PARENT COMPANY >

EXPLANATORY NOTES

270

| 2013 ANNUAL REPORT | PRYSMIAN GROUP

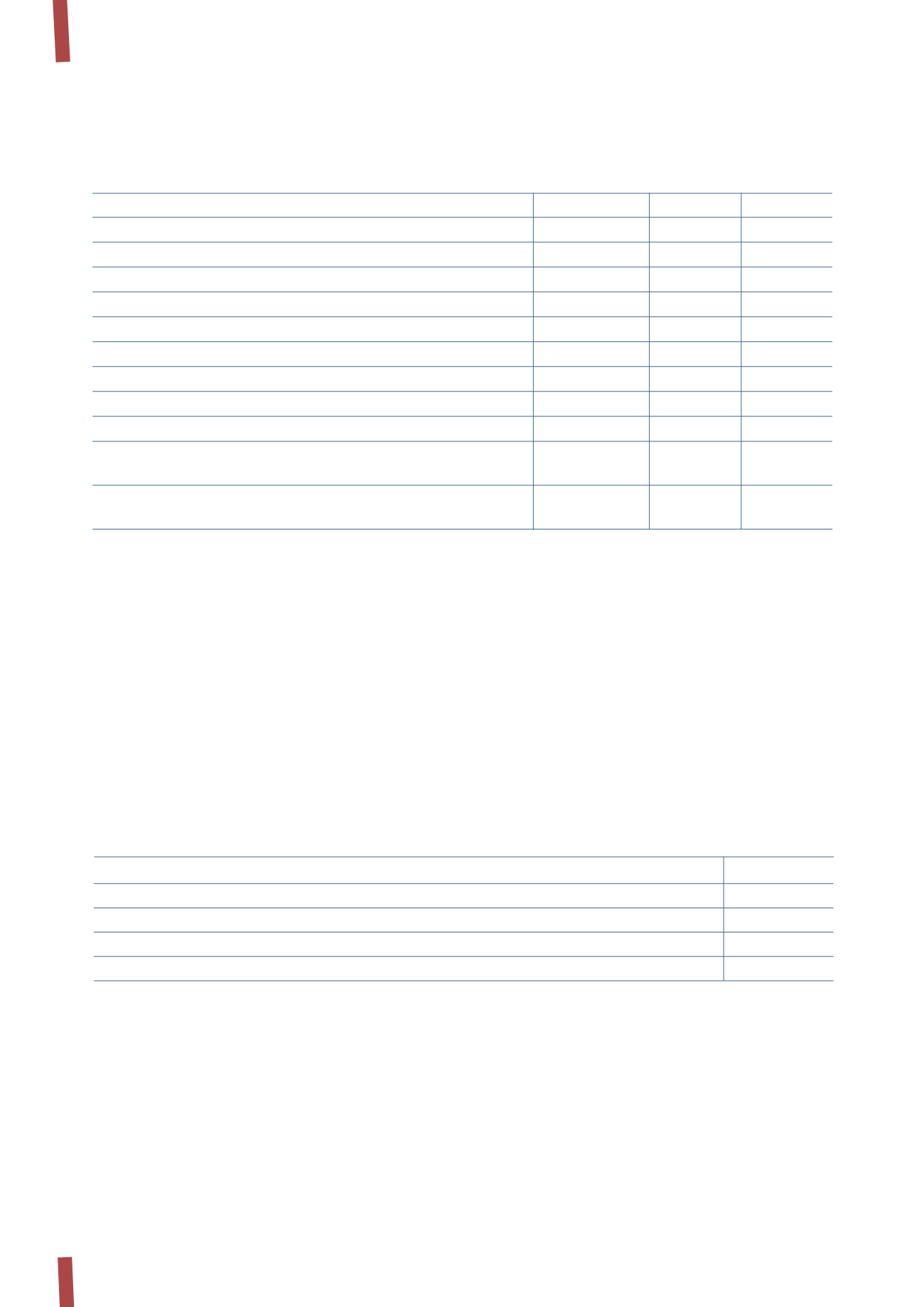

The following table summarises key information about investments held in subsidiaries:

These are detailed as follows:

4.

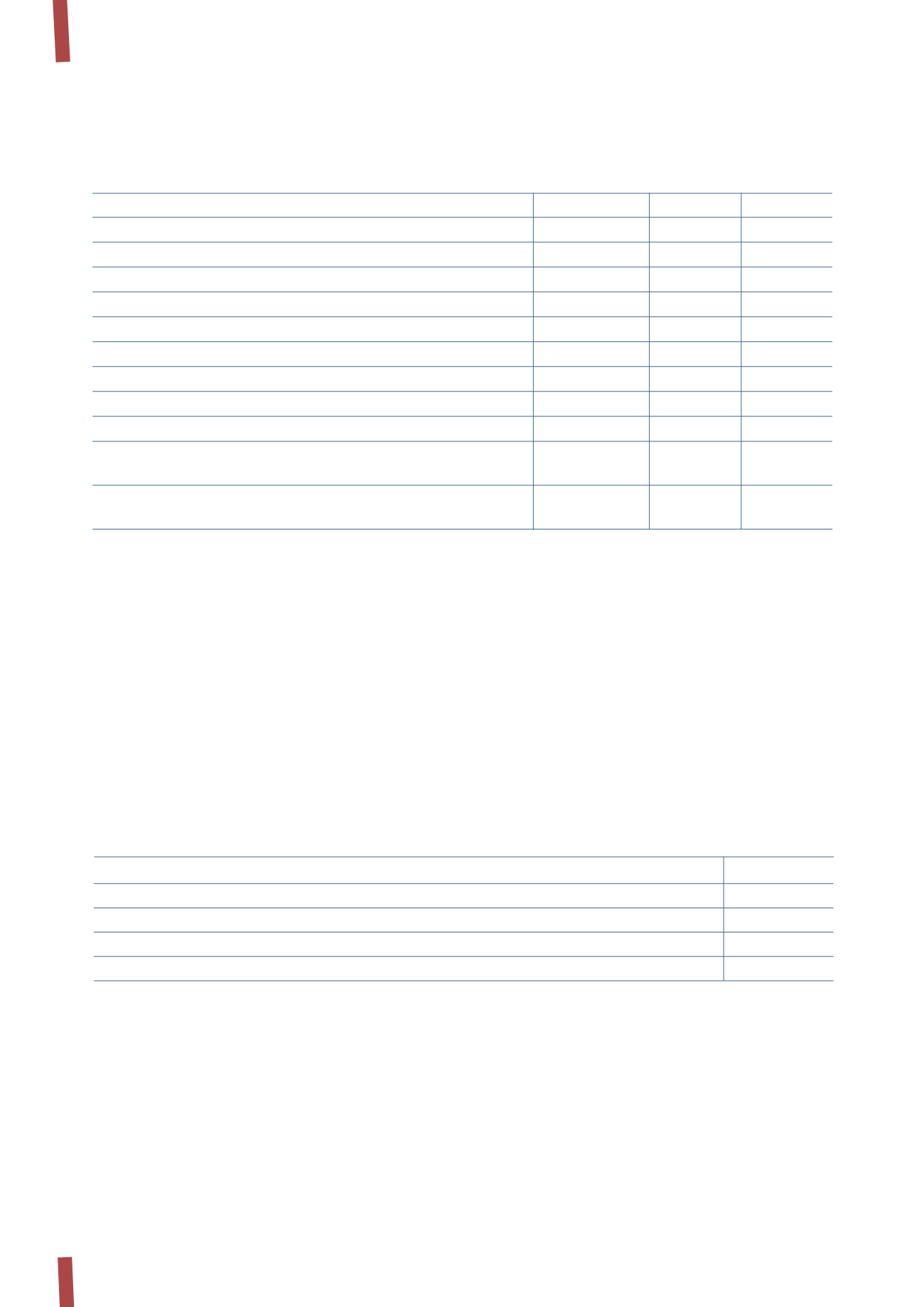

DEFERRED TAX ASSETS

(in thousands of Euro)

31 December 2013 31 December 2012

Deferred tax assets:

- Deferred tax assets recoverable beyond 12 months

1,100

3,809

- Deferred tax assets recoverable within 12 months

1,862

2,192

Total deferred tax assets

2,962

6,001

Registered office

Share capital

% owned 2013 % owned 2012

Prysmian Cavi e Sistemi S.r.l.

Milan

EUR 100,000,000

100

100

Draka Holding N.V.

Amsterdam

EUR 42,952,436

63.43

69.691

Prysmian Cavi e Sistemi Italia S.r.l.

Milan

EUR 77,143,249

100

100

Prysmian PowerLink S.r.l.

Milan

EUR 50,000,000

100

100

Fibre Ottiche Sud - F.O.S. S.r.l.

Battipaglia

EUR 47,700,000

100

100

Prysmian Treasury S.r.l.

Milan

EUR 30,000,000

100

100

Prysmian Kabel Und Systeme GmbH

Berlin

EUR 15,000,000

6.25

6.25

Prysmian Pension Scheme Trustee L.

Hampshire

GBP 1

100

100

Prysmian Kablo SRO

(1)

Bratislava

EUR 21,246,001

0.005

0.005

Jaguar Communication Consultancy

Services Private Ltd.

(1)

Mumbai

INR 34,432,100

0.00003

0.00008

Prysmian Surflex Umbilicais e Tubos

Flexiveis do Brasil Ltda

(1)

Vila Velha

BRL 158,385,677

0.000001

0.01

(1) Controlled indirectly

The process of corporate rationalisation following the

acquisition of Draka in 2011 carried on throughout 2013. It

was as part of this process that the subsidiary Prysmian

Cavi e Sistemi S.r.l. transferred its interest in two of its own

subsidiaries (Prysmian Cable Holding B.V. and Prysmian Cables

and Systems B.V.) to Draka Holding N.V. at market value. This

transfer has raised the interest of Prysmian Cavi e Sistemi S.r.l.

in Draka Holding N.V. to 36.57%, with a corresponding reduction

in the interest of Prysmian S.p.A. in this same company to

63.43%.