301

b) Non-financial covenants

A number of non-financial covenants have been established

in line with market practice applying to transactions of a

similar nature and size. These covenants involve a series

of restrictions on the grant of secured guarantees to third

parties, on the conduct of acquisitions or equity transactions,

and on amendments to the Company’s by-laws.

Default events

The main default events are as follows:

• default on loan repayment obligations;

• breach of financial covenants;

• breach of some of the non-financial covenants;

• declaration of bankruptcy or subjection of Group

companies to other insolvency proceedings;

• issuance of particularly significant judicial rulings;

• occurrence of events that may adversely and significantly

affect the business, the assets or the financial conditions

of the Group.

Should any default event occur, the lenders are entitled

to demand full or partial repayment of the outstanding

amounts lent under the Credit Agreements, together with

interest and any other amount due under the terms and

conditions of these Agreements. No collateral security is

required.

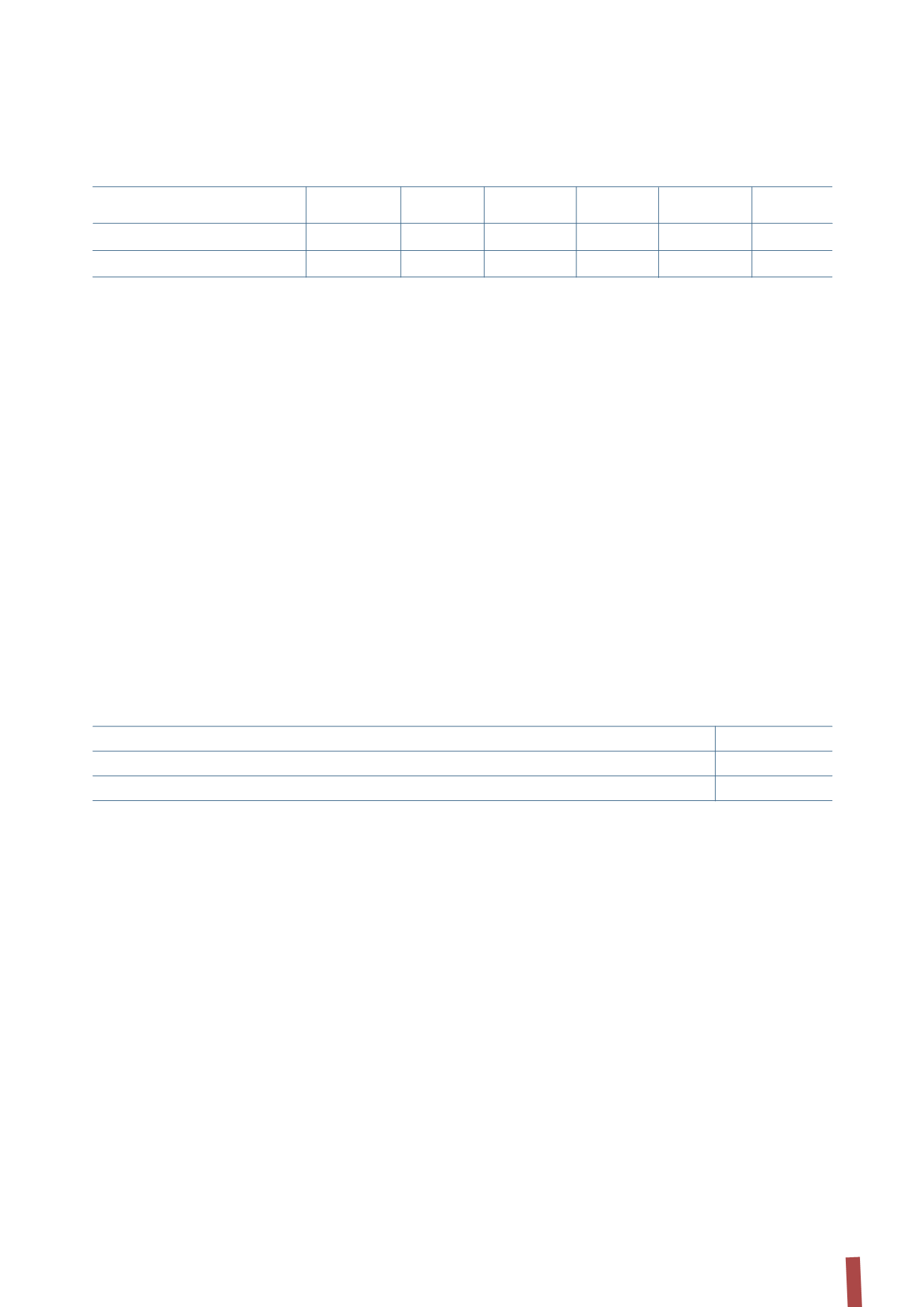

The evolution of the Covenants for the above agreements is shown in the following table:

(*) The ratios have been calculated on the basis of the definitions contained in the Credit Agreement 2010 and the Credit Agreement 2011.

(*) The ratios have been calculated on the basis of the definitions contained in the Credit Agreement 2010 and the Credit Agreement 2011.

30 June

31 December

30 June

31 December

30 June

31 December

30 June 2014

2011

2011

2012

2012

2013

2013 and thereafter

Net financial position/EBITDA (*)

3.50x

3.50x

3.50x

3.00x

3.00x

2.75x

2.50x

EBITDA/Net finance costs (*)

4.00x

4.00x

4.00x

4.25x

4.25x

5.50x

5.50x

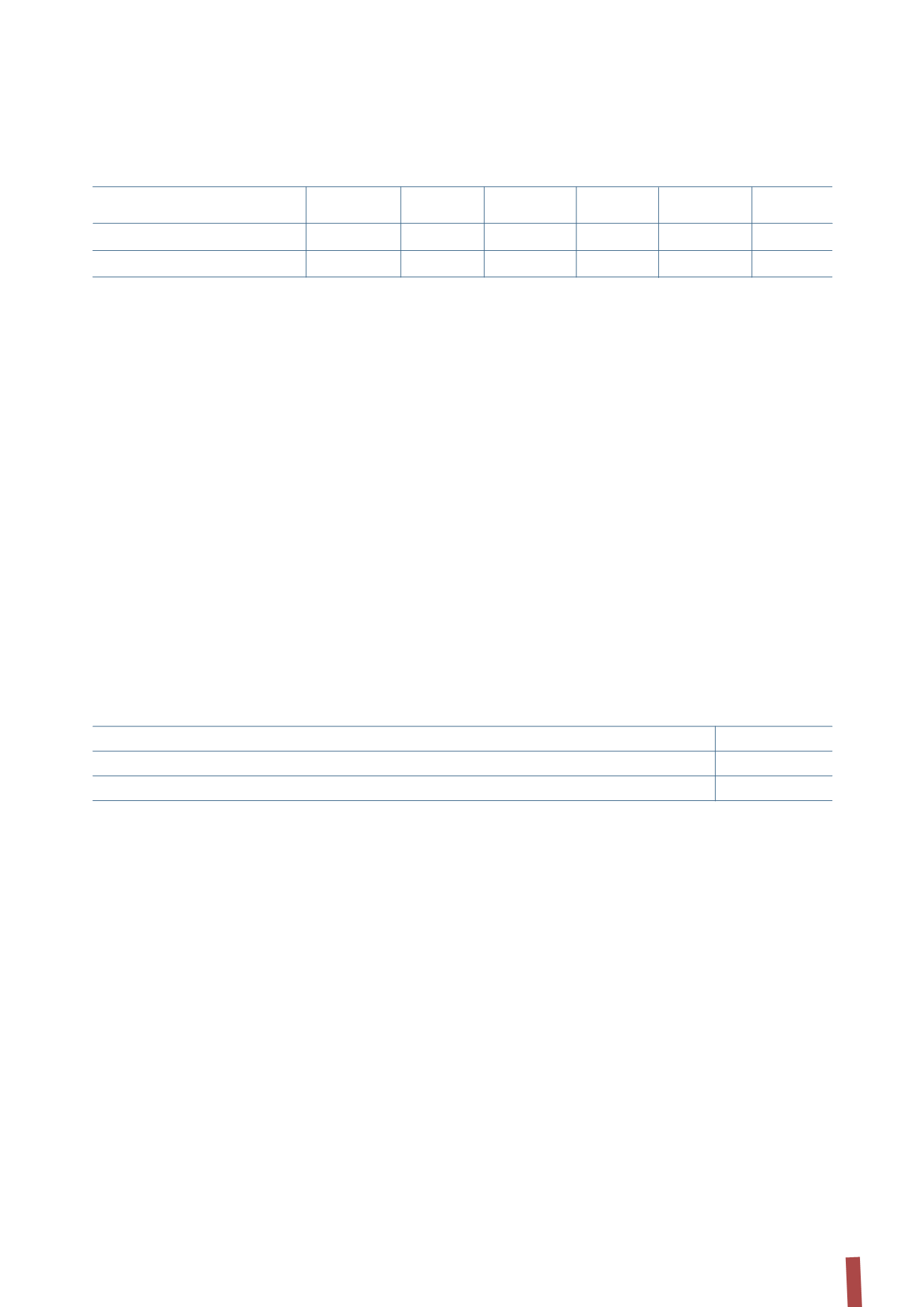

31 December 2013

31 December 2012

EBITDA/Net finance costs (*)

6.91

6.78

Net financial position/EBITDA (*)

1.28

1.32

The above financial ratios comply with both the covenants contained in the Credit Agreement 2010 and in the Credit Agreement 2011.

Actual financial ratios reported at period end, calculated at a consolidated level for the Prysmian Group, are as follows:

Net cash flow provided by operating activities amounted

to Euro 283,310 thousand in 2013, inclusive of Euro 27,097

thousand in taxes collected by the Group’s Italian companies

for IRES transferred under the group tax consolidation (art.

117 et seq. of the Italian Income Tax Code).

Investing activities provided a net positive Euro 124,112

thousand in cash flow, after collecting Euro 202,286

thousand in dividends from subsidiaries.

Net finance costs recognised in the income statement

came to Euro 38,776 thousand inclusive of non-cash items;

excluding these items, net cash finance costs reflected in the

statement of cash flows amounted to Euro 23,934 thousand,

most of which referring to interest expense, bank fees and

other incidental expenses in connection with the Credit

Agreement 2010, the Credit Agreement 2011, the Convertible

bond and the Non-convertible bond.

Cash flow relating to financing activities includes the

proceeds of the Convertible bond and the early repayment of

the Credit Agreement 2010.

30. STATEMENT OF CASH FLOWS