2013 SuStainability RepoRt >

eConomiC and finanCial ReSponSibility

30

| pRySmian gRoup | 2013 SuStainability RepoRt

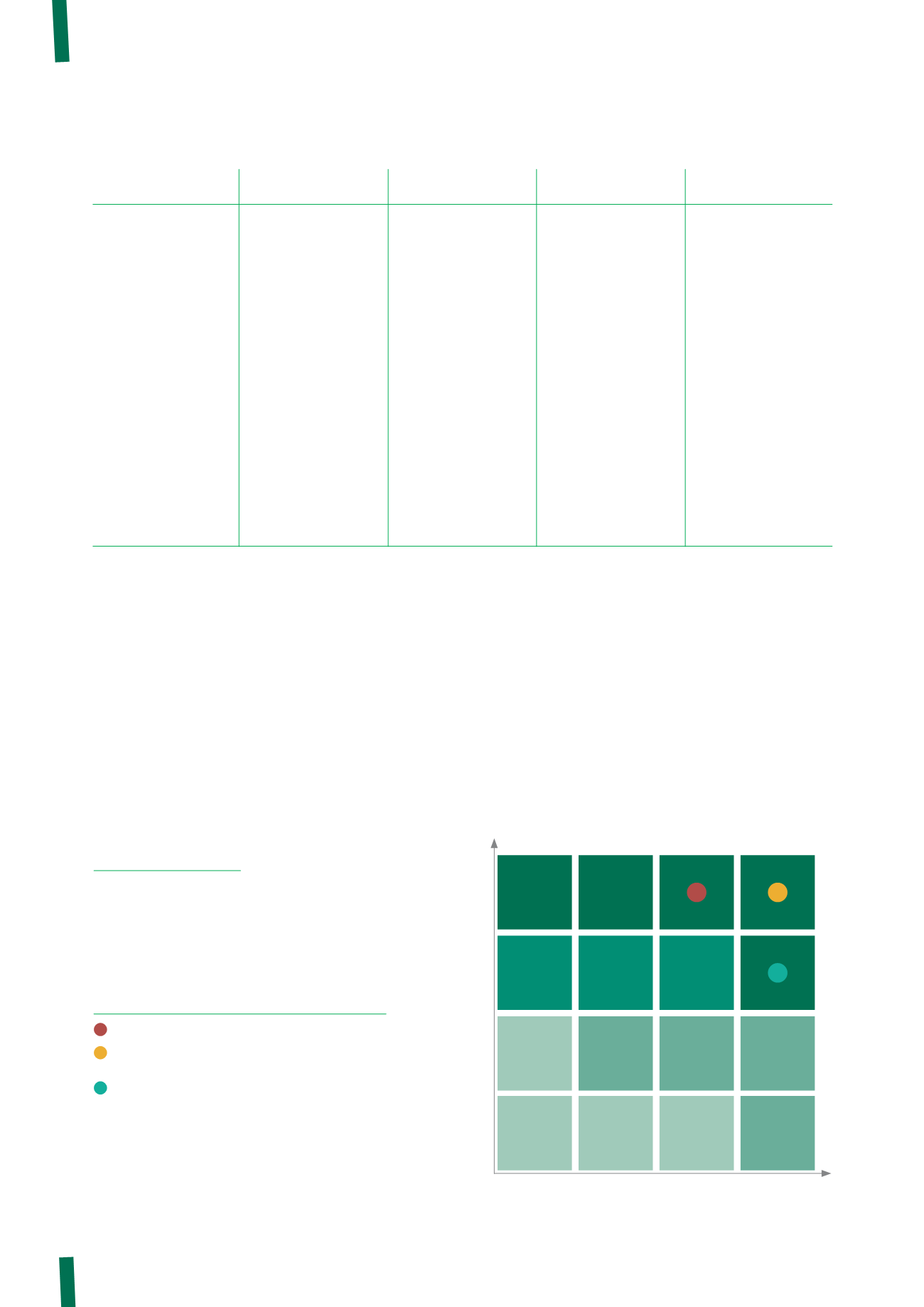

PRYSMIAN’S RISK MODEL

Having regard for the risk model adopted, the process involves

a top-down approach whereby the Chief Risk Officer, together

with the Board of Directors and Senior Management, identifies

the risk areas that are most significant when it comes to

achieving the strategic objectives. These areas are then

analysed further to identify the specific situations and risk

events to be measured and assessed in subsequent phases of

the process. The top-down approach ensures that an overall

assessment is made of the Group’s entire risk portfolio. If

any significant risks are identified, suitable measures can be

taken to reduce the chance of underestimating them or their

interaction with other types of risk.

Each situation or specific risk event identified is analysed,

considering the impact of the risk, the probability of

occurrence and the adequacy of the risk management process

should the situation actually arise.

RISK ASSESSMENT CRITERIA

Strategic

financial

operational

legal & Compliance

planning & Reporting

Changes in

macroeconomic and

competitive environment

and in demand

Stakeholders expectations

Key customers and

business partners

Emerging market risk

M&A/JVs and related

integration processes

Investments

Strategy implementation

Organisational structure

& governance

Commodity price

fluctuation

Exchange rate fluctuation

Interest rate fluctuation

Financial instruments

Credit risk

Liquidity/working capital

Availability/cost

of capital

Financial counterparties

Sales and calls for tender

Production capacity/

efficiency

Supply chain capacity/

efficiency

Business interruption/

catastrophic events

Contract performance/

liability

Product quality/liability

Environment

Information systems

Human resources

Outsourcing

Intellectual property

rights

Compliance with laws

and regulations

Compliance with Code

of Ethics, policy

e procedures

Budget & strategic

planning

Tax & financial planning

Management reporting

Financial reporting

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

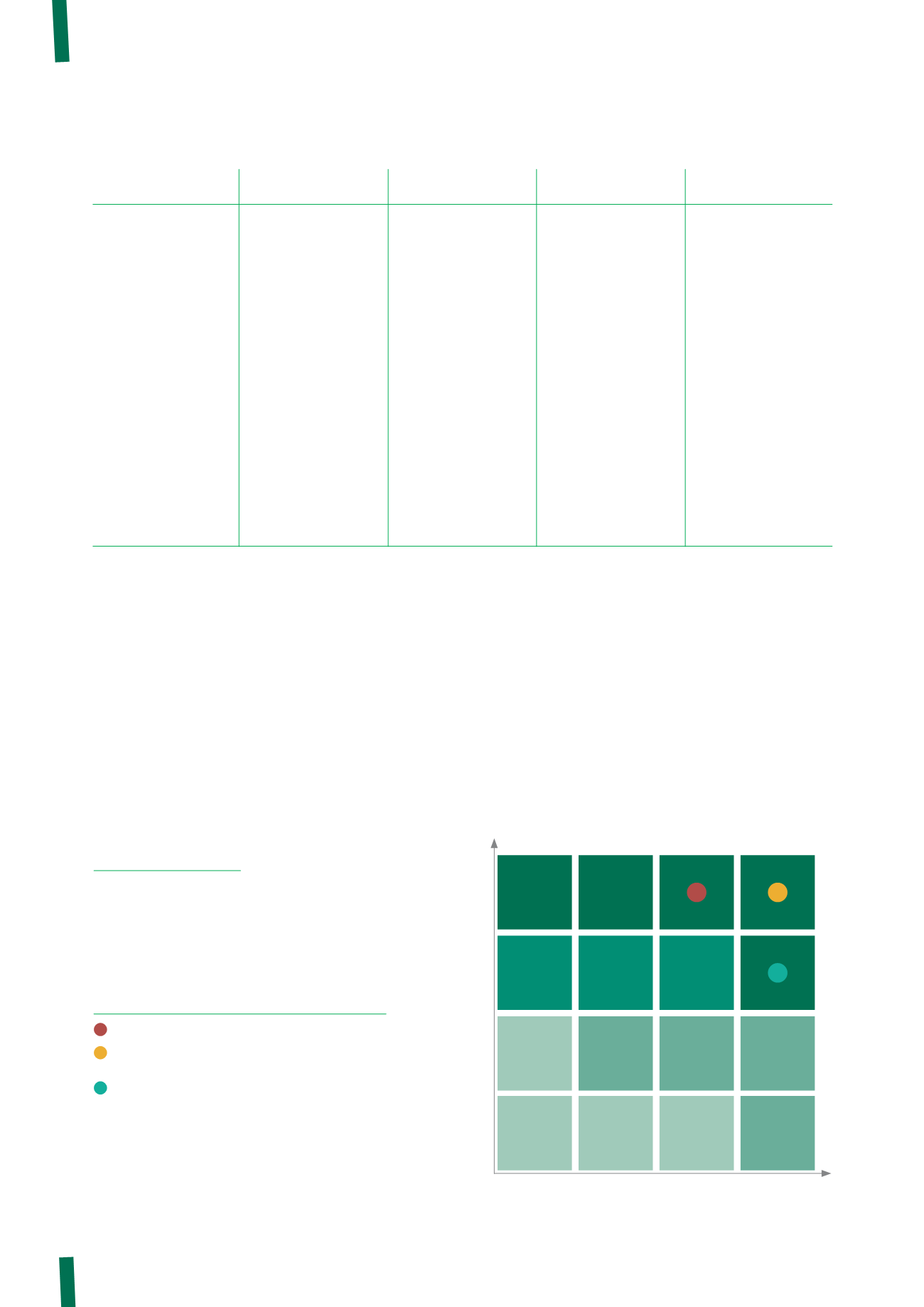

assessment Criteria

likelihood

impaCt

• Impact

• Likelihood

• Level of Risk Management

Remote

Negligible

Low

Moderate

Medium

High

High

Critical

level of Risk management

Risk INADEQUATELY covered and/or managed

Risk covered and/or managed but with ROOM

FOR IMPROVEMENT

Risk ADEQUATELY covered and/or managed