Parent Company Financial Report |

DIRECTORS’ REPORT

2014 Annual Report

Prysmian Group

264

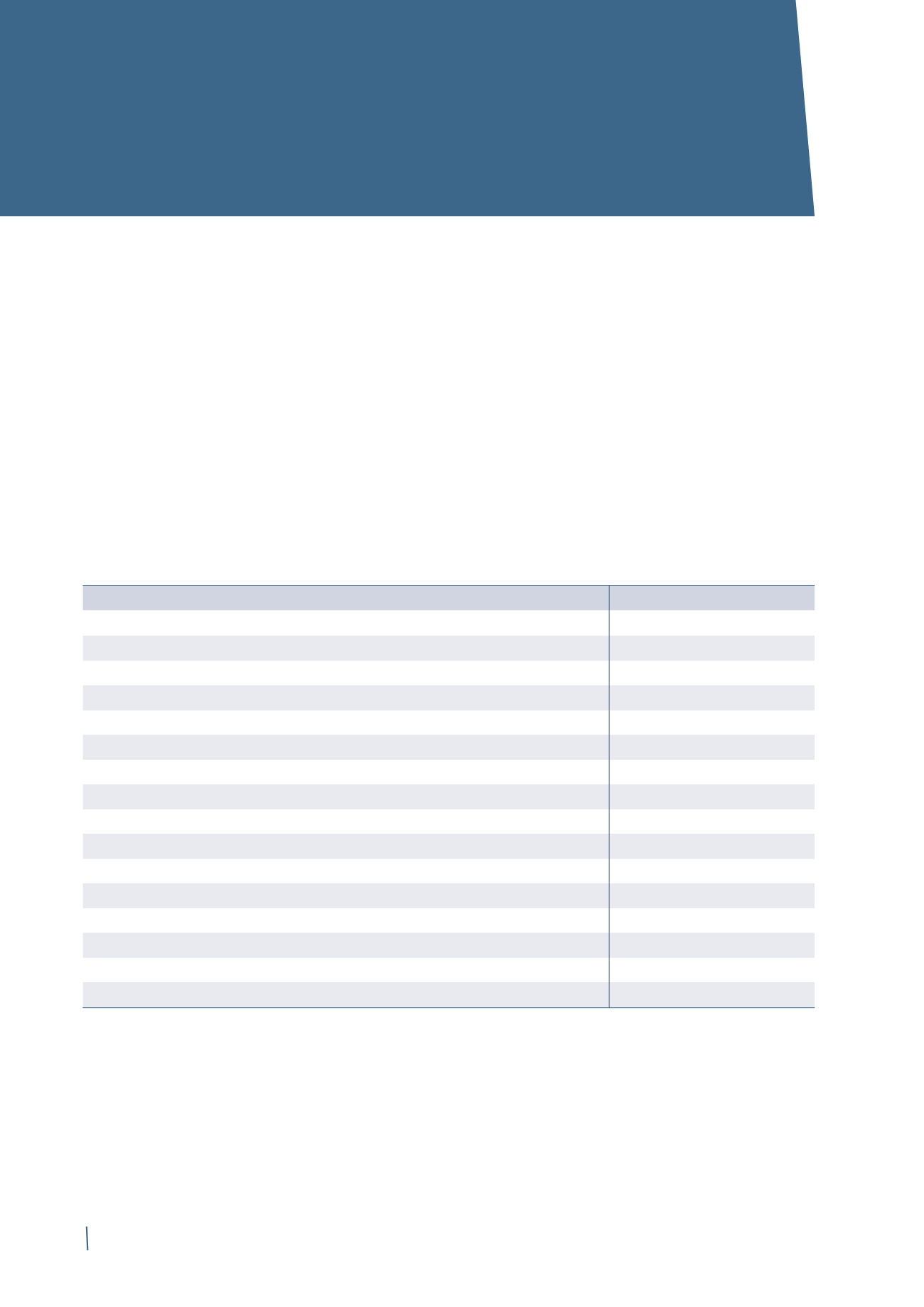

FINANCIAL PERFORMANCE

OF PRYSMIAN S.P.A.

The tables presented and discussed belowhave been prepared

by reclassifying the financial statements at 31 December

2014, which in turn have been drawn up in accordance with

the International Financial Reporting Standards (IFRS) issued

by the International Accounting Standards Board (IASB) and

endorsed by the European Union, and with the provisions

implementing art. 9 of Legislative Decree 38/2005.

As from 1 July 2013, the activities of purchasing strategic

materials (copper, aluminium and lead) from third-party

suppliers and reselling them to the Group's operating

INCOME STATEMENT

companies have been centralised in Prysmian S.p.A.. This

operation is part of the reorganisation of activities within the

Prysmian Group with the goal of having greater control over

what is considered a strategic business for the Group.

Following this centralisation, Prysmian S.p.A.'s "Revenue

from ordinary operations" relates to the sale of strategic

metals to Group operating companies, while "Other income"

primarily refers to services provided and royalties from the

licensing of patents and know-how to Group companies or

even third parties.

2014

2013

Revenue from ordinary operations

1,090,578

452,225

Other income

106,624

102,068

of which non-recurring other income

-

333

Operating costs

(1,130,685)

(501,444)

of which non-recurring income/(expenses)

(2,186)

(2,463)

of which personnel costs for stock option fair value

(496)

(4,599)

Other expenses

(47,348)

(67,031)

of which non-recurring other expenses

17,835

(1,666)

Amortisation, depreciation and impairment

(9,493)

(10,463)

Operating income

9,676

(24,645)

Net finance income/(costs)

(38,862)

(38,775)

of which non-recurring net finance income/(costs)

(1,790)

(2,311)

Net income from investments

204,606

219,861

Profit/(loss) before taxes

175,420

156,441

Income taxes

16,136

28,244

Net profit/(loss) for the year

191,556

184,685

(in thousands of Euro)