PARENT COMPANY >

EXPLANATORY NOTES

274

| 2013 ANNUAL REPORT | PRYSMIAN GROUP

BILANCIO ANNUALE 2013 PRYSMIAN GROUP

Share capital

Share capital amounts to Euro 21,459 thousand at 31 December

2013, consisting of 214,591,710 ordinary shares (including

3,028,500 treasury shares), with a nominal value of Euro

0.10 each. The total number of outstanding voting shares is

211,552,541, stated net of 10,669 treasury shares held indirectly.

More details about treasury shares can be found in the

subsequent note on “Treasury shares”.

Share premium reserve

This amounts to Euro 485,873 thousand at 31 December 2013,

reporting an increase of Euro 377 thousand since 31 December

2012, due to the exercise of 82,929 options under the Stock

option plan described in Note 17. Personnel costs.

Capital increase costs

This reserve, which reports a post-tax negative balance of

Euro 4,244 thousand at 31 December 2013, relates to the costs

incurred for the capital increase serving the public mixed

exchange and cash offer for the ordinary shares of Draka

Holding N.V., announced on 22 November 2010 and formalised

on 5 January 2011.

Legal reserve

This amounts to Euro 4,291 thousand at 31 December 2013,

and is Euro 3 thousand higher than at 31 December 2012

following apportionment of part of the prior year’s net profit,

as approved by the shareholders on 16 April 2013.

Treasury shares reserve

This reserve amounts to Euro 30,179 thousand at 31 December

2013, in compliance with the legal limit (art. 2357-ter of

the Italian Civil Code). It was formed during 2008 after the

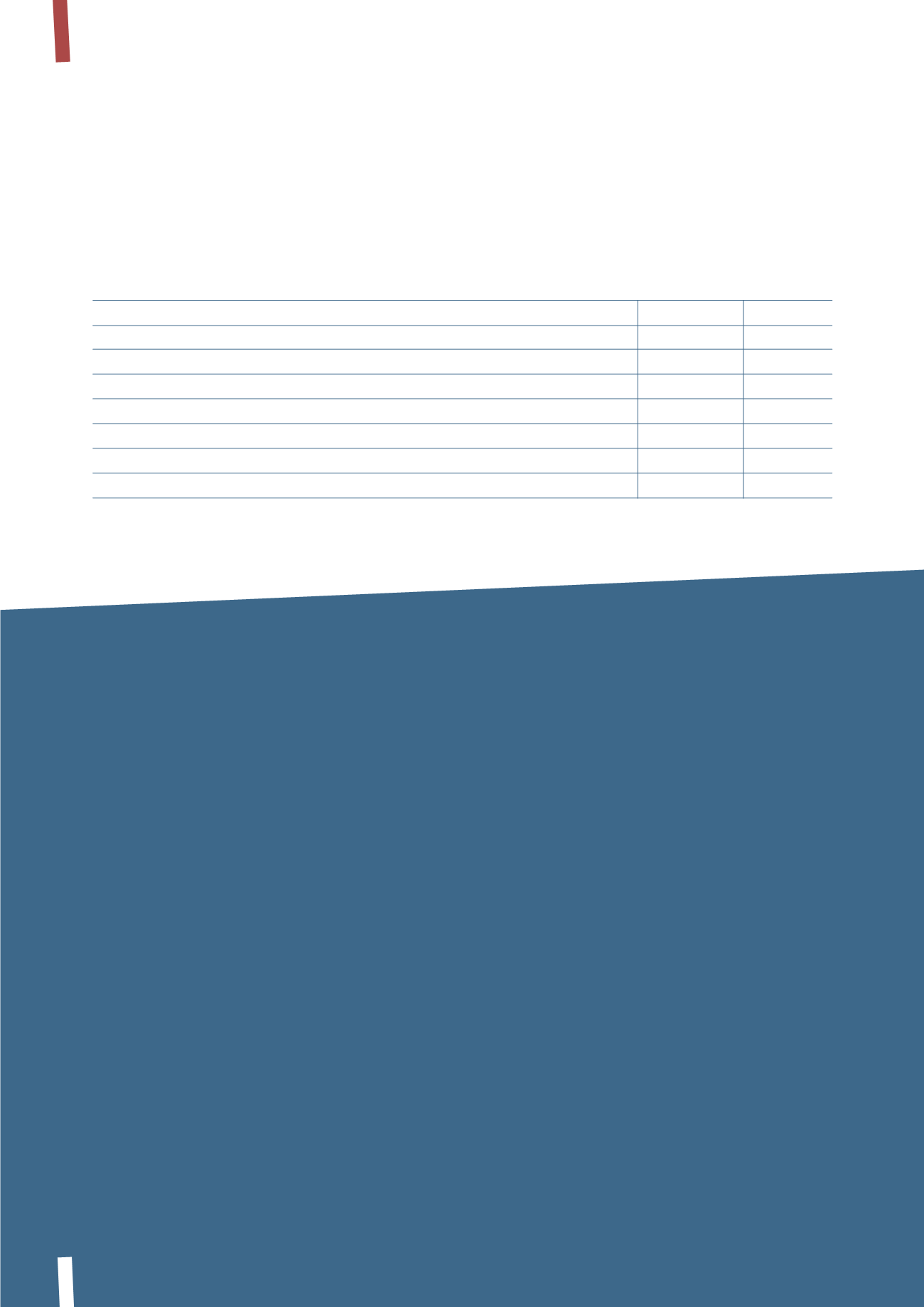

The following table reconciles the number of outstanding

shares at 31 December 2011, at 31 December 2012 and 31

December 2013:

shareholders adopted a resolution on 15 April 2008 authorising

a programme to buy back up to 10% of the Company’s shares.

Under this resolution, purchases and sales of shares had to

meet the following conditions: (i) the minimum price could

be no more than 10% below the stock’s official price reported

in the trading session on the day before carrying out each

individual purchase transaction; (ii) the maximum price could

be no more than 10% above the stock’s official price reported

in the trading session on the day before carrying out each

individual purchase transaction; (iii) the maximum number of

shares purchased per day could not exceed 25% of the average

daily volume of trades in Prysmian shares on the Milan Stock

Exchange in the 20 trading days prior to the purchase date;

(iv) the purchase price could not be greater than the higher of

the price of the last independent transaction and the highest

independent bid price currently quoted on the market. On 7

October 2008, the Board of Directors subsequently granted

the Chief Executive Officer and Chief Financial Officer separate

powers to purchase up to 4 million of the Company’s shares

by 31 December 2008. At that date a total of 3,028,500 shares

had been bought back for Euro 30.2 million.

On 9 April 2009, the shareholders renewed the authorisation

to buy and dispose of treasury shares, while cancelling

the previous resolution adopted on 15 April 2008. The

authorisation permitted the purchase of shares representing

no more than 10% of the Company’s share capital at any

time, including any treasury shares already held by the

Ordinary shares Treasury shares

Total

Balance at 31 December 2011

214,393,481

(3,028,500)

211,364,981

Capital increase

(1)

115,300

-

115,300

Treasury shares

-

-

-

Balance at 31 December 2012

214,508,781

(3,028,500)

211,480,281

Capital increase

(1)

82,929

-

82,929

Treasury shares

-

-

-

Balance at 31 December 2013

214,591,710

(3,028,500)

211,563,210

(1) Capital increase following exercise of a part of options under the Stock Option Plan 2007-2012.

274 | 2013

ANNUAL REPORT |

N