283

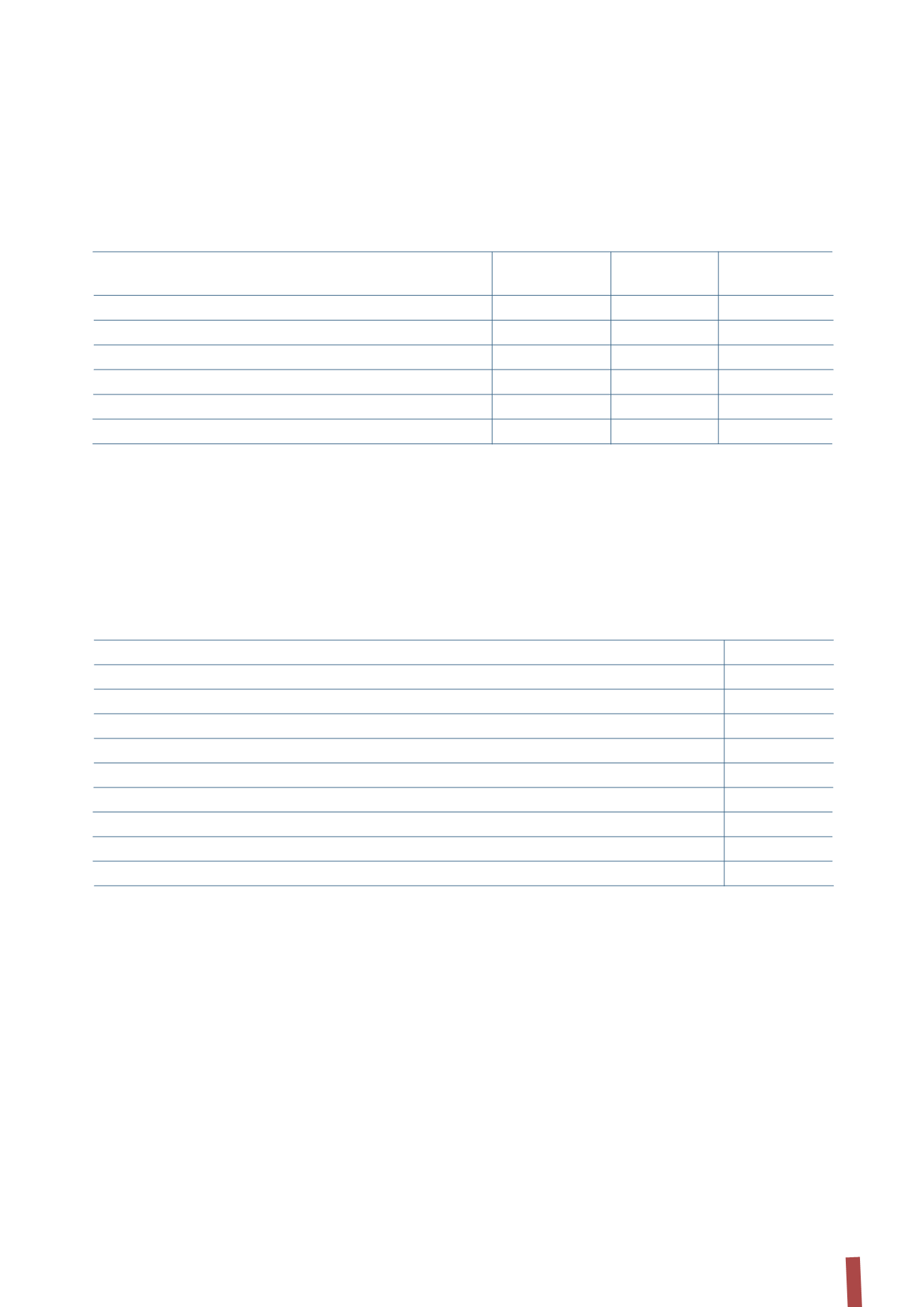

(in thousands of Euro)

31 December 2013

31 December 2012

Trade payables - current portion

295,791

27,653

Total trade payables - current portion

295,791

27,653

Other payables - current portion:

Tax and social security payables

4,293

3,919

Payables to employees

23,102

7,987

Accrued expenses

45

490

Other

1,820

1,421

Total other payables - current portion

29,260

13,817

Total

325,051

41,470

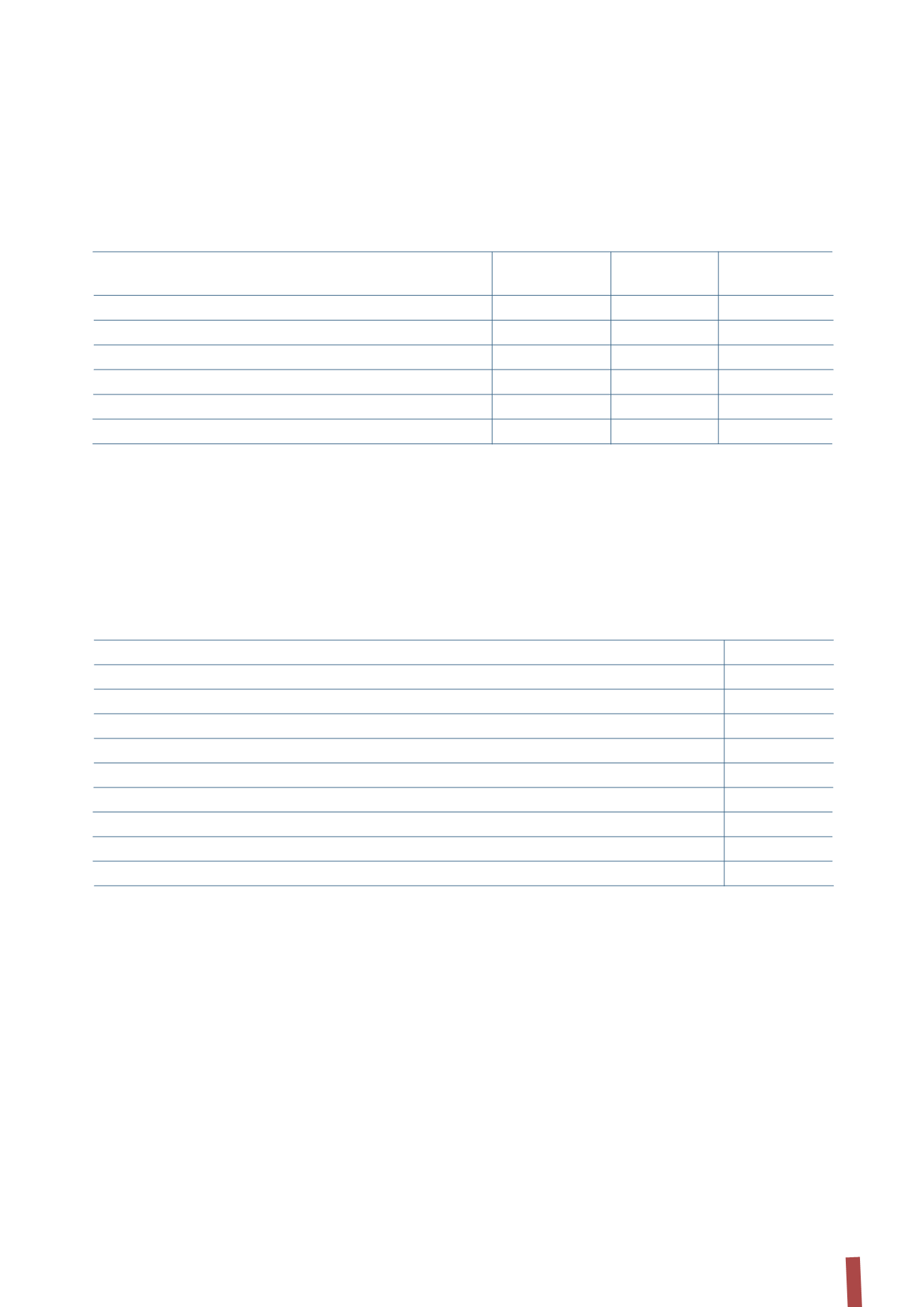

(in thousands of Euro)

31 December 2013

Of which related 31 December 2012

Of which related

parties (Note 25)

parties (Note 25)

Net financial position - as reported above

612,667

920,587

Long-term financial receivables

26

21

Long-term bank fees

-

3,919

Net forward currency contracts on commercial transactions

27

27

Net metal derivatives

(38)

(38)

-

Recalculated net financial position

612,682

924,527

The Company’s Net financial position is reconciled below to the amount that must be reported under Consob Communication

DEM/6064293 issued on 28 July 2006 in compliance with the CESR recommendation dated 10 February 2005 “Recommendations

for the consistent implementation of the European Commission’s Regulation on Prospectuses”:

These are detailed as follows:

11.

TRADE AND OTHER PAYABLES

Trade payables mostly refer to charges by suppliers of

strategic metals and only partly to those by suppliers of

other goods and services provided by external consultants in

organisational, legal and IT matters.

Other payables comprise:

• social security payables relating to contributions on

employee wages and salaries and amounts payable into

supplementary pension funds;

• tax payables mainly relating to tax withheld from

employees and not yet paid to the tax authorities;

• payables to employees for accrued wages and salaries not

yet paid. The balance at 31 December 2013 includes Euro

14,908 thousand in respect of the liability for the Long-

term incentive plan 2011-2013, which will be paid in the first

half of 2014;

• other payables, which mainly relate to amounts due

to Group companies for the transfer of recoverable

withholding taxes to the Company under the group tax

consolidation (art. 117 et seq of the Italian Income Tax

Code).