PARENT COMPANY >

EXPLANATORY NOTES

290

| 2013 ANNUAL REPORT | PRYSMIAN GROUP

As at 31 December 2013 the options were all fully vested and

exercised. The last window for exercising the options closed

early in 2013.

Long-term incentive plan 2011-2013

On 14 April 2011, the Ordinary Shareholders’ Meeting of

Prysmian S.p.A. approved, pursuant to art. 114-bis of

Legislative Decree 58/98, a long-term incentive plan for

the period 2011-2013 for employees of the Prysmian Group,

including certain members of the Board of Directors of

Prysmian S.p.A., and granted the Board of Directors the

necessary authority to establish and execute the plan. The

plan’s purpose was to incentivise the process of integration

following Prysmian’s acquisition of the Draka Group, and was

conditional upon the achievement of performance targets, as

detailed in the specific information memorandum.

The plan originally involved the participation of 290(*)

employees of Group companies in Italy and abroad viewed as

key resources, and divided them into three categories, to whom

the shares would be granted in the following proportions:

•

CEO

: to whom 7.70% of the total rights to receive Prysmian

S.p.A. shares were allotted.

•

Senior Management

: this category initially had 44

participants who held key positions within the Group

(including the Directors of Prysmian S.p.A. who held

the positions of Chief Financial Officer, Energy Business

Executive Vice President and Chief Strategic Officer), to

whom 41.64% of the total rights to receive Prysmian shares

were allotted.

•

Executives

: this category initially had 245 participants

from the various operating units and businesses around

the world, to whom 50.66% of the total rights to receive

Prysmian shares were allotted.

The plan established that the number of options granted

would depend on the achievement of common business and

financial performance objectives for all the participants.

The plan established that the participants’ right to exercise

the allotted options depended on achievement of the Target

(being a minimum performance objective of at least Euro

1.75 billion in cumulative Adj. EBITDA for the Group in the

period 2011-2013, assuming the same group perimeter) as

well as continuation of a professional relationship with the

Group up until 31 December 2013. The plan also established

an upper limit for Adj. EBITDA as the Target plus 20% (i.e.

Euro 2.1 billion), assuming the same group perimeter, that

would determine the exercisability of the maximum number of

options granted to each participant.

Access to the Plan was conditional upon each participant’s

acceptance that part of their annual bonus would be co-

invested, if achieved and payable in relation to financial years

2011 and 2012.

The allotted options will carry the right to receive or subscribe

to ordinary shares in Prysmian S.p.A., the Parent Company.

These shares may partly comprise treasury shares and partly

new shares, obtained through a capital increase that excludes

pre-emptive rights under art. 2441, par. 8 of the Italian Civil

Code. Such a capital increase, involving the issue of up to

2,131,500 new ordinary shares of nominal value Euro 0.10 each,

for a maximum amount of Euro 213,150, was approved by the

shareholders in the extraordinary session of their meeting on

14 April 2011. The shares obtained from the Company’s holding

of treasury shares will be allotted for zero consideration, while

the shares obtained from the above capital increase will be

allotted to participants upon payment of an exercise price

corresponding to the nominal value of the Company’s shares.

In accordance with IFRS 2, for both new and treasury shares,

the options granted have been measured at their grant date

fair value.

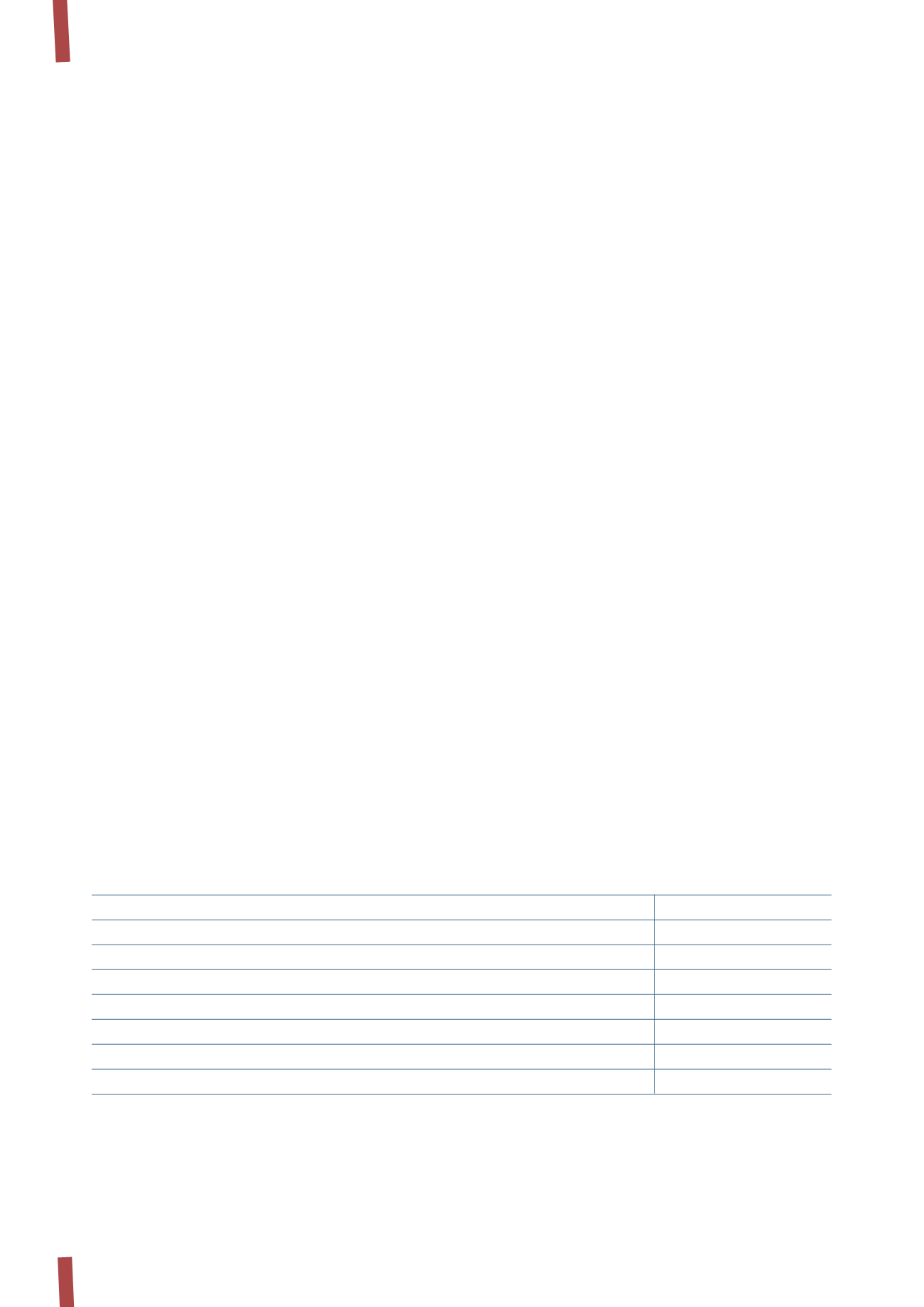

In detail, the fair value of the options has been determined

using the Cox-Ross-Rubinstein binomial pricing model, based

on the following assumptions:

(*) Following movements since the plan’s issue, the number of plan participants amounted to 268 at 31 December 2013. The number of employees of Prysmian

S.p.A. participating in the above plan is 45.

Options for consideration

Options for no consideration

Grant date

2 September 2011

2 September 2011

Residual life at grant date (in years)

2.33

2.33

Exercise price (Euro)

0.10

-

Expected volatility

45.17%

45.17%

Risk-free interest rate

3.96%

3.96%

Expected interest rate

1.56%

1.56%

Option fair value at grant date (Euro)

10.53

10.63