291

As at 31 December 2013 the options were all fully vested. The

options will be exercisable in 2014, within the three months

following the anniversary of the grant date (2 September

2014). Options not exercised during this period will be

deemed forfeited and void.

At 31 December 2013, the overall cost recognised in the

income statement under “Personnel costs” in relation to the

fair value of the options granted has been estimated at Euro

4,476 thousand.

The information memorandum, prepared under art. 114-bis

of Legislative Decree 58/98 and describing the characteristics

of the above incentive plan, is publicly available on the

Company’s website at

,

from its registered offices and from Borsa Italiana S.p.A..

Group employee share purchase plan (YES Plan)

On 16 April 2013, the shareholders approved a share

ownership plan reserved for employees of Prysmian S.p.A.

and/or of its subsidiaries, including some of the Company’s

Directors, and granted the Board of Directors the relevant

powers to establish and implement this plan.

The reasons behind the introduction of the Plan are:

• to strengthen the sense of belonging to the Group

by offering employees an opportunity to share in its

successes, through equity ownership;

• to align the interests of the Prysmian Group’s stakeholders

(its employees and shareholders), by identifying a common

goal of creating long-term value;

• to help consolidate the integration process started in the

wake of the Draka Group’s acquisition.

The Plan offers the opportunity to purchase Prysmian’s

ordinary shares on preferential terms, with a maximum

discount of 25% on the stock price, offered in the form of

treasury shares, except for the Chief Executive Officer, the

Chief Financial Officer, the Chief Strategy Officer and two key

managers, for whom the discount is equal to 1% of the stock

price.

The shares purchased will be subject to a retention period,

during which they cannot be sold. The Plan envisages three

purchase windows: 2014, 2015 and 2016.

The Plan therefore qualifies as “of particular relevance”

within the meaning of art. 84-bis, par. 2 of the Issuer

Regulations.

A maximum number of 500,000 treasury shares has been

earmarked to serve the discounted purchases envisaged by

the Plan.

During the month of October 2013, the plan was presented

and explained to some 16,000 of the Group’s employees in

27 countries. Employees were free to express their readiness

to participate in the Plan by the end of December 2013 and

have accordingly communicated the amount they intended

to invest in the first purchase window and the method

of payment. The amount collected, totalling Euro 7,640

thousand, will be used to make purchases of the Company’s

ordinary shares on the Milan Stock Exchange (MTA) over

a period of 5 consecutive business days during the month

of May 2014. The number of shares assigned to each

participant will then be determined by taking into account

the average purchase price of the shares acquired on behalf

of participants, the individual investment and the applicable

discount percentage.

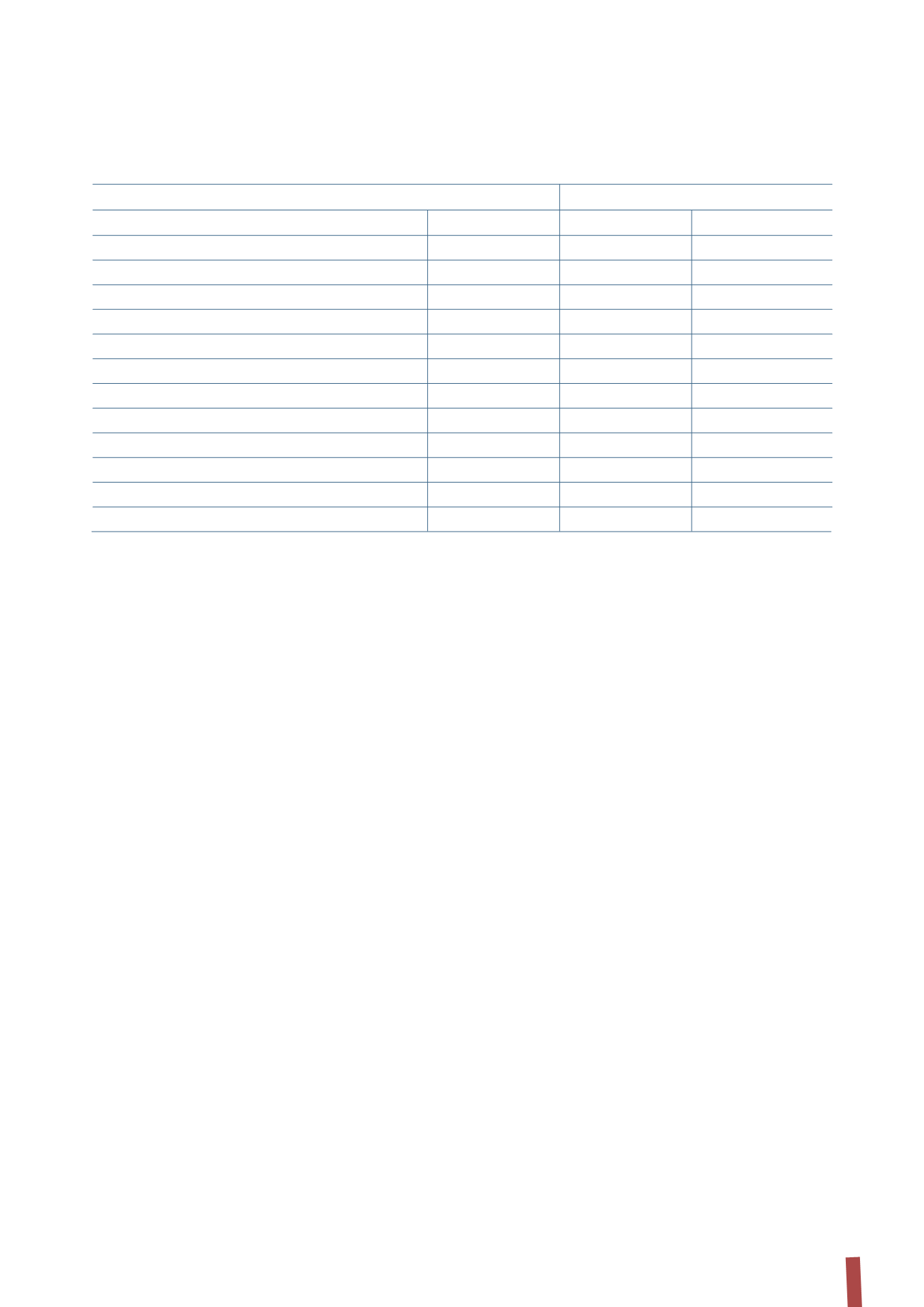

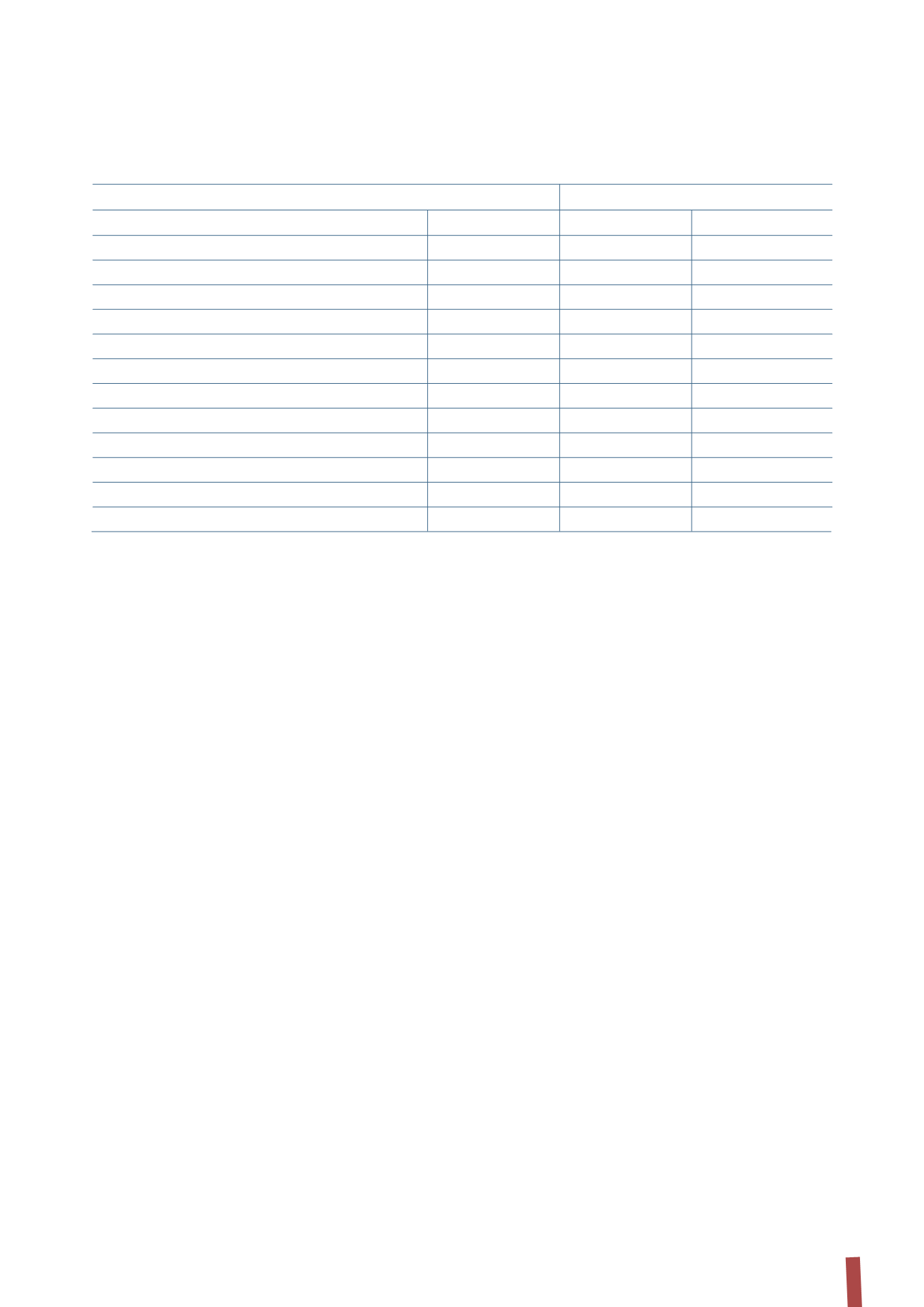

(*) The number of options shown has been determined based on cumulative EBITDA for the three years 2011-2013.

The following table provides additional details about the plan:

(in Euro)

For consideration

For no consideration

Number of options (*)

Exercise price Number of options (*)

Exercise price

Options at start of year

2,131,500

0.10

1,890,875

-

Granted

-

-

-

-

Variation for target remeasurement

-

(309,331)

Cancelled

-

-

(165,235)

-

Exercised

-

-

-

-

Options at end of year

2,131,500

0.10

1,416,309

-

of which for Prysmian S.p.A. employees

745,126

0.10

495,887

-

of which vested at end of year

2,131,500

0.10

1,416,309

-

of which for Prysmian S.p.A. employees

745,126

0.10

495,887

-

of which exercisable

-

-

-

-

of which not vested at end of year

-

-

-

-

of which for Prysmian S.p.A. employees

-

-

-

-