CONSOLIDATED FINANCIAL STATEMENTS >

DIRECTORS’ REPORT

12

| 2013 ANNUAL REPORT | PRYSMIAN GROUP

FINANCIAL HIGHLIGHTS

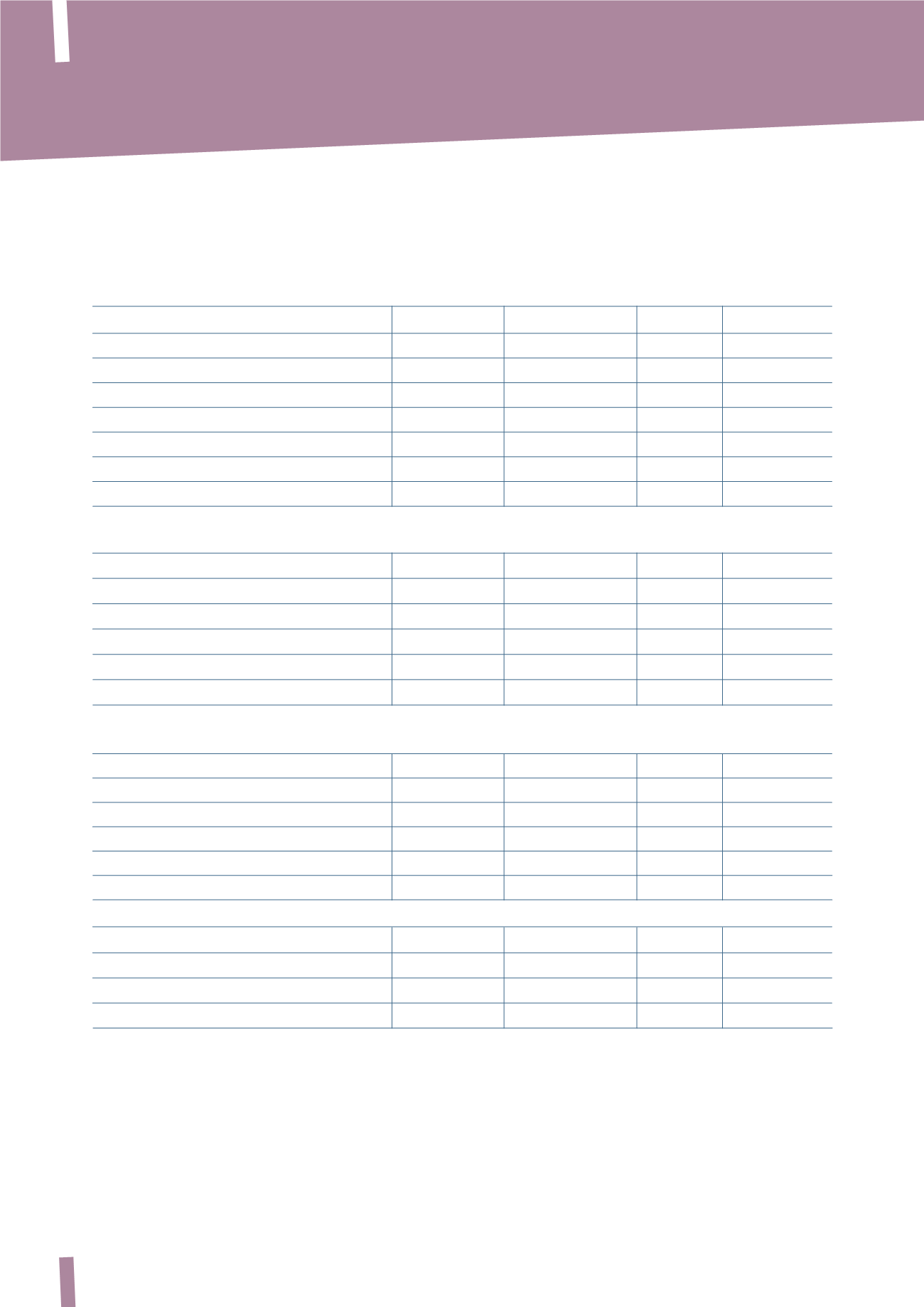

MAIN FINANCIAL AND OPERATING DATA (*)

(in millions of Euro)

2013

2012(***)

Change %

2011(**)

Sales

7,273

7,848

-7.3%

7,583

EBITDA

(1)

562

546

2.9%

269

Adjusted EBITDA

(2)

612

647

-5.5%

568

Operating income

360

362

-0.8%

19

Adjusted operating income

(3)

457

483

-5.4%

426

Profit/(loss) before taxes

222

242

-8.4%

(101)

Net profit/(loss) for the year

154

169

-8.6%

(145)

(in millions of Euro)

31 December 2013 31 December 2012(***)

Change

31 December 2011

Net capital employed

2,337

2,421

(84)

2,436

Employee benefit obligations

308

344

(36)

268

Equity

1,195

1,159

36

1,104

of which attributable to non-controlling interests

48

47

1

62

Net financial position

834

918

(84)

1,064

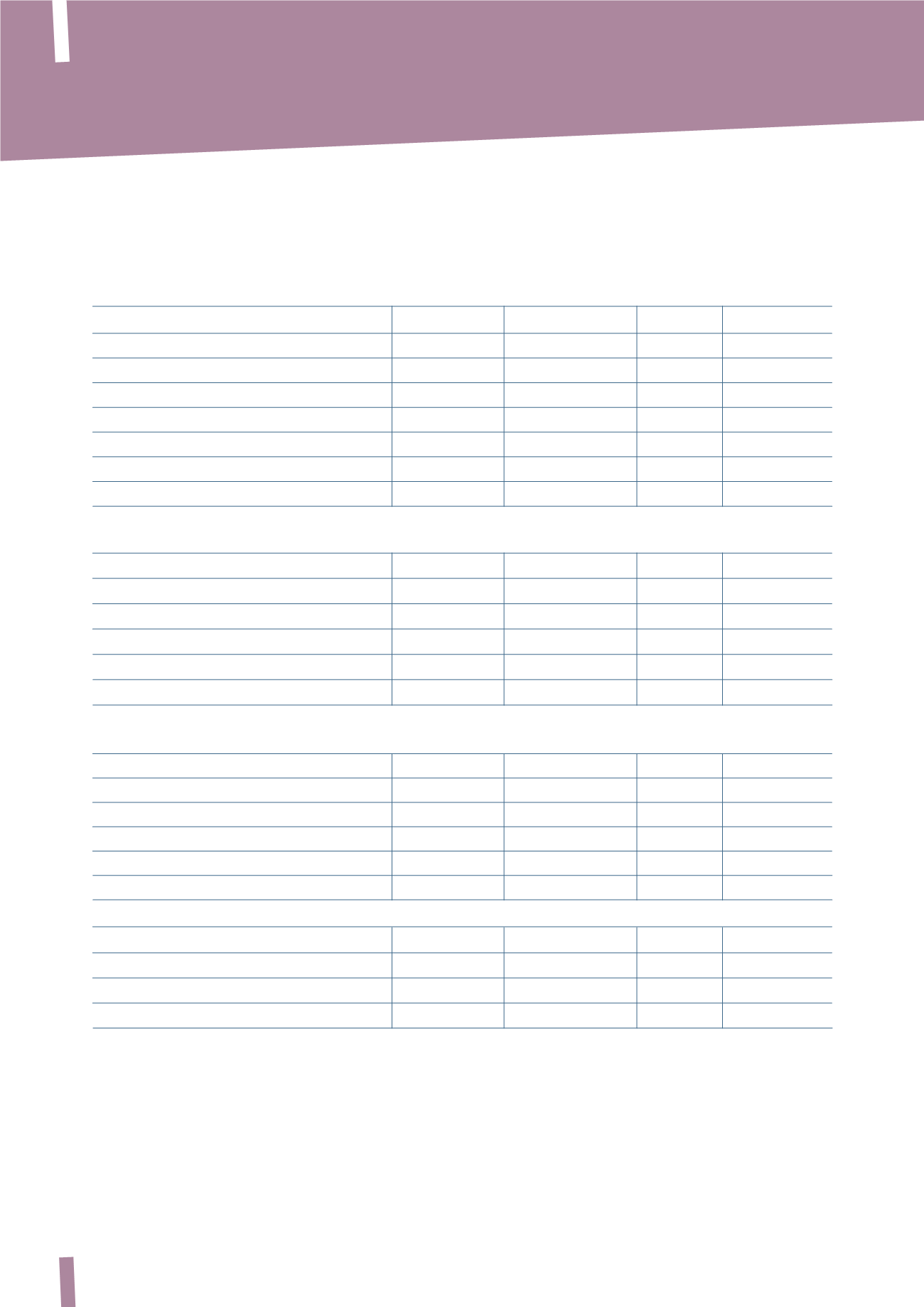

(in millions of Euro)

2013

2012(***)

Change %

2011(**)

Investments

(4)

144

152

-5.3%

159

Employees (at period end)

19,374

19,896

-2.6%

21,547

Earnings/(loss) per share

- basic

0.71

0.79

(0.65)

- diluted

0.71

0.78

(0.65)

Patents(****)

5,731

5,644

5,288

Number of plants

91

91

97

Percentage of plants certified ISO 14001

86%

82%

80%

Percentage of plants certified OHSAS 18001

49%

42%

40%

(1)

EBITDA is defined as earnings/(loss) for the year, before the fair value change in metal derivatives and in other fair value items, amortisation,

depreciation, and impairment, finance costs and income, the share of net profit/(loss) of associates, dividends from other companies and taxes.

(2)

Adjusted EBITDA is defined as EBITDA before non-recurring income/(expenses).

(3)

Adjusted operating income is defined as operating income before non-recurring income/(expenses) and the fair value change in metal derivatives and

in other fair value items.

(4)

Investments refer to increases in Property, plant and equipment and Intangible assets.

(*) All percentages contained in this report have been calculated with reference to amounts expressed in thousands of Euro.

(**) Includes the Draka Group’s results for the period 1 March – 31 December 2011.

(***) The previously published figures have been amended. Further details can be found in Section C. Restatement of comparative figures at 31 December

2012 in the Explanatory Notes to the Consolidated Financial Statements.

(****) The figures report the total number of patents, comprising patents granted plus patent applications pending worldwide.