277

These amount to Euro 1,175,121 thousand at 31 December 2013, compared with Euro 1,126,574 thousand at 31 December 2012.

Non-current borrowings from banks and other financial

institutions

At 31 December 2013, Non-current borrowings from banks

and other financial institutions, amounting to Euro 396,976

thousand, refer to the Company’s share of the outstanding

debt under the Credit Agreement 2011 entered into by

Prysmian S.p.A. on 7 March 2011, net of the related fees being

amortised.

Current borrowings from banks and other financial

institutions

The current portion of Borrowings from banks and other

financial institutions, amounting to Euro 88,041 thousand,

primarily reflects Euro 87,346 thousand for the Company’s

share of the outstanding debt repayable on 31 December 2014

under the Credit Agreement 2010, net of the related fees

being amortised, Euro 143 thousand in 2013 interest payable

on the Credit Agreement 2010, and Euro 329 thousand in 2013

interest payable on the Credit Agreement 2011.

Borrowings from banks and other financial institutions and

Bonds are analysed as follows:

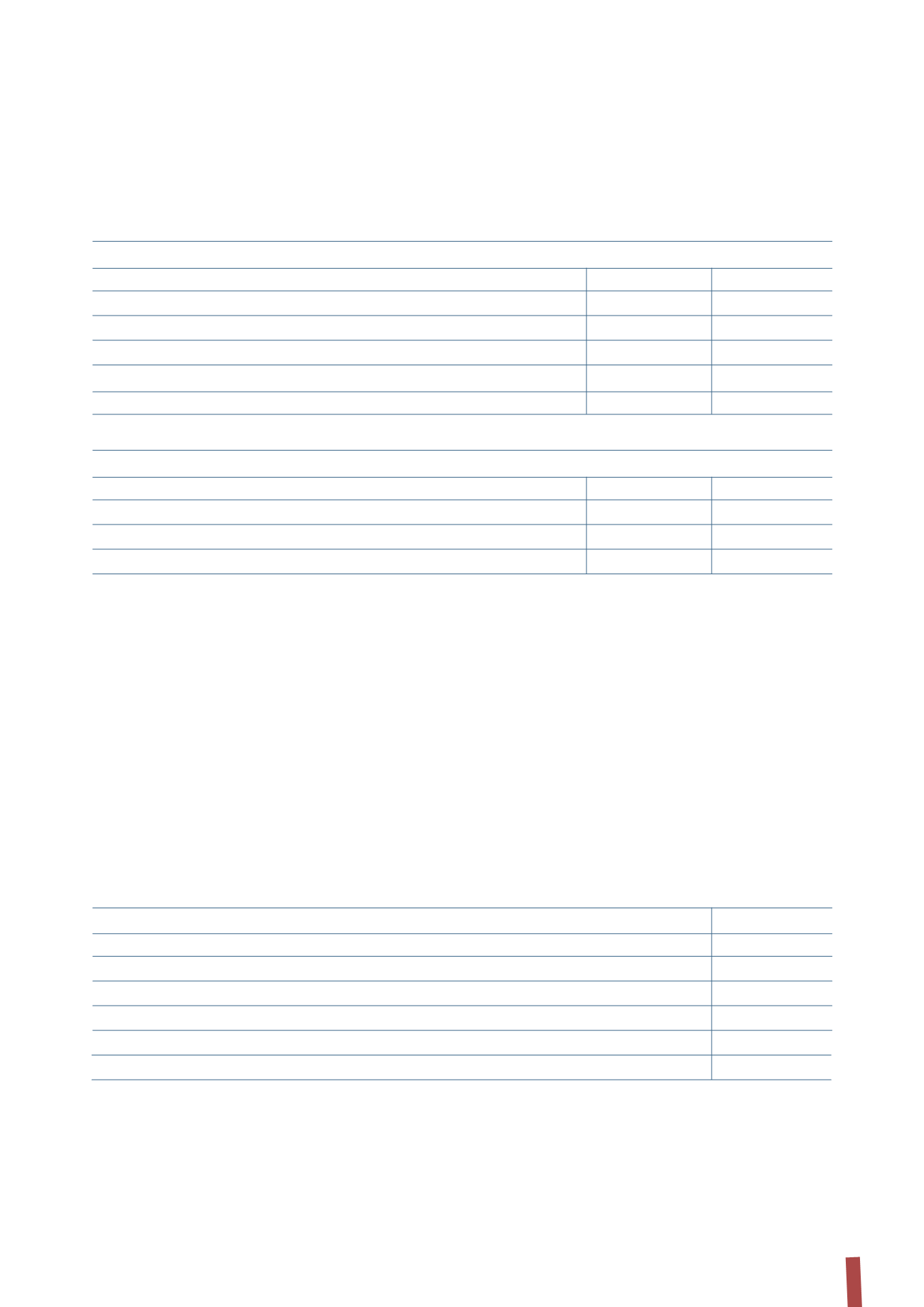

10.

BORROWINGS FROM BANKS AND OTHER LENDERS

(in thousands of Euro)

31 December 2013

Non-current

Current

Total

Borrowings from banks and other financial institutions

396,976

88,041

485,017

Non-convertible bond

398,576

15,305

413,881

Convertible bond

263,401

1,187

264,588

Finance lease obligations

11,098

537

11,635

Total

1,070,051

105,070

1,175,121

(in thousands of Euro)

31 December 2012

Non-current

Current

Total

Borrowings from banks and other financial institutions

653,474

60,281

713,755

Non-convertible bond

397,515

15,304

412,819

Total

1,050,989

75,585

1,126,574

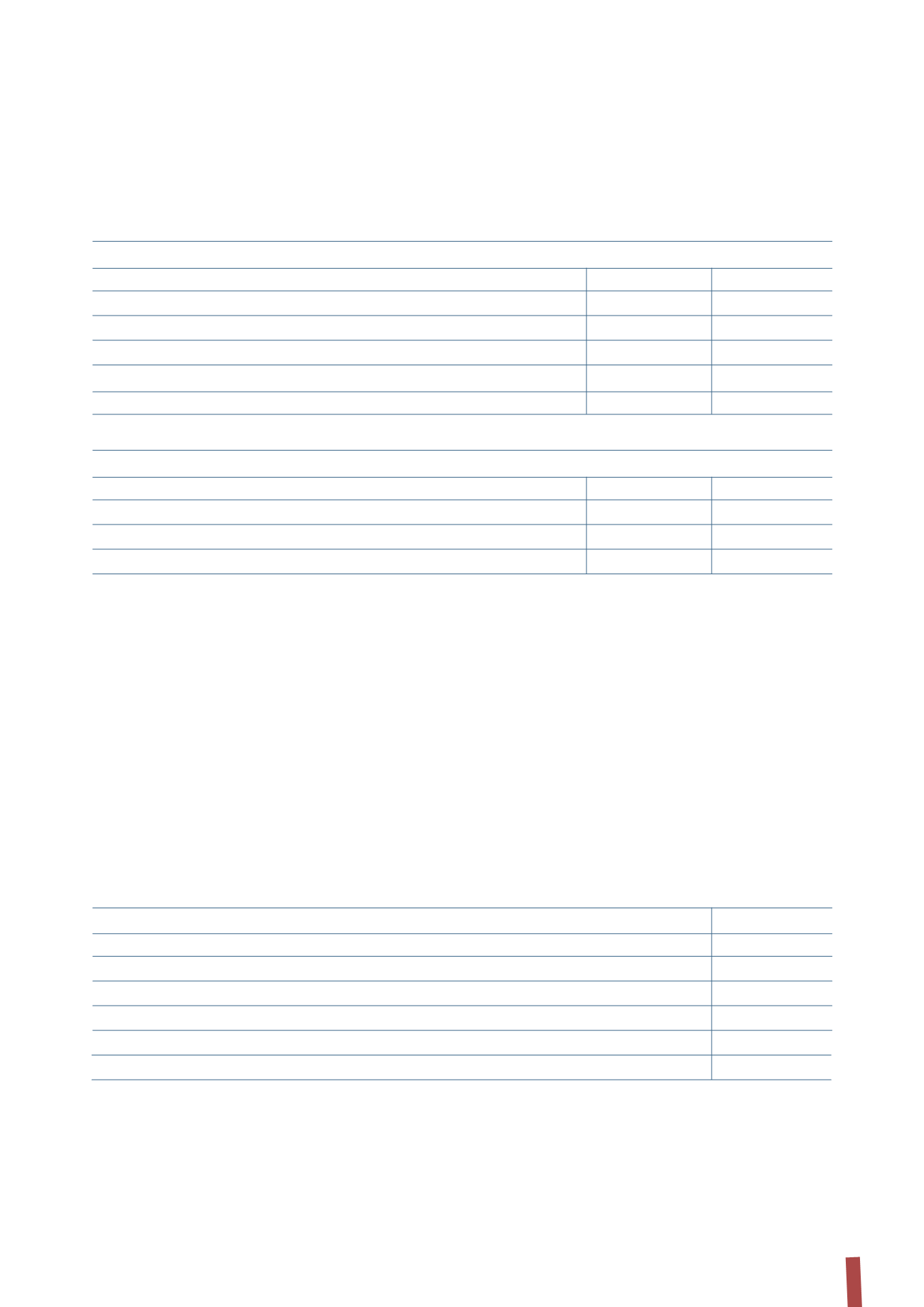

(in thousands of Euro)

31 December 2013 31 December 2012

Credit Agreements

(1)

484,794

713,033

Other borrowings

11,858

722

Borrowings from banks and other financial institutions

496,652

713,755

Non-convertible bond

413,881

412,819

Convertible bond

264,588

-

Total

1,175,121

1,126,574

(1) Credit Agreements refer to the following lines: Term Loan Facility 2010 and Term Loan Facility 2011.