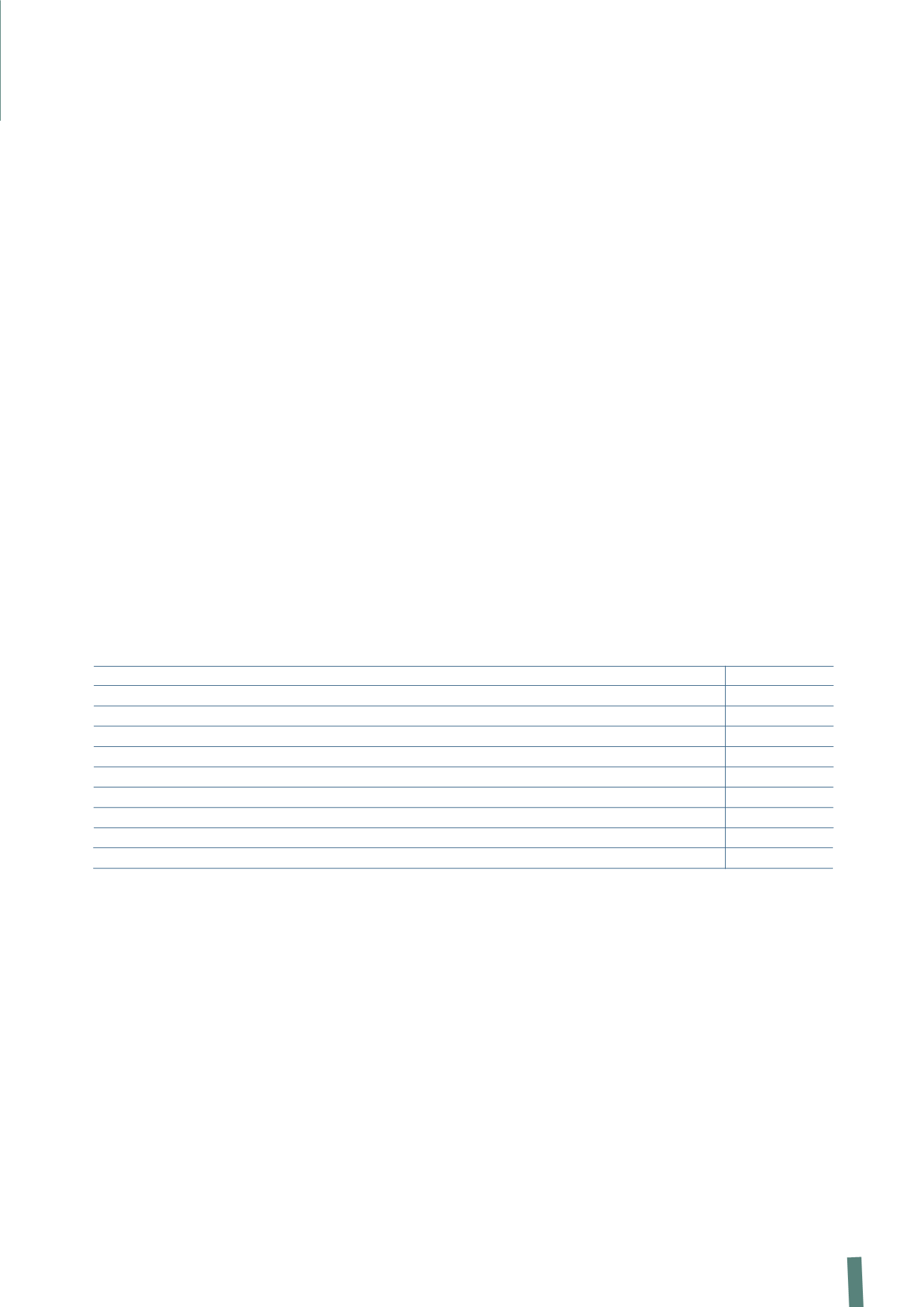

STATEMENT OF FINANCIAL POSITION

The Parent Company’s statement of financial position is summarised as follows:

Note: The composition and method of calculating the above indicators are discussed in the Directors’ Report contained in the Group Annual Report.

(in thousands of Euro)

31 December 2013 31 December 2012

Net fixed assets

1,787,648

1,721,587

- of which: Investments in subsidiaries

1,728,516

1,660,978

Net working capital

(116,147)

114,087

Provisions

(31,477)

(27,619)

Net capital employed

1,640,024

1,808,055

Employee benefit obligations

6,305

15,880

Equity

1,021,052

871,588

Net financial position

612,667

920,587

Total equity and sources of funds

1,640,024

1,808,055