PARENT COMPANY >

EXPLANATORY NOTES

292

| 2013 ANNUAL REPORT | PRYSMIAN GROUP

At 31 December 2013, the overall cost recognised in the income statement under “Personnel costs” in relation to the fair value of

the options granted under this plan is Euro 124 thousand.

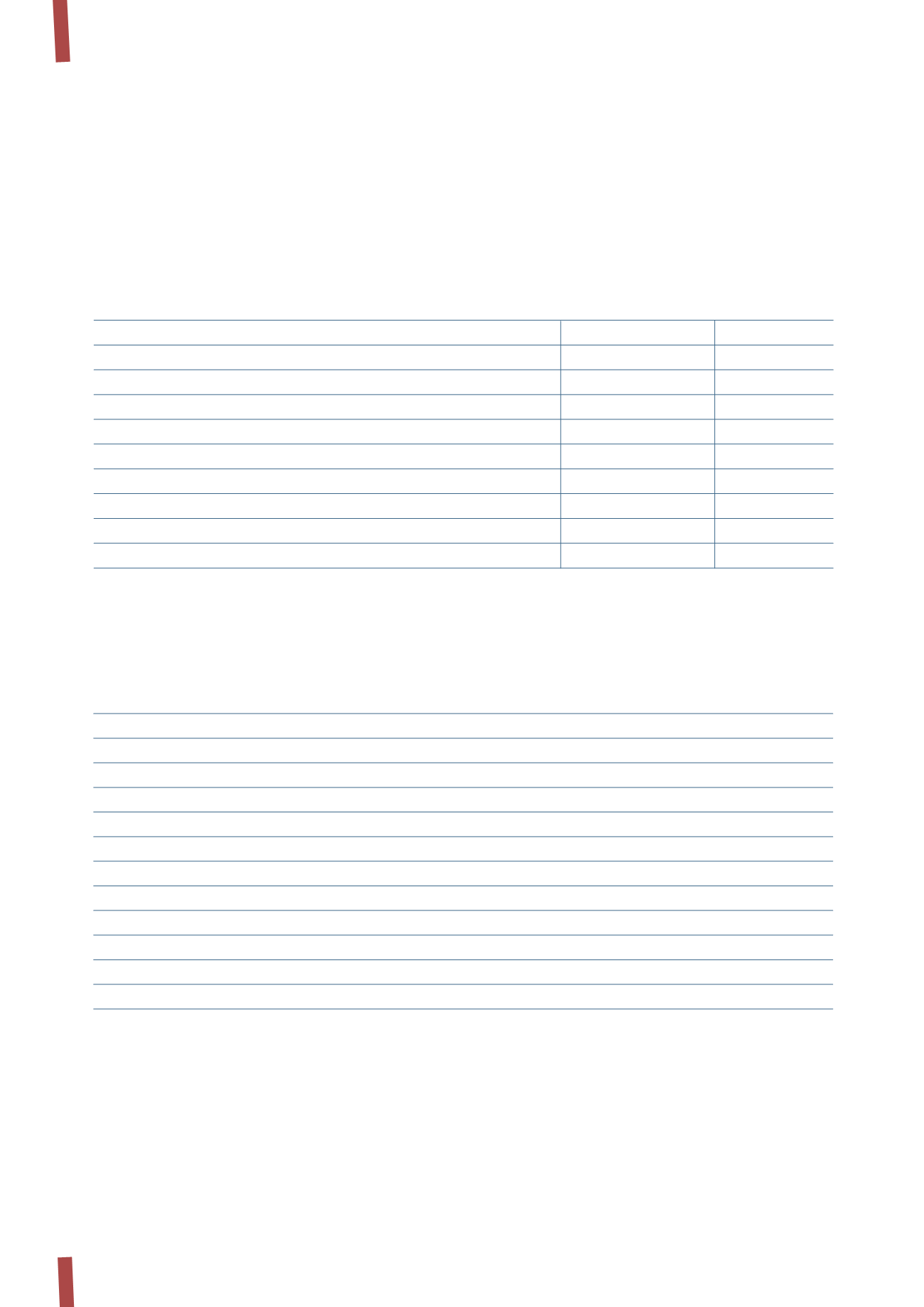

The following table provides additional details about the plan:

The fair value of the options has been determined using the Monte Carlo binomial pricing model, based on the following

assumptions:

1st Window (2014)

2nd Window (2015)

3rd Window (2016)

Grant date

13 November 2013

13 November 2013

13 November 2013

Share purchase date

19 May 2014

19 May 2015

19 May 2016

End of retention period

19 May 2017

19 May 2018

19 May 2019

Residual life at grant date (in years)

0.35

1.35

2.35

Share price at grant date (Euro)

18.30

18.30

18.30

Expected volatility

29.27%

30.11%

36.79%

Risk-free interest rate

0.028%

0.052%

0.203%

Expected dividend %

2.830%

2.830%

2.830%

Option fair value at grant date (Euro)

18.04

17.54

17.11

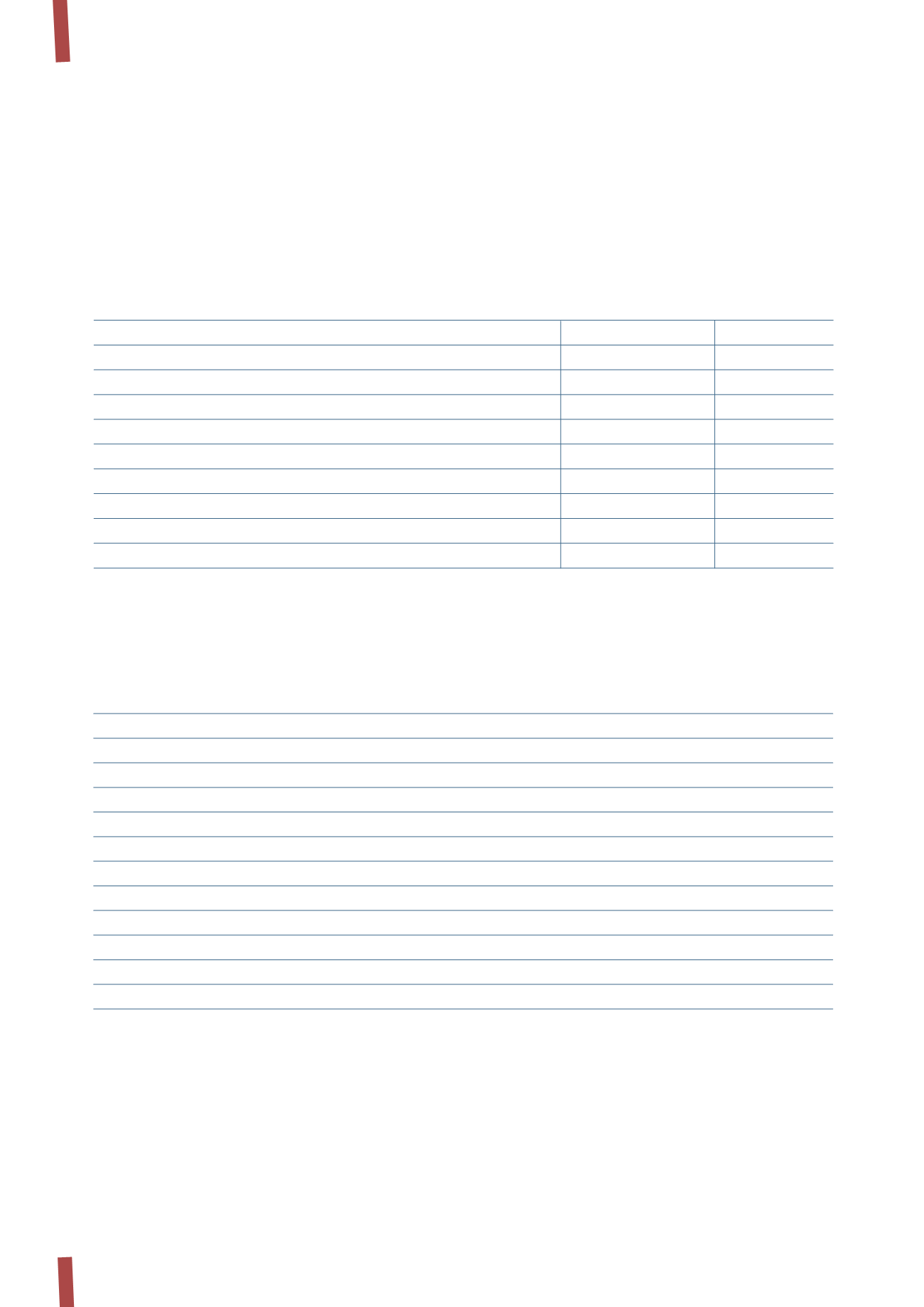

Number of options

Options at start of year

-

Granted (*)

300,682

Cancelled

-

Exercised

-

Options at end of year

300,682

of which for Prysmian S.p.A. employees

36,015

of which vested at end of year

-

of which for Prysmian S.p.A. employees

-

of which exercisable

-

of which not vested at end of year

300,682

of which for Prysmian S.p.A. employees

36,015

All those who have adhered to the plan will also receive an

entry bonus of six free shares, taken from the Company’s

portfolio of treasury shares, only available at the time of first

purchase.

The shares purchased by participants, as well as those

received by way of discount and entry bonus, will generally

be subject to a retention period during which they cannot

be sold and the length of which varies according to local

regulations.

(*) The number of options has been determined on the basis of the number of shares expected to be bought by employees in the three purchase windows.

The information memorandum, prepared under art. 114-bis

of Legislative Decree 58/98 and describing the characteristics

of the above share purchase plan, is publicly available on the

Company’s website at

,

from its registered offices and from Borsa Italiana S.p.A..

As at 31 December 2013, Prysmian S.p.A. had made no loans

or given guarantees to any of its directors, senior managers or

statutory auditors.