PARENT COMPANY >

EXPLANATORY NOTES

278

| 2013 ANNUAL REPORT | PRYSMIAN GROUP

Credit Agreement 2010 and Credit Agreement 2011

The evolution of the Credit Agreements 2010 and 2011, signed

at Group level, is summarised below, along with their impact

on the Company’s financial statements.

On 3 May 2012, a Forward Start Credit Agreement (now

termed “Credit Agreement 2010”) was activated with a pool of

major national and international banks. This credit agreement

replaced the previous “Credit Agreement” entered into on 18

April 2007.

The Credit Agreement 2010 is an agreement negotiated

in advance of its period of use, under which the lenders

have made available to Prysmian S.p.A. and some of its

subsidiaries, loans and credit facilities totalling Euro 1,070

million at Group level (including a Term Loan Facility for Euro

320 million made available to Prysmian S.p.A.).

On 22 February 2013 and 15 March 2013, the Prysmian Group

made early repayments of Euro 186 million and Euro 300

million respectively against the Term Loan Facility disbursed

on 3 May 2012; Prysmian S.p.A.’s share of these repayments

was Euro 88,800 thousand and Euro 143,284 thousand

respectively. The first repayment was in respect of payments

due in 2013 and in the first half 2014, while the second

referred to the payment due in December 2014. As a result

of these repayments, Prysmian S.p.A. has accelerated the

amortisation of Euro 2,311 thousand in bank fees relating to

the Credit Agreement 2010; this cost has been treated as a

non-recurring item in Finance costs, as shown in Note 26.

The repayment of the Term Loan Facility 2010 ends on 31

December 2014 with a final payment of Euro 184 million by

the Prysmian Group (of which the Prysmian S.p.A. share is

Euro 87,916 thousand) and has therefore been classified in

current liabilities.

On 7 March 2011, Prysmian S.p.A. entered into a five-year

credit agreement for Euro 800 million with a syndicate of

major banks (known as the “Credit Agreement 2011”). This

agreement comprises a loan for Euro 400 million (Term

Loan Facility 2011), all of which is recorded among the

Company’s liabilities and repayable in full on 7 March 2016,

and a revolving facility for Euro 400 million (Revolving Credit

Facility 2011). The Term Loan Facility 2011 has therefore been

classified in non-current liabilities.

The Credit Agreement 2010 and Credit Agreement 2011 do

not require any collateral security. Further information can be

found in Note 29. Financial covenants.

At 31 December 2013, the fair values of the Credit Agreements

2010 and 2011 approximate the related carrying amounts. The

fair values have been determined using valuation techniques

that refer to observable market data.

EIB Loan

On 18 December 2013, Prysmian S.p.A. entered into a loan

agreement with the European Investment Bank (EIB) for Euro

100 million, to fund the Prysmian Group’s European Research

& Development (R&D) programmes over the period 2013-2016.

The EIB Loan is particularly intended to support projects

developed in the Group’s R&D centres in six countries (France,

Great Britain, the Netherlands, Spain, Germany and Italy) and

represents about 50% of the Group’s planned investment

expenditure in Europe during the period concerned.

The EIB Loan was received on 5 February 2014 and will be

repaid in 12 equal half-yearly instalments starting on 5

August 2015 and ending on 5 February 2021.

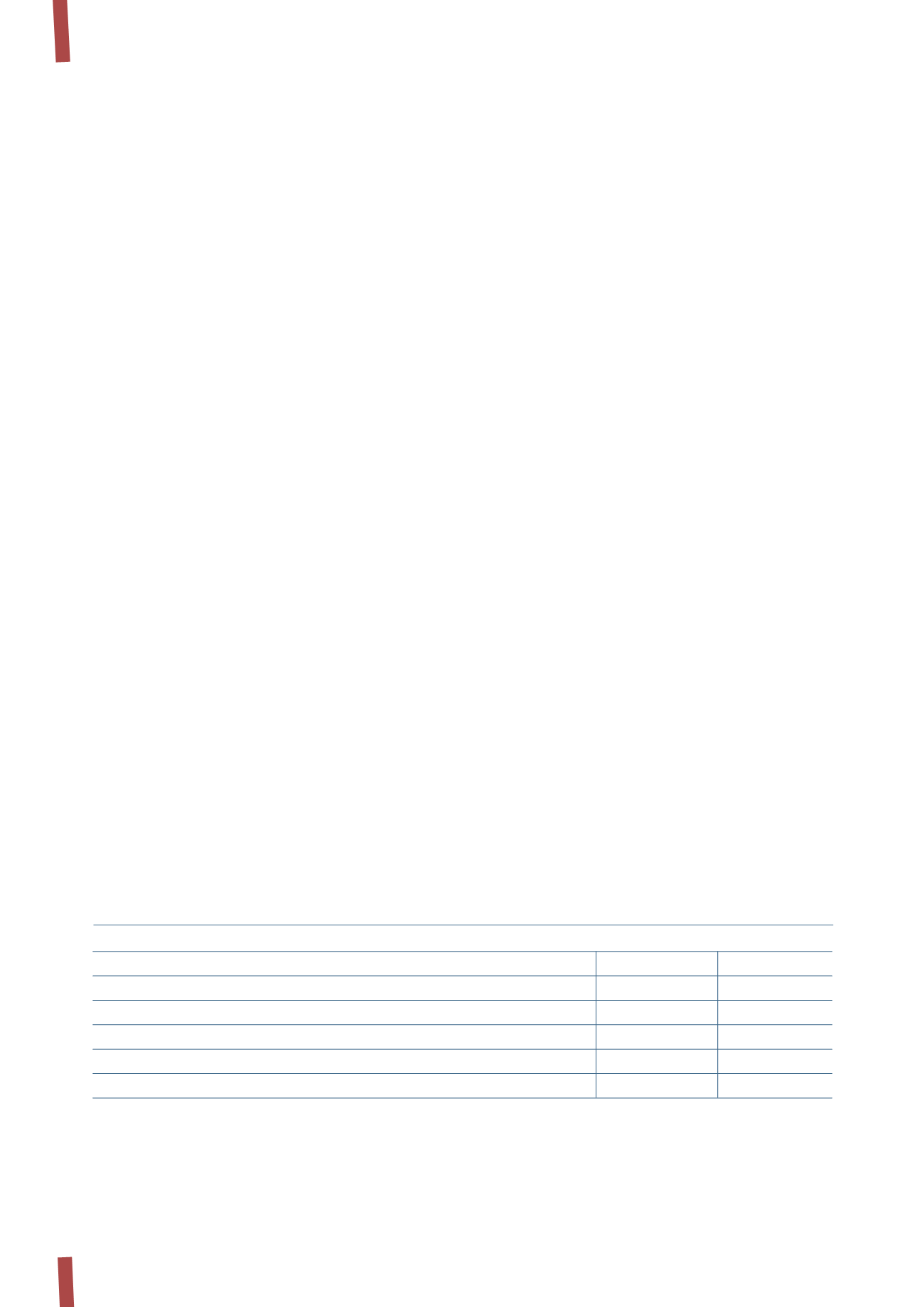

The following tables summarise the Committed Lines

available to the Company at 31 December 2013 and 31

December 2012:

(in thousands of Euro)

31 December 2013

Total lines

Used

Unused

Term Loan Facility 2010

87,916

(87,916)

-

Term Loan Facility 2011

400,000

(400,000)

-

Total Credit Agreements

487,916

(487,916)

-

EIB Loan

100,000

-

100,000

Total

587,916

(487,916)

100,000