PARENT COMPANY >

EXPLANATORY NOTES

286

| 2013 ANNUAL REPORT | PRYSMIAN GROUP

Prysmian S.p.A. provides post-employment benefits through programmes that include defined benefit plans, like the Employee

indemnity liability and seniority bonuses.

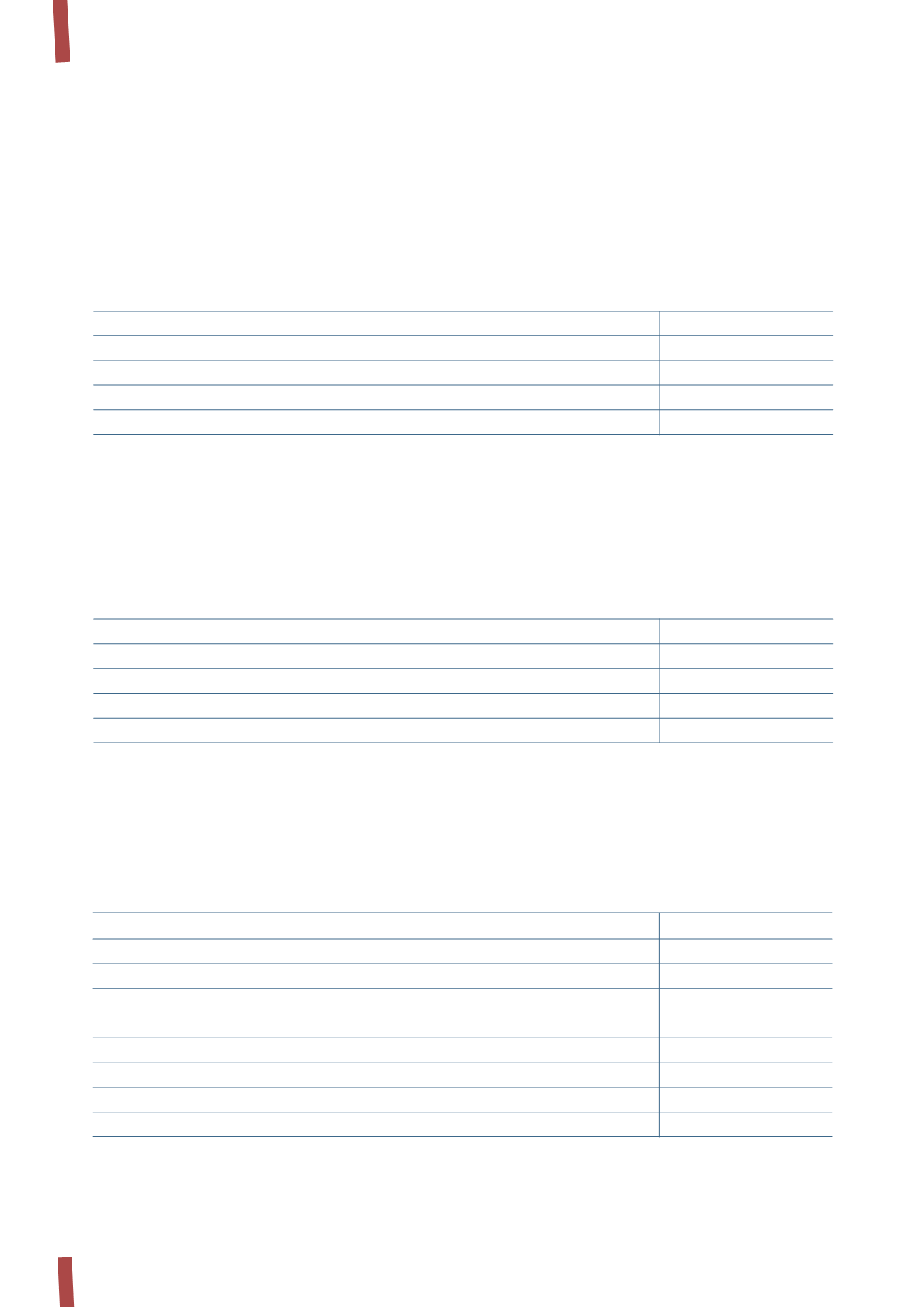

Employee benefit obligations amount to Euro 6,305 thousand at 31 December 2013 (Euro 15,880 thousand at 31 December 2012)

and are detailed as follows:

The change of Euro 9,575 thousand is mainly attributable to

the reclassification of liabilities for the long-term incentive

plan 2011-2013 as Payables to employees, since they are due

for settlement in the first few months of 2014; further details

can be found in Note 17. Personnel costs.

As from 1 January 2013, the Prysmian Group has applied

IAS 19 (revised) to measure the Group’s Employee benefit

obligations; this adoption has not had any effects on the

financial statements of Prysmian S.p.A..

The income and expenses relating to Employee benefit

obligations are as follows:

13.

EMPLOYEE BENEFIT OBLIGATIONS

EMPLOYEE INDEMNITY LIABILITY

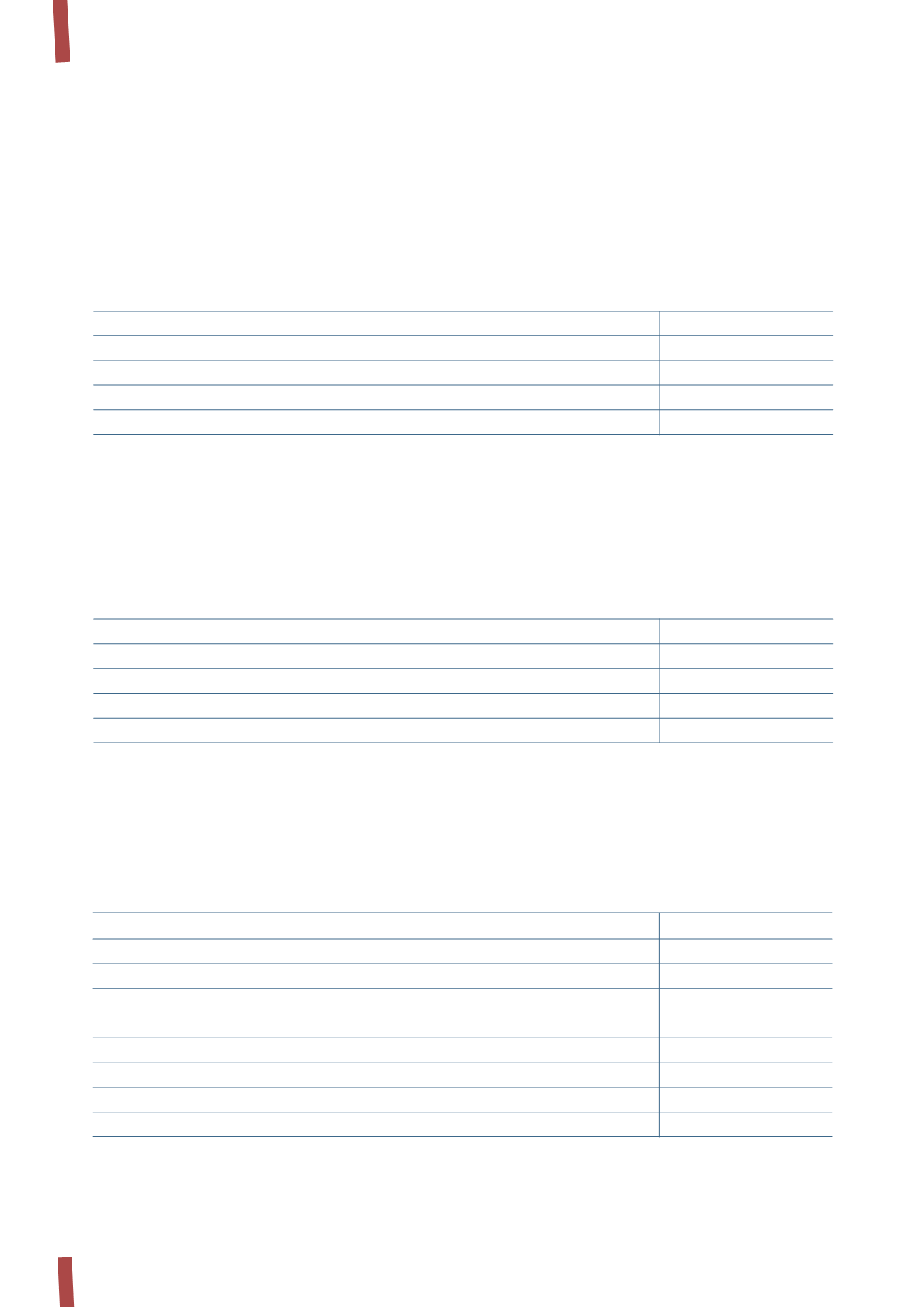

Movements in this balance are as follows:

The actuarial gains recognised at 31 December 2013 (Euro 149 thousand) mainly relate to the change in the associated economic

parameters (the discount and inflation rates).

(in thousands of Euro)

31 December 2013

31 December 2012

Employee indemnity liability (Italian TFR)

289

382

Termination and other benefits

139

585

Incentive plans

-

6,652

Total

428

7,619

(in thousands of Euro)

31 December 2013

31 December 2012

Employee indemnity liability (Italian TFR)

4,545

5,029

Termination and other benefits

1,760

1,663

Incentive plans

-

9,188

Total

6,305

15,880

(in thousands of Euro)

2013

2012

Opening balance

5,029

3,975

Current service costs

156

200

Interest cost

133

182

Actuarial (gains)/(losses recognised in equity

(149)

522

Staff transfer

(36)

522

Disbursements

(588)

(372)

Total movements

(484)

1,054

Closing balance

4,545

5,029