245

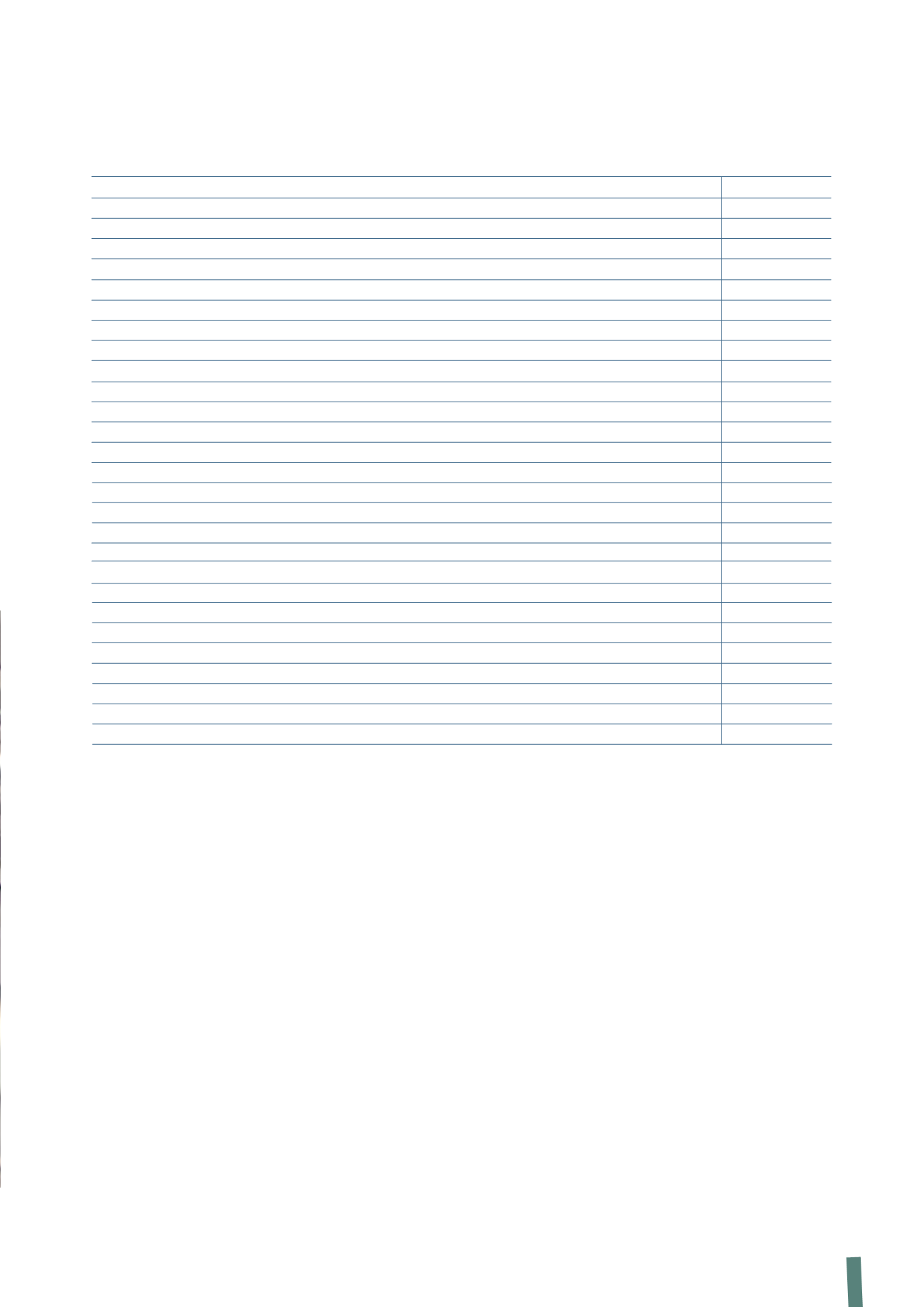

Note 10 to the Parent Company Financial Statements

presents the reconciliation of the Company’s net financial

position to the amount that must be reported under Consob

Communication DEM/6064293 dated 28 July 2006 in

compliance with the CESR recommendation dated 10 February

2005 “Recommendations for the consistent implementation

The composition of Net financial position is presented in detail in the following table.

(in thousands of Euro)

31 December 2013 31 December 2012

Long-term financial payables

Term Loan Facility

400,000

660,800

Bank fees

(3,024)

(7,326)

Credit Agreements

396,976

653,474

Non-convertible bond

398,576

397,515

Convertible bond

263,401

-

Finance leases

11,098

-

Total long-term financial payables

1,070,051

1,050,989

Short-term financial payables

Term Loan Facility

88,388

60,237

Bank fees

(570)

(678)

Non-convertible bond

15,305

15,304

Convertible bond

1,187

-

Finance leases

537

-

Other borrowings

223

722

Total short-term financial payables

105,070

75,585

Total financial liabilities

1,175,121

1,126,574

Long-term financial receivables

26

21

Long-term bank fees

-

3,919

Short-term financial receivables

55

7

Short-term financial receivables from Group companies

553,744

197,440

Short-term bank fees

4,029

3,919

Cash and cash equivalents

4,600

681

Net financial position

612,667

920,587

of the European Commission’s Regulation on Prospectuses”.

A more detailed analysis of cash flows is presented in the

statement of cash flows, forming part of the Parent Company

Financial Statements presented in the following pages.