CONSOLIDATED FINANCIAL STATEMENTS >

DIRECTORS’ REPORT

14

| 2013 ANNUAL REPORT | PRYSMIAN GROUP

(1) Organic growth: growth on 2011 pro-forma amounts, calculated net of changes in the group structure, in metal prices and exchange rates.

(2) Adjusted EBITDA is defined as EBITDA before non-recurring income/(expenses).

(3) Adjusted Operating Income is defined as Operating Income before non-recurring income/(expenses) and the fair value change in metal derivatives

and in other fair value items.

(4) Adjusted Net Profit is defined as net profit/(loss) before non-recurring income/(expenses), the effect of derivatives and of other fair value items,

exchange rate differences, non-monetary interest on the convertible bond and the related tax effects.

(5) Net Operating Working Capital means Net Working Capital excluding the effect of derivatives. The percentage is calculated as Net Working Capital/

Annualised last-quarter sales.

(*) Draka consolidated from 1 March 2011.

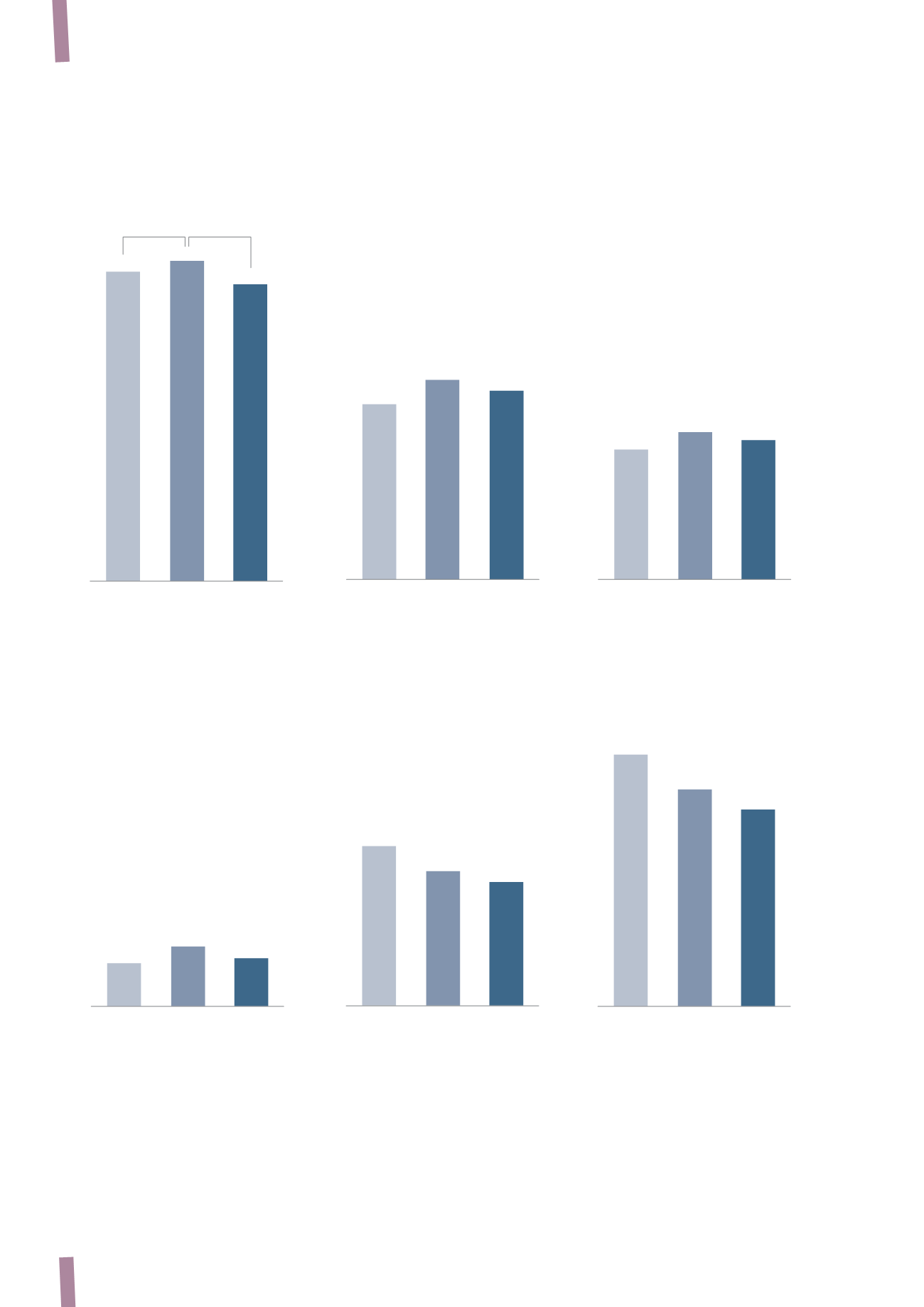

KEY FINANCIALS (*)

Amounts in millions of Euro – Percentages on sales

SALES

ADJ. NET PROFIT

(4)

ADJ. OPERATING INCOME

(3)

NET FINANCIAL POSITION

ADJ. EBITDA

(2)

NET OPERATING

WORKING CAPITAL

(5)

2011

2012

2013

7,583

7,848

7,273

-1.8%

(1)

SALES

-3.1%

(1)

2011

2012

2013

426

483

457

5.6%

6.2%

6.3%

ADJ. OPERATING

INCOME

(3)

2011

2012

2013

568

647

612

ADJ. EBITDA

(2)

7.5%

8.2%

8.4%

2011

2012

2013

231

280

268

3.0%

3.6% 3.7%

ADJ. NET PROFIT

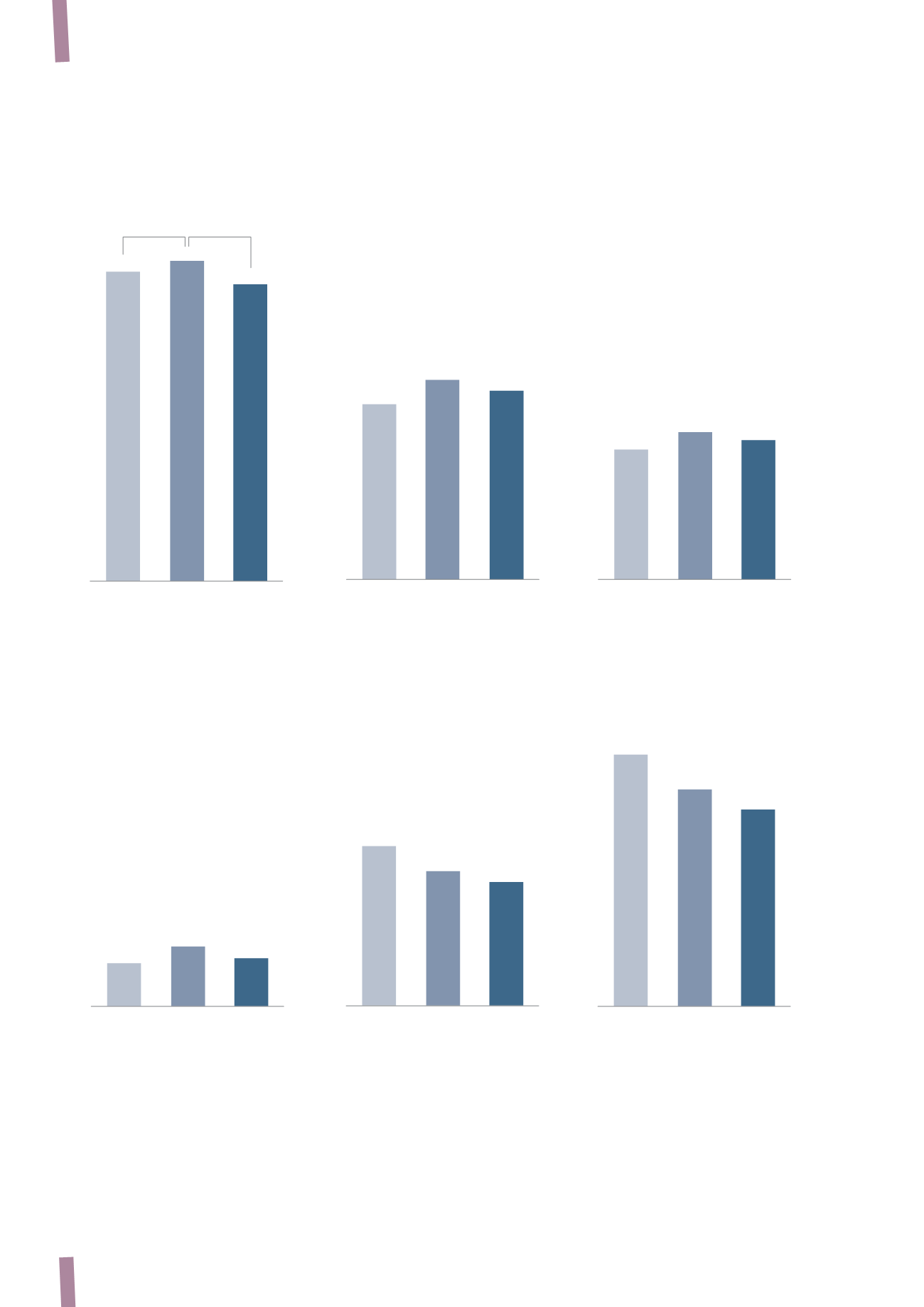

(4)

2011

2012

2013

1,064

918

834

NET FINANCIAL POSITION

2011

2012

2013

579

489

450

NET OPERATING

WORKING C PITAL

(5)

7.3%

6.4% 6.3%