277

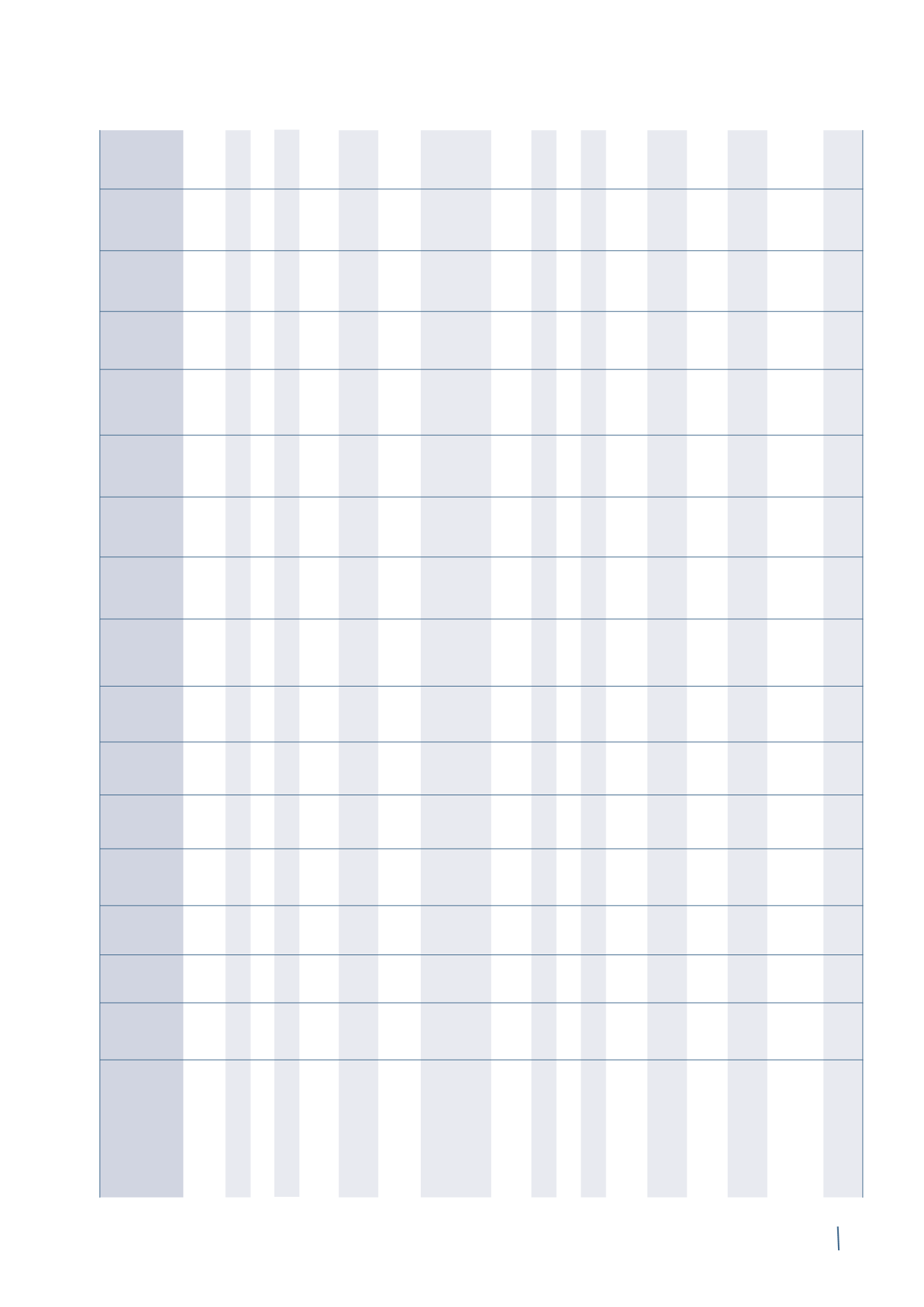

STATEMENT OF CHANGES IN EQUITY

See Note 9. Share capital and reserves for a discussion of the contents of the above table.

(*) At 31 December 2014, the number of treasury shares held came to 2,819,649 with a total nominal value of Euro 281,965.

Share

Share Capital

Legal

Treasury

Extra- IAS/IFRS

Capital

Actuarial

Convertible

Stock Cash flow Treasury Share issue

Retained Net profit/

Total

capital

premium increase reserve

shares

ordinary first-time contribution

gains/

bond

option

hedge

shares (*)

reserve

earnings

(loss) for

reserve

costs

reserve reserve adoption

reserve

(losses)-

reserve

reserve

reserve

the year

reserve

employee

benefits

Balance at

21,451

485,496 (3,982)

4,288

30,179 52,688

30,177

6,113

(1,124)

-

25,975

-

(30,179)

-

138,368

112,138 871,588

31 December 2012

Capital increases

8

377

-

-

-

-

-

-

-

-

-

-

-

-

-

-

385

Dividend distribution

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

(88,857)

(88,857)

Share-based compensation -

-

-

-

-

-

-

-

-

-

12,593

-

-

-

1,576

- 14,169

Allocation of prior

year net profit

-

-

-

3

-

-

-

-

-

-

-

-

-

-

23,278

(23,281)

-

Non-monetary component

of convertible bond

-

-

-

-

-

-

-

-

-

39,236

-

-

-

-

-

-

39,236

Capital increase

costs - tax effect

-

-

(262)

-

-

-

-

-

-

-

-

-

-

-

-

-

(262)

Total

comprehensive

income/(loss)

for the year

-

-

-

-

-

-

-

-

108

-

-

-

-

-

-

184,685 184,793

Balance at

21,459 485,873 (4,244)

4,291

30,179 52,688

30,177

6,113

(1,016)

39,236

38,568

-

(30,179)

-

163,222

184,685 1,021,052

31 December 2013

Capital increases

212

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

212

Dividend distribution

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

(88,857)

(88,857)

Share-based compensation -

-

-

-

(16,210)

-

-

-

-

-

(33,848)

-

16,210

-

37,465

-

3,617

Allocation of prior

year net profit

-

-

-

1

-

-

-

-

-

-

-

-

-

536

95,291

(95,828)

-

Non-monetary component

of convertible bond

-

-

-

-

-

-

-

-

-

(28)

-

-

-

-

-

-

(28)

Capital increase

costs - tax effect

-

-

(262)

-

-

-

-

-

-

-

-

-

-

-

-

-

(262)

Purchase of treasury

shares

-

-

-

-

19,954

-

-

-

-

-

-

-

(19,954)

-

(19,538)

-

(19,538)

Total comprehensive

income/(loss)

for the year

-

-

-

-

-

-

-

-

(705)

-

-

(20)

-

-

-

191,556 190,831

Balance at

21,671

485,873 (4,506)

4,292

33,923

52,688

30,177

6,113

(1,721)

39,208

4,720

(20)

(33,923)

536

276,440

191,556 1,107,027

31 December 2014

(in thousands of Euro)