PARENT COMPANY >

EXPLANATORY NOTES

296

| 2013 ANNUAL REPORT | PRYSMIAN GROUP

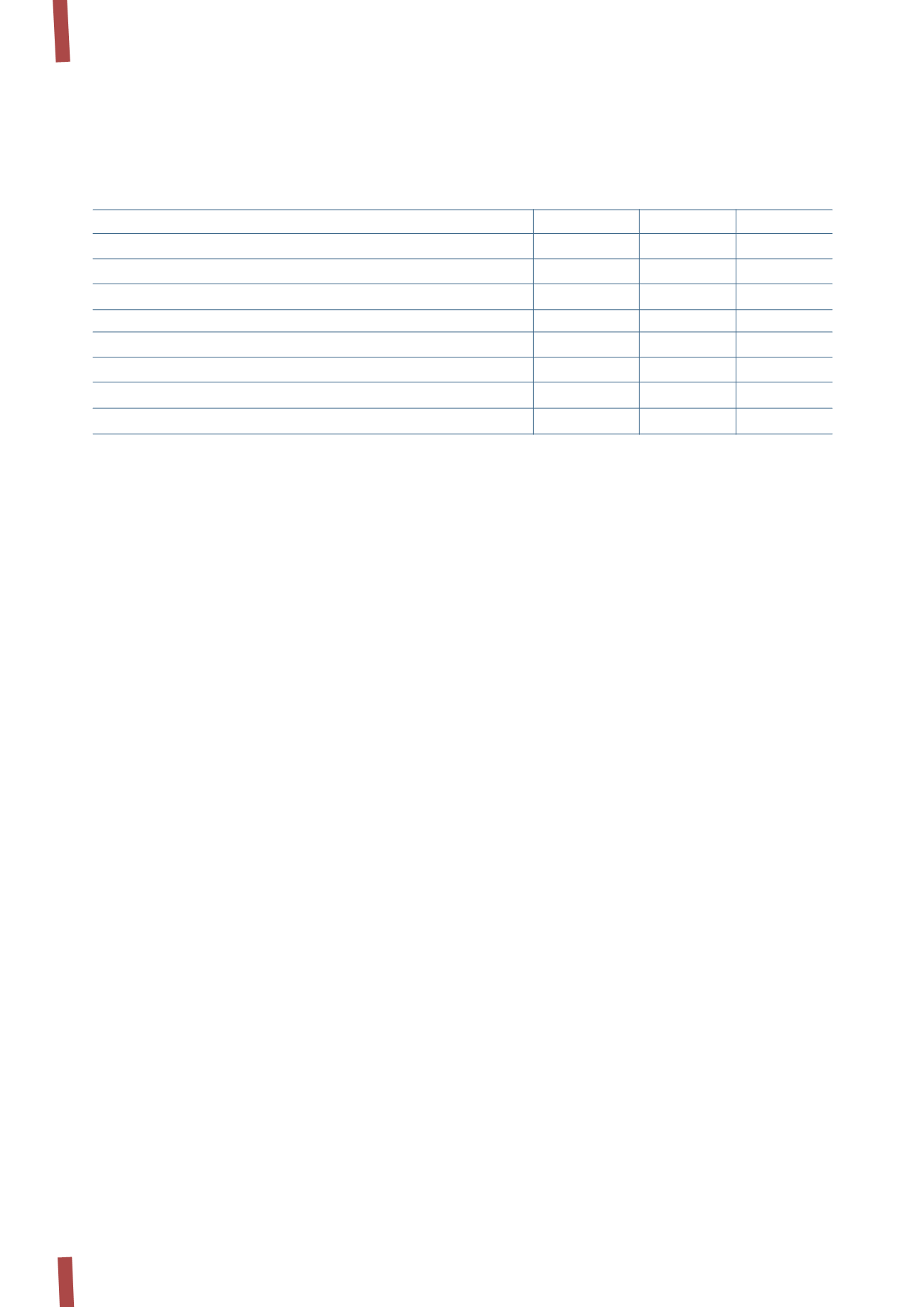

Taxes charged on profit before taxes differ from those calculated using the theoretical tax rate applying to the Company for the

following reasons:

23. CONTINGENT LIABILITIES

(in thousands of Euro)

2013

Tax rate

2012

Tax rate

Profit before taxes

156,441

90,922

Theoretical tax expense at Parent Company’s nominal tax rate

43,021

27.5%

25,004

27.5%

Dividends from subsidiaries

(57,439)

(36.7%)

(39,188)

(43.1%)

Other permanent differences

407

0.3%

854

0.9%

Tax credit paid abroad

(8,192)

(5.2%)

-

0.0%

Other

1,237

0.8%

(1,235)

(1.4%)

Net effect of group tax consolidation for the year

(7,278)

(4.7%)

(6,651)

(7.3%)

Effective income taxes

(28,244)

(18.1%)

(21,216)

(23.3%)

Since 2006 the Company, along with all its Italian resident

subsidiaries, has opted to file for tax on a group basis,

pursuant to art. 117 et seq. of the Italian Income Tax Code,

with the Company acting as the head of this group. The

intercompany transactions arising under such a group tax

consolidation are governed by specific rules and an agreement

between the participating companies, which involve common

procedures for applying the tax laws and regulations.

These rules were updated in 2008 to reflect the amendments

and additions introduced by Law 244 of 24 December 2007

(Finance Act 2008) and Legislative Decree 112 of 25 June

2008.

These rules were amended on 26 March 2012 to incorporate

in the transactions between the head of the tax group and

the individual participating companies, the amendments

introduced by Legislative Decree 201/2011 and the Ministerial

Decree dated 14 March 2012 concerning Aid for Economic

Growth.

Prysmian S.p.A. acts as the head of the tax group and

calculates a single taxable base for companies in the Italian

tax group. This has the benefit of being able to offset taxable

As a global operator, the Company is exposed to legal risks

primarily, by way of example, in the areas of product liability,

and environmental, antitrust and tax rules and regulations.

Outlays relating to current or future proceedings cannot be

predicted with certainty. The outcome of such proceedings

could result in the payment of costs that are not covered, or

not fully covered, by insurance, which would therefore have a

profits against tax losses in a single tax return, thereby

ensuring optimisation of the tax charge.

On 7 June 2012, the head of the tax group sent the required

notice of renewal of the group tax election for the three years

2012 – 2013 – 2014 for the following companies:

• Fibre Ottiche Sud – F.O.S. S.r.l.

• Prysmian Cavi e Sistemi S.r.l.

• Prysmian Cavi e Sistemi Italia S.r.l.

• Prysmian Treasury S.r.l.

This notice also included the election to include the Prysmian

Electronics S.r.l. in the group tax consolidation with effect

from 2012.

Prysmian PowerLink S.r.l. had renewed its election to file for

tax on a group basis for the three years 2011 - 2012 – 2013 on

7 June 2011.

The rate used for calculating the tax charge is 27.5% for IRES

(Italian corporate income tax), and 5.57% for IRAP (Italian

regional business tax).

direct effect on the Company’s financial position and results.

It is also reported, with reference to the Antitrust

investigations in the various jurisdictions involved, that the

only jurisdiction for which Prysmian S.p.A. has been unable to

estimate the related risk is Brazil.