87

purchase price to systematically lag behind changes in the

petroleum price.

More generally, depending on the size and speed of copper

price fluctuations, such fluctuations may have a significant

impact on customers’ buying decisions particularly in the

Trade & Installers business area, the Power Distribution

business line and certain lines in the Industrial area more

exposed to cyclical trends in demand, and on the Group’s

margins and working capital. In particular, (i) significant,

rapid increases and decreases in the copper price may

cause absolute increases and decreases respectively in the

Group’s profit margins due to the nature of the commercial

relationships and mechanisms for determining end product

prices and (ii) increases and decreases in the copper price may

cause increases and decreases respectively in working capital

(with a consequent increase or decrease in the Group’s net

debt).

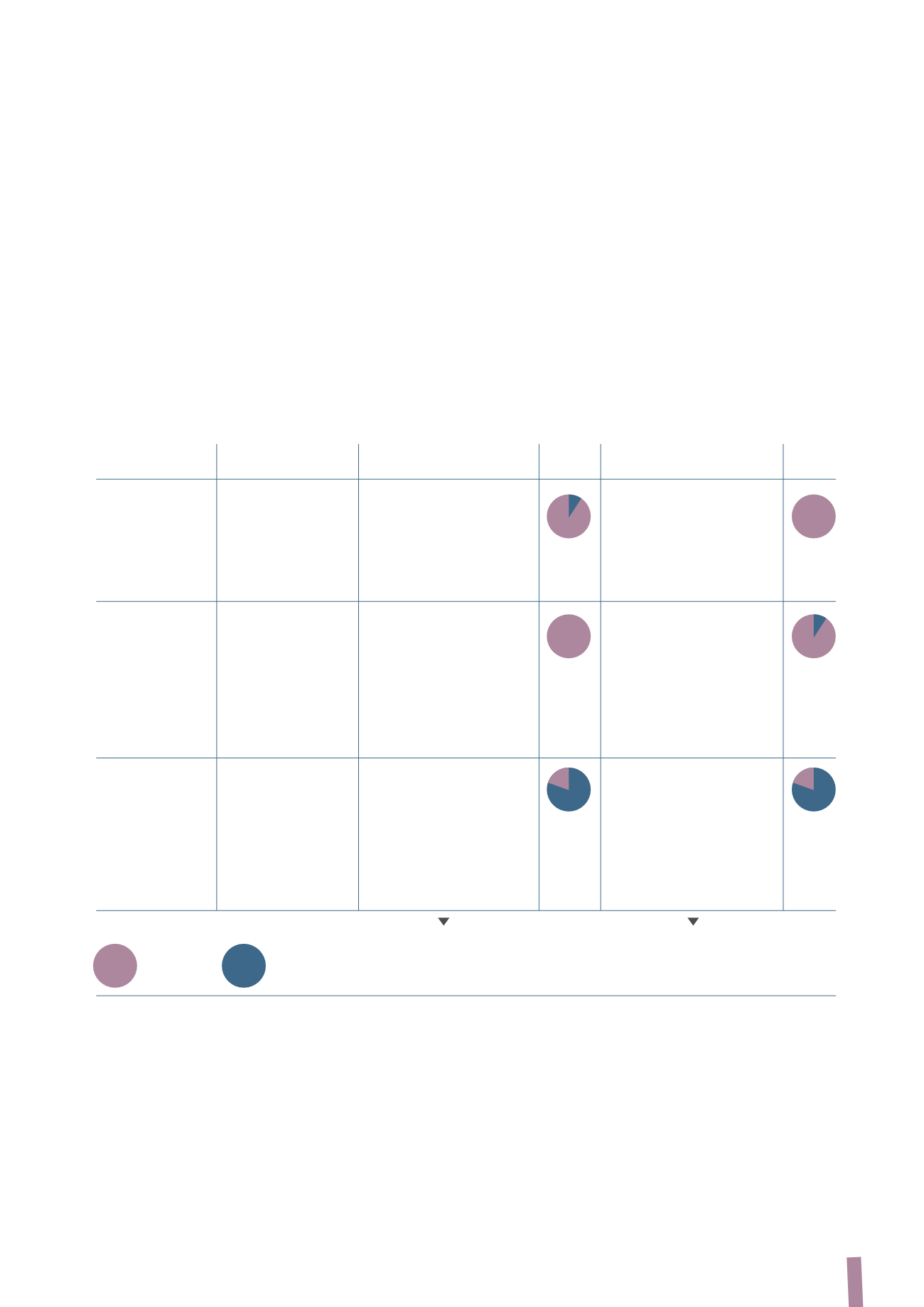

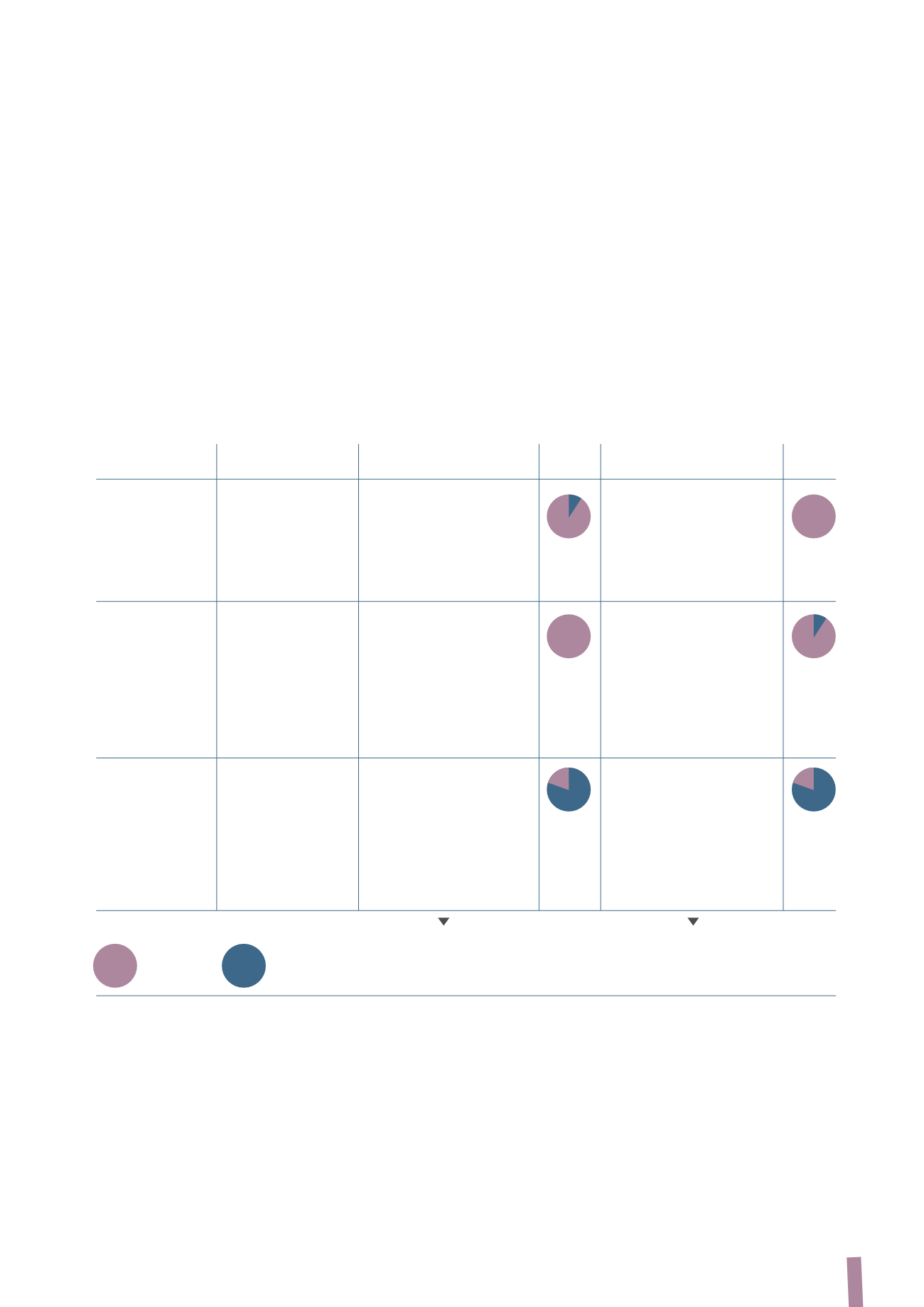

Risk hedging differs according to the type of business and

supply contract, as shown in the following diagram:

A more detailed analysis of the risk in question can nonetheless be found in the “Financial Risk Management” section of the

Explanatory Notes to the Consolidated Financial Statements.

Supply Contract

Main Application

Metal influence on Cable Price Impact

Hedging of Metal Price

Impact

Fluctuations

Predetermined

Projects (Power

Technology and Design

Princing locked in at order

delivery date

trasmission)

content are the main

intake.

Cables for industrial

elements of the

Profitability protection

applications (eg. OGP)

“solutions” offered.

through systematic hedging

Pricing little affected by

(long order-to-delivery

metals.

cycle).

Frame contracts

Cables for Utlilities

Pricing defined as hollow

Price adjusted through

(eg. power distribution thus automatic price

formulas linked to

cables)

adjustment through

publicly avaible metal

formulas linked to

quatation (avarage last month).

publicly available metal

Profitability protection

quotation.

through systematic

hedging (short

order-to-delivery cycle).

Spot orders

Cables for construction Standard products, high

Princing managed through

and civil engineering

copper content, limited

price lists (frequently

value added.

updated).

Competitive pressure

may result in delayed

price adjustment.

Hedging based on forecasted

volumes rather than orders.

HIGH

LOW

Metal price fluctuations are normally passed through to customers

under supply contracts.

Hedging is used to systematically minimise profitability risks.