275

Company. Purchases could not exceed the amount of

undistributed earnings and distributable reserves reported

in the most recently approved annual financial statements.

The programme was to last for a maximum of 18 months

commencing from the date of the shareholders’ approval and

therefore expired on 9 October 2010.

The Shareholders’ Meeting held on 16 April 2013 authorised

a share buy-back and disposal programme. This programme

provides the opportunity to purchase, on one or more

occasions, a maximum number of ordinary shares whose

total cannot exceed 10% of share capital, equal to 18,420,002

ordinary shares as at the date of 16 April 2013, taking account

of the treasury shares already held by the Company.

Extraordinary reserve

This reserve amounts to Euro 52,688 thousand at 31

December 2013 and was formed following the apportionment

of net profit for 2006, as approved by the shareholders on 28

February 2007.

IAS/IFRS first-time adoption reserve

This reserve was created in accordance with IFRS 1 and

reflects the differences arising on first-time adoption

of IAS/IFRS.

It amounts to Euro 30,177 thousand at 31 December 2013, the

same as at 31 December 2012.

Convertible bond reserve

This reserve amounts to Euro 39,236 thousand (net of the

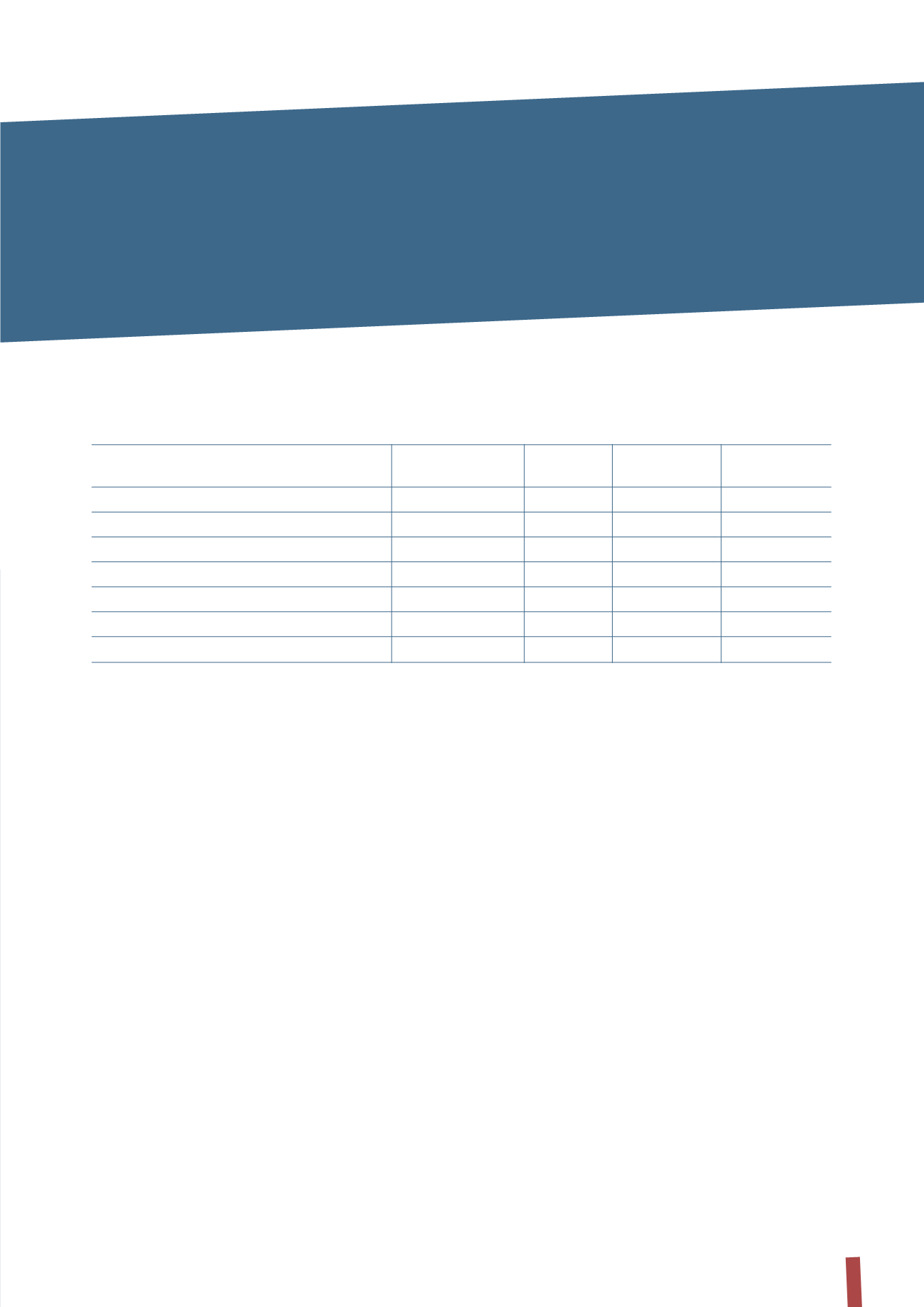

Movements in treasury shares are as follows:

related tax effect) at 31 December 2013 and refers to the

non-monetary components of the bond, discussed in more

detail in Note 10. Borrowings from banks and other lenders.

Stock option reserve

This reserve amounts to Euro 38,568 thousand at 31

December 2013, reporting a net increase of Euro 12,593

thousand since 31 December 2012 due to:

• the total cost of Euro 4,599 thousand recognised in the

income statement during the year (Euro 5,557 thousand

in 2012), for stock option plans involving Prysmian S.p.A.

shares;

• the grant date fair value (Euro 7,789 thousand), recognised

as a receivable from subsidiaries in which beneficiaries of

stock option plans involving Prysmian S.p.A. shares are

directly or indirectly employees;

• an increase of Euro 1,781 thousand in the carrying amount

of investments in subsidiaries, in which beneficiaries of

stock option involving Prysmian S.p.A. shares are directly

or indirectly employees;

• the reclassification to retained earnings of Euro 1,576

thousand in respect of the Stock option plan 2007-2012,

all of whose options are now fully vested and exercised.

Number of

Total nominal

% of total

Average unit

Total carrying

ordinary shares

value (in Euro)

share capital

value (in Euro)

value (in Euro)

At 31 December 2011

3,028,500

302,850

1.41%

9.965

30,179,003

- Purchases

-

-

-

-

-

- Sales

-

-

-

-

-

At 31 December 2012

3,028,500

302,850

1.41%

9.965

30,179,003

- Purchases

-

-

-

-

-

- Sales

-

-

-

-

-

At 31 December 2013

3,028,500

302,850

1.41%

9.965

30,179,003