287

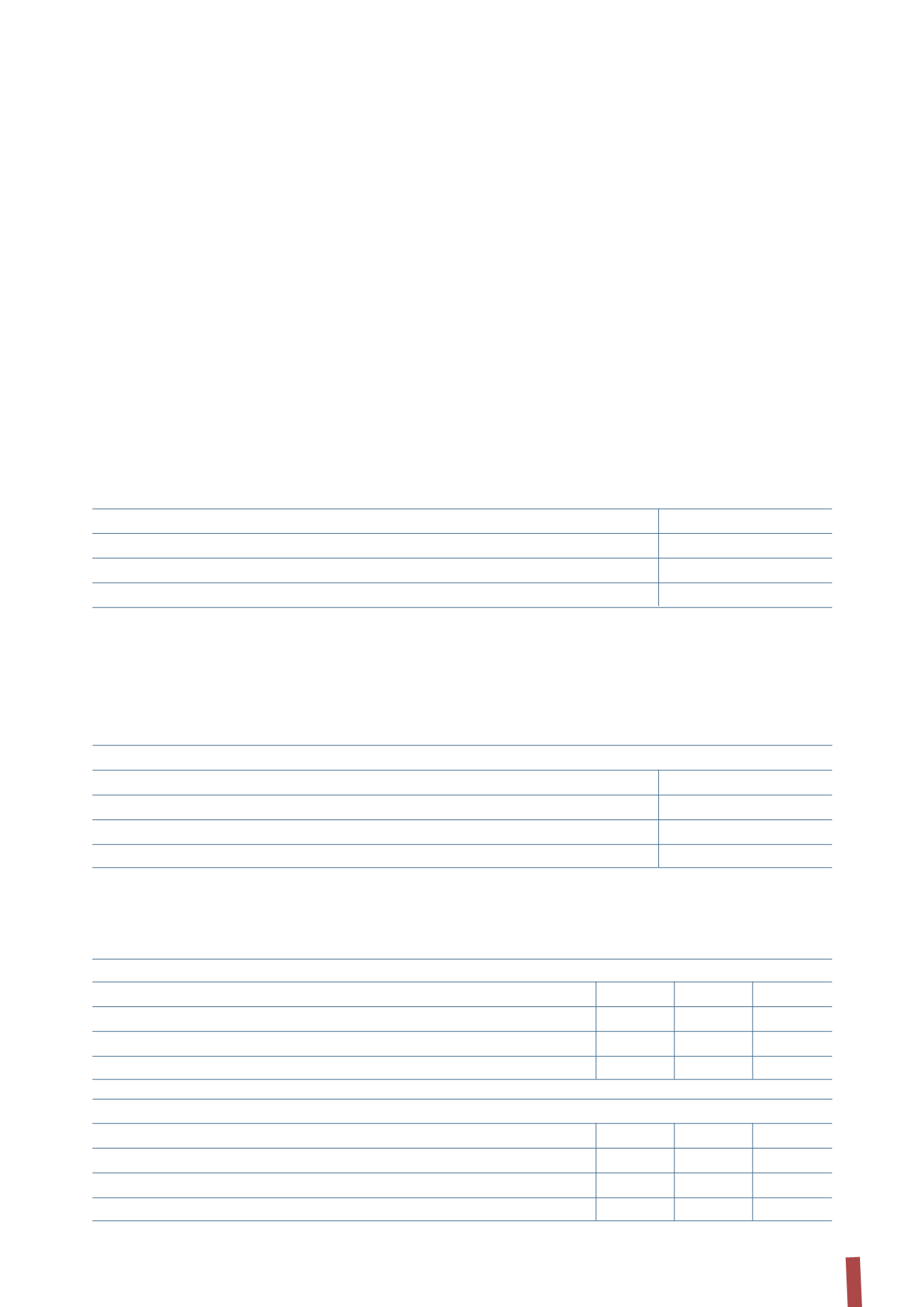

The following table presents a sensitivity analysis of the effects of an increase/decrease in the most significant actuarial

assumptions used to determine the present value of the Employee indemnity liability, namely the discount rate and inflation

rate:

Under Italian law, the amount due to each employee accrues

with service provided and is paid when the employee

leaves the company. The amount due upon termination

of employment is calculated on the basis of the length of

service and the taxable remuneration of each employee.

The liability is adjusted annually for the official cost of

living index and statutory interest, and is not subject to any

vesting conditions or periods, or any funding obligation;

there are therefore no assets that fund this liability.

The rules governing this liability were revised by Legislative

Decree 252/2005 and Law 296/2006 (Finance Act 2007).

Amounts accruing since 2007 by companies with at least

50 employees now have to be paid into the INPS Treasury

Fund or to supplementary pension schemes, as decided

by employees, which now take the form of “defined

contribution plans”. All companies nonetheless still account

for revaluations of amounts accrued before 2007, while those

companies with fewer than 50 employees continue to accrue

amounts in respect of this liability that are not intended for

supplementary pension schemes.

The benefits relating to this plan are paid to participants in

the form of capital, in accordance with the related rules.

The plan also allows partial advances to be paid against the

full amount of the accrued benefit in specific circumstances.

The main risk is the volatility of the inflation rate and the

discount rate, as determined by the market yield on AA

corporate bonds denominated in Euro. Another risk factor

is the possibility that members leave the plan earlier than

expected or that higher advance payments than expected are

requested, resulting in an actuarial loss for the plan, due to

an acceleration of cash flows.

The actuarial assumptions used to value Employee

indemnity liability are as follows:

Contributions for employee benefit obligations (Employee

indemnity liability) are estimated at Euro 298 thousand

for 2014.

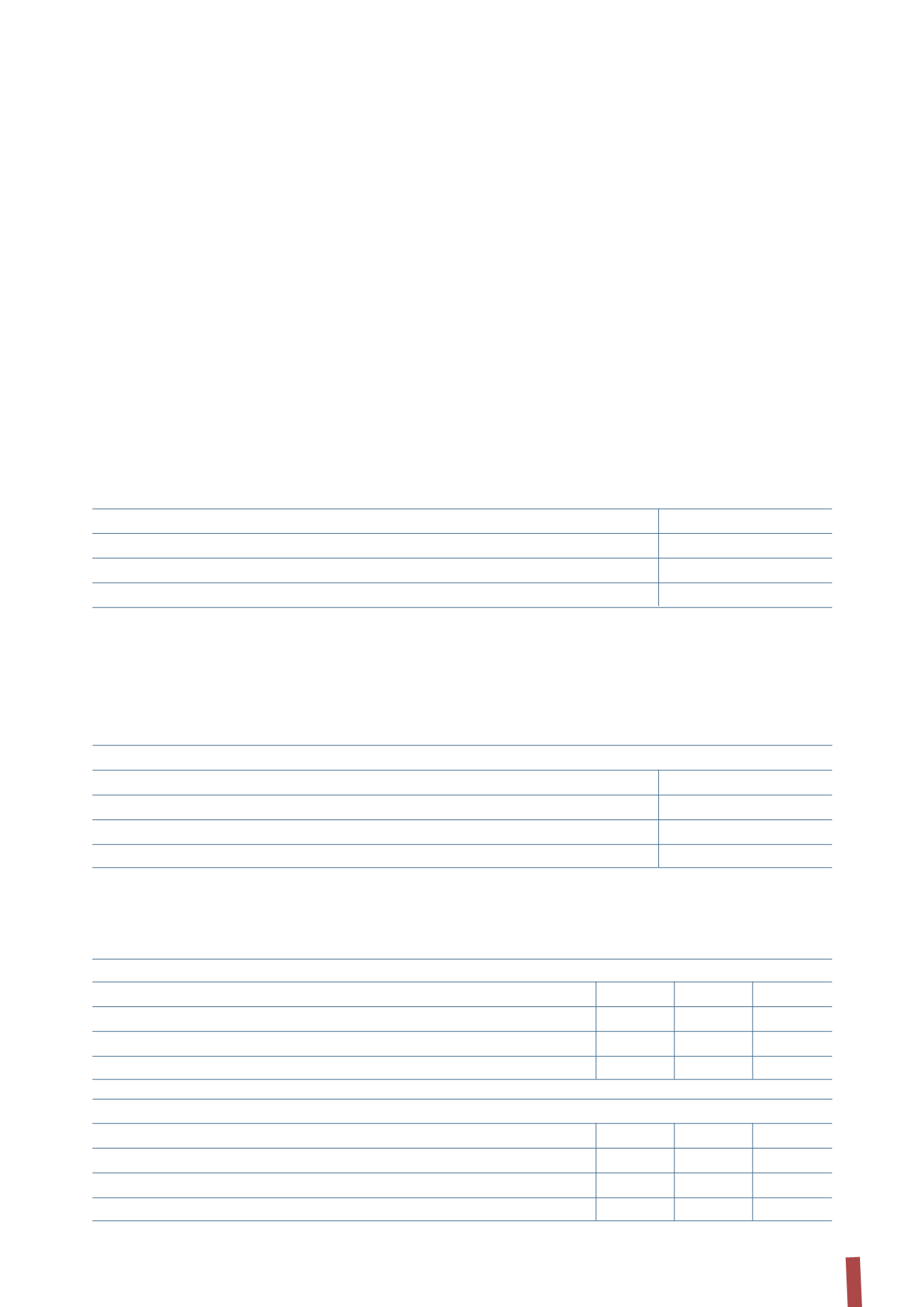

Average headcount in the period is reported below, compared

with closing headcount at the end of each period:

31 December 2013

31 December 2012

Discount rate

3.00%

2.75%

Future expected salary increase

2.00%

2.00%

Inflation rate

2.00%

2.00%

31 December 2013

Change in inflation rate

- 0.25%

+ 0.25%

Effects on liability

-3.16%

3.25%

Change in discount rate

- 0.5%

+ 0.5%

Effects on liability

4.98%

-4.53%

2013

Average

% Closing

%

White collar and management

294

89%

290

89%

Blue collar

35

11%

35

11%

Total

329

100%

325

100%

2012

Average

% Closing

%

White collar and management

278

89%

287

89%

Blue collar

36

11%

37

11%

Total

314

100%

324

100%