81

a particular situation or event will occur within a twelve-

month period, using a scale that goes from remote to high,

where the prospect of risk must also reflect whether, in

the course of time, the likelihood is increasing, constant or

decreasing;

• Level of Risk Management is assessed with reference to the

maturity and efficiency of the risk management systems

and processes adopted, using a scale that goes from

adequate to inadequate.

RISK ASSESSMENT CRITERIA

The process of identifying, analysing, measuring and

evaluating risks results in the production of an analysis of

key risks, that are quantified, categorised and listed in order

of priority. This analysis is used by the Board of Directors to

assess the consistency of the nature and level of key risks

with the Group’s strategic objectives and risk appetite, and

to define, with Senior Management, the risks for which

risk management or risk mitigation strategies should be

developed, implemented and monitored and how existing

strategies should be enhanced.

The type of instrument to develop and/or implement for risk

management will depend on the nature of the specific risk

situation or event identified, categorised as follows:

• Risks depending on External Factors or beyond the Group’s

influence, namely those risks whose occurrence cannot be

prevented by the Group but whose impact can be mitigated

by adopting countermeasures such as, for example,

continuous monitoring activities, stress testing of the

business plan, insurance coverage, disaster recovery plans,

alternative strategies;

• Accepted Risks, i.e. those risks that are strategically

acceptable in view of the potential related benefits and can

be managed using a system that reduces the probability of

an event’s occurrence and the negative impact if the event

does occur; such a system includes, for example, scenario

analysis, adoption of specific risk management policies like

hedging or other forms of risk transfer, monitoring of key

risk indicators;

• Preventable Risks, i.e. risks inherent in the business that

can be controlled using a system of internal rules designed

to dictate the adoption of conduct likely to prevent such

risks and to prevent mistakes; such a system includes, for

example, the entire internal control system and its main

elements, namely internal processes and procedures,

reporting activities, ongoing monitoring and audit

activities.

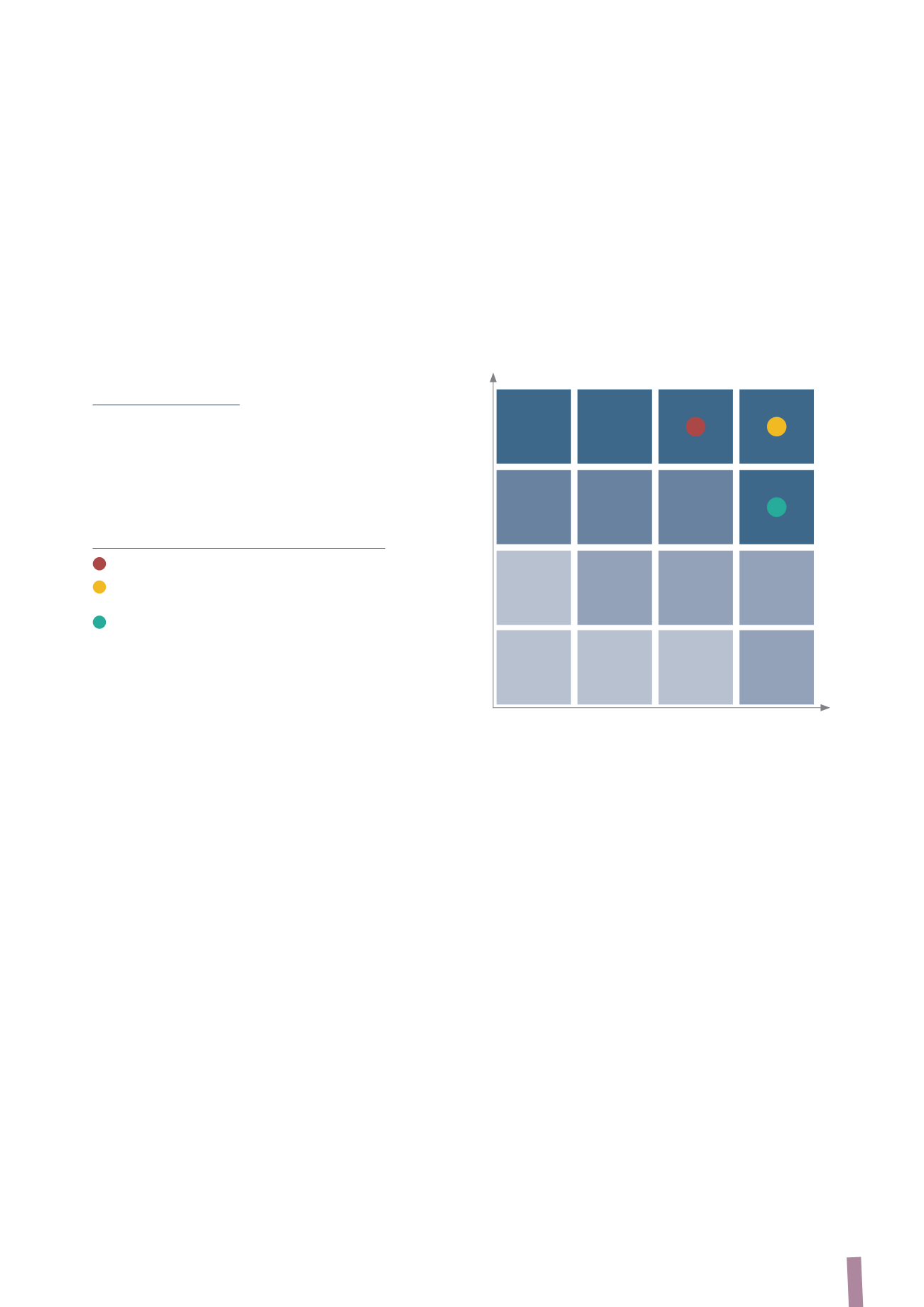

Assessment Criteria

LIKELIHOOD

IMPACT

• Impact

• Likelihood

• Level of Risk Management

Remote

Negligible

Low

Moderate

Medium

High

High

Critical

Level of Risk Management

Risk INADEQUATELY covered and/or managed

Risk covered and/or managed but with ROOM

FOR IMPROVEMENT

Risk ADEQUATELY covered and/or managed