263

information, the foreign currency debtor and creditor positions

and related financial hedging instruments reported by

Prysmian S.p.A. at 31 December 2013 are of limited relevance.

More information can be found in Note 7. Derivatives.

(b) Interest rate risk

The interest rate risk to which the Company is exposed is

mainly due to long-term financial liabilities, carrying both

fixed and variable rates.

Fixed rate debt exposes the Company to a fair value risk. The

Company does not operate any particular hedging policies in

relation to the risk arising from such contracts.

The Group Finance Department monitors the exposure to

interest rate risk and adopts appropriate hedging strategies

to keep the exposure within the limits defined by the Group

Finance, Administration and Control Department, arranging

derivative contracts, if necessary.

The net liabilities considered for sensitivity analysis include

variable rate financial receivables and payables and cash and

cash equivalents whose value is influenced by rate volatility.

The Company calculates the pre-tax impact on the income

statement of changes in interest rates.

The simulations carried out for balances at 31 December

2013 indicate that, with all other variables remaining

equal, an increase of 25 basis points in interest rates would

have decreased financial payables by Euro 146 thousand

(2012: increase of Euro 1,307 thousand), while a 25-point

decrease would have increased financial payables by Euro

146 thousand (2012: decrease of Euro 1,307 thousand). This

simulation exercise is carried out on a regular basis to ensure

that the maximum potential loss is within the limits set by

management.

(c) Price risk

This risk relates to the possibility of fluctuations in the

price of strategic materials, whose purchase price is subject

to market volatility. Following the business reorganisation

discussed in Section A. General information, the Company

is now responsible for centrally managing the purchase of

such materials from third-party suppliers and their resale

to Group operating companies. The Company is exposed to

a residual price risk on those buying positions that have not

been promptly recharged to Group operating companies. More

information about metal derivatives can be found in Note 7.

Derivatives.

(d) Credit risk

The Company does not have significant concentrations of

credit risk insofar as almost all its customers are companies

belonging to the Group. There are also no significant past due

receivables that have not been written down.

(e) Liquidity risk

Prudent management of the liquidity risk arising from the

Company’s normal operations involves the maintenance of

adequate levels of cash and cash equivalents, short-term

securities and funds obtainable from an adequate amount of

committed credit lines. The Company’s Finance Department

prefers flexibility when sourcing funds by using committed

credit lines.

At 31 December 2013, cash and cash equivalents stand at

Euro 4,600 thousand, compared with Euro 681 thousand at 31

December 2012. The Company can potentially draw down the

credit lines granted to the Group in the form of the Revolving

Credit Facility (Euro 400 million) and the EIB Loan (Euro 100

million). More details can be found in the Explanatory Notes

to the Consolidated Financial Statements (Section D. Financial

risk management).

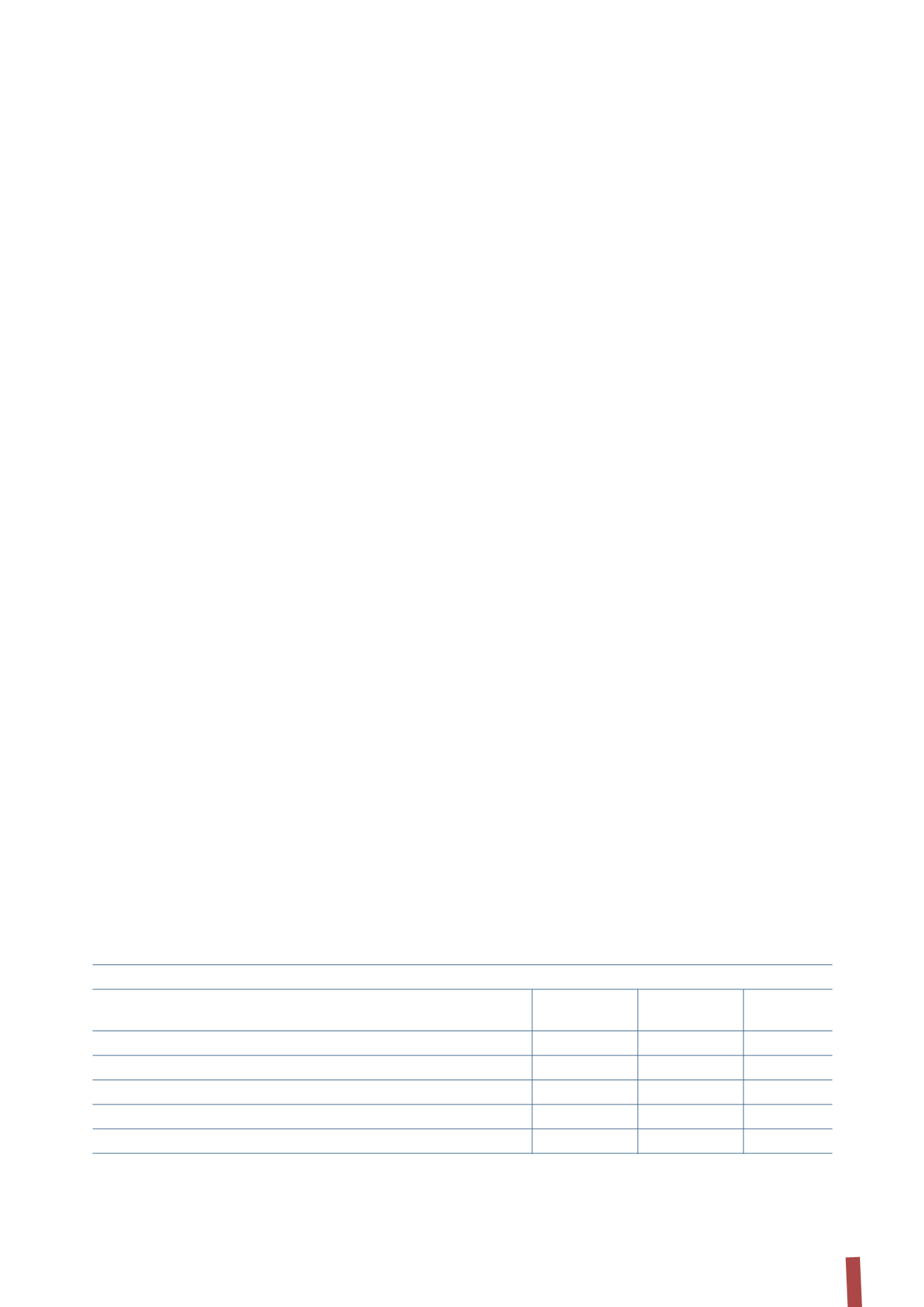

The following table presents an analysis, by due date, of the

payables and liabilities settled on a net basis. The various

due date categories are determined on the basis of the period

between the reporting date and the contractual due date of

the obligations.

(in thousands of Euro)

31 December 2013

Due within

Due between

Due between

Due after

1 year

1-2 years

2-5 years

5 years

Borrowings from banks and other lenders

140,204

418,298

672,715

-

Finance lease obligations

1,428

651

1,952

9,978

Derivatives

88

36

-

-

Trade and other payables

325,051

-

-

-

Total

466,771

418,985

674,667

9,978