275

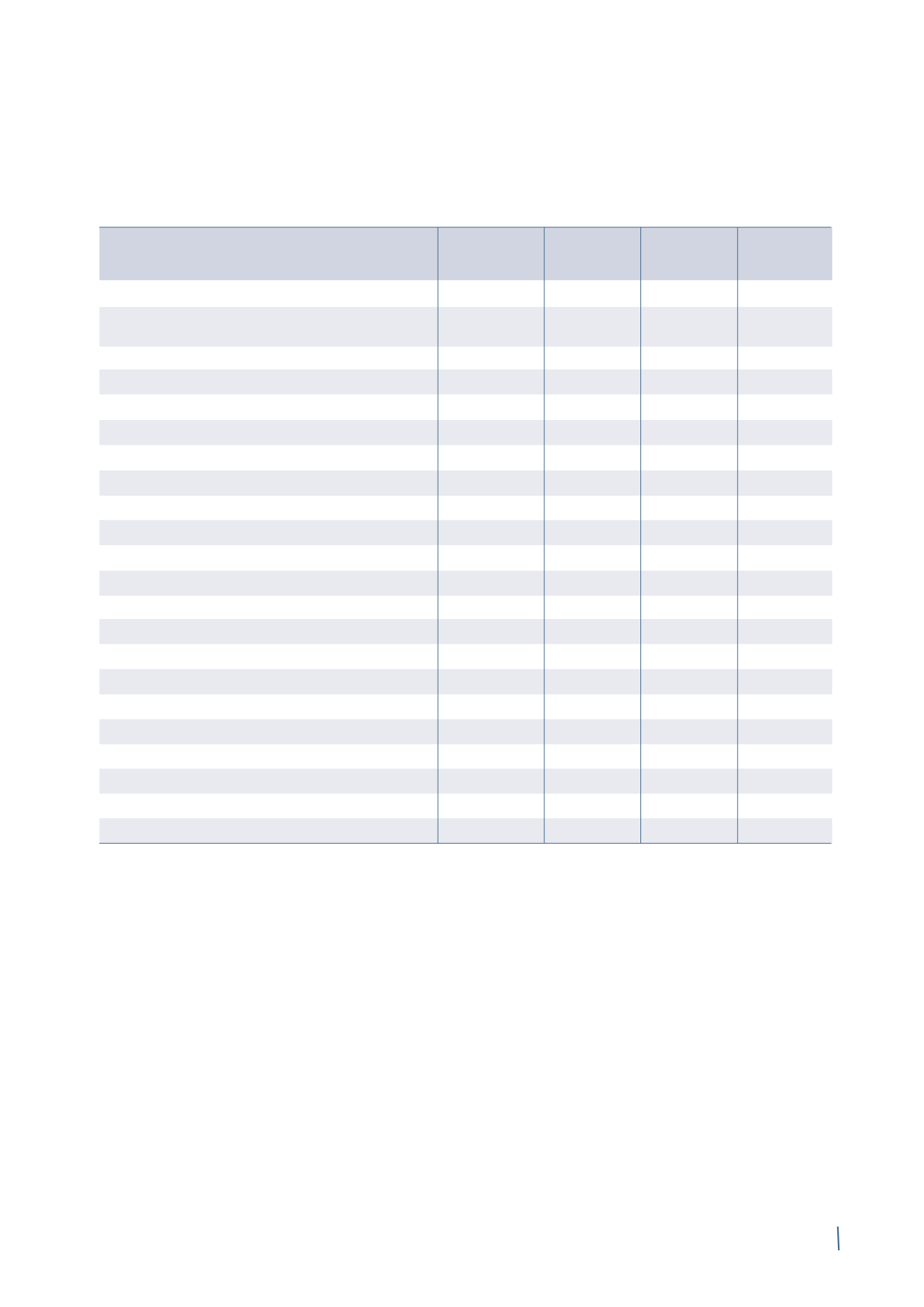

INCOME STATEMENT

Note

2014

of which

2013

of which

related parties

related parties

(Note 25)

(Note 25)

Sales of goods and services

14

1,091,702,248

1,091,594,320

451,099,905

449,437,400

Change in inventories of work in progress,

semi-finished and finished goods

(1,124,530)

-

1,124,530

-

Other income

15

106,624,599

99,870,994

102,068,048

97,293,623

of which non-recurring other income

26

-

-

333,438

333,438

Raw materials, consumables used and goods for resale

16

(1,090,772,337)

(1,954,805)

(453,014,043)

(511,335)

Fair value change in metal derivatives

(31,880)

(31,880)

38,249

38,249

Personnel costs

17

(39,880,929)

(5,685,416)

(48,467,095)

(12,648,676)

of which non-recurring personnel costs

26

(2,185,838)

(2,462,737)

(1,687,000)

of which personnel costs for fair value of stock options

17

(495,887)

(12,736)

(4,599,442)

(1,670,829)

Amortisation, depreciation and impairment

18

(9,492,951)

(10,463,424)

Other expenses

19

(47,348,242)

(14,862,427)

(67,030,778)

(18,551,644)

of which non-recurring other (expenses)/releases

26

17,835,905

(1,264,152)

(1,666,229)

(1,731,992)

Operating income

9,675,978

(24,644,608)

Finance costs

20

(58,414,473)

(3,196,232)

(53,323,707)

(1,208,533)

of which non-recurring finance costs

(2,048,425)

(2,310,817)

Finance income

20

19,552,167

19,386,018

14,547,994

14,340,956

of which non-recurring finance income

257,837

257,837

-

Dividends from subsidiaries

21

221,071,176

221,071,176

219,861,163

219,861,163

(Impairment)/Reversal of impairment of investments in subsidiaries

(16,465,310)

(16,465,310)

-

Profit before taxes

175,419,538

156,440,842

Taxes

22

16,136,697

13,256,634

28,243,716

27,115,381

Net profit/(loss) for the year

191,556,235

184,684,558

(in Euro)