CONSOLIDATED FINANCIAL STATEMENTS >

DIRECTORS’ REPORT

80

| 2013 ANNUAL REPORT | PRYSMIAN GROUP

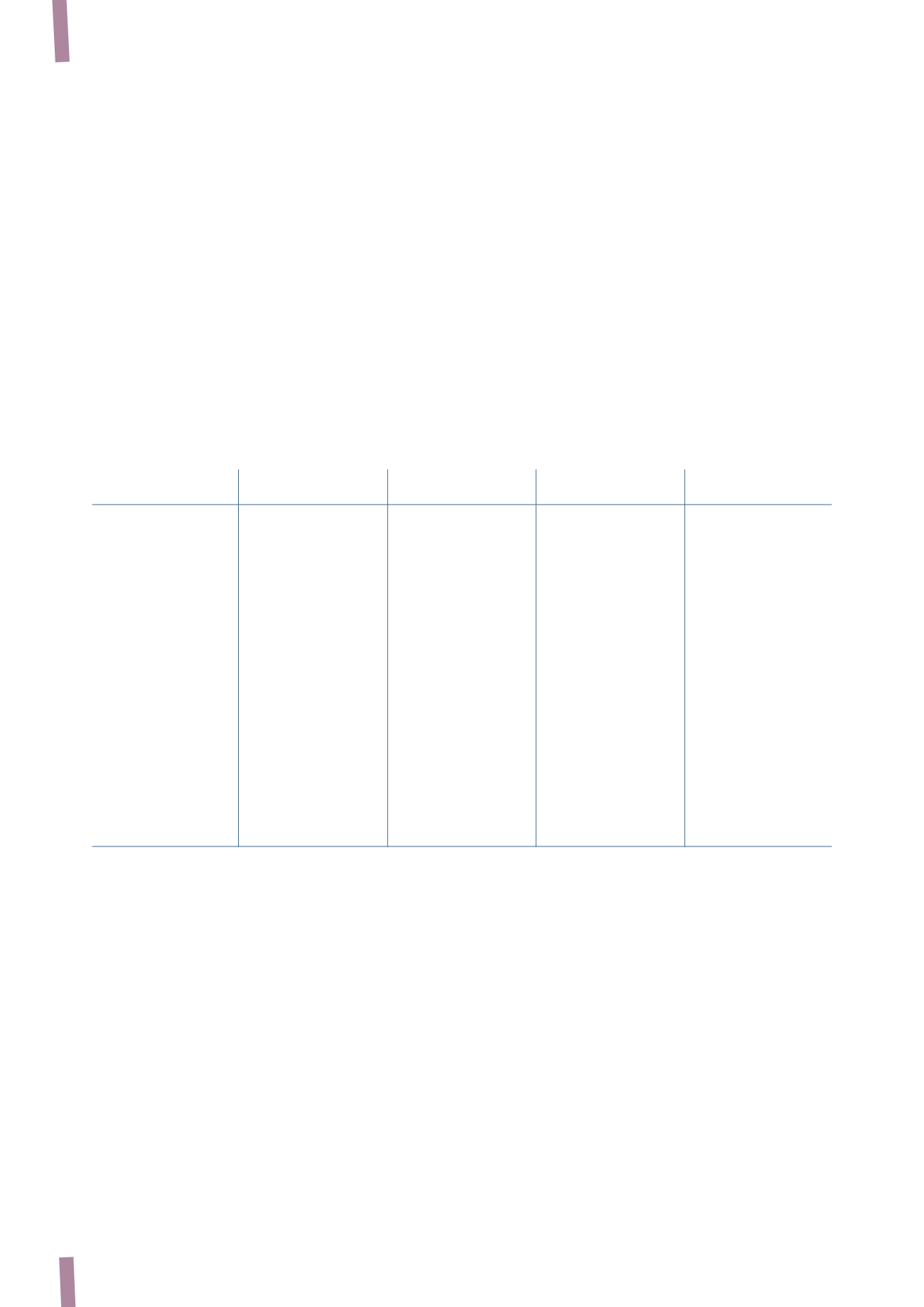

risk model designed to capture a wide portfolio view of the

potential risks, both of external or internal origin, to which

the business could find itself exposed. This model takes into

consideration the following five main categories of risk:

• Strategic Risks, linked to external or internal factors that

may affect the Group’s results or decisions relating to

strategies, activities, organisational structure, etc.;

• Financial Risks, associated with the amount of available

financial resources and the ability to manage currency and

interest rate volatility efficiently;

• Operational Risks, arising from the occurrence of events or

situations that may limit the effectiveness and efficiency

of key processes and are able to have an impact on value

creation;

• Legal and Compliance Risks, relating to any shortcomings

in defining or executing the Group’s procedures that might

lead to infringements of the law;

• Planning and Reporting Risk, related to the adverse effects

that irrelevant, untimely or incorrect information could have

on strategic, operational and financial decisions.

Under the risk model adopted, the process starts with a

top-down approach, in which it is the Chief Risk Officer, the

Board of Directors and Senior Management who together

define the areas of risk most relevant to the achievement

of strategic objectives; these areas must then be further

analysed to identify specific risk situations and events for

measurement and assessment at later stages of the process.

The top-down approach allows the Group’s risk portfolio to be

evaluated as a whole and, where relevant risks are identified,

allows appropriate measures to be taken to reduce the risk of

underestimating such risks or their possible interaction with

risks of another kind.

Functional heads and Region, Country and Business Unit

managers are required to use a clearly defined method to

measure and assess risk situations and events, taking account

of the Impact of the risk, the Likelihood of its occurrence

and the Adequacy of Risk Management should the risk

materialise:

• Impact is assessed both with reference to the Financial

impact, measured, where possible, in terms of expected

EBITDA or cash flow at risk, and with reference to the

Reputational and Operational impact, using a rating scale

that goes from negligible to critical, which must also take

into account the Group’s level of risk tolerance or risk

appetite, as defined by the Board of Directors;

• Likelihood is assessed in relation to the probability that

THE PRYSMIAN RISK MODEL

Strategic

Financial

Operational

Legal & Compliance

Planning & Reporting

Changes in

macroeconomic and

competitive environment

and in demand

Stakeholders’ expectations

Key customers and

business partners

Emerging market risk

M&A/JVs and related

integration processes

Investments

Strategy implementation

Organisational structure

& governance

Commodity price

fluctuation

Exchange rate fluctuation

Interest rate fluctuation

Financial instruments

Credit risk

Liquidity/working capital

Availability/cost

of capital

Financial counterparties

Sales and calls for tender

Production capacity/

efficiency

Supply chain capacity/

efficiency

Business interruption/

catastrophic events

Contract performance/

liability

Product quality/liability

Environment

Information systems

Human resources

Outsourcing

Intellectual property

rights

Compliance with laws

and regulations

Compliance with Code

of Ethics, policy

e procedures

Budget & strategic

planning

Tax & financial planning

Management reporting

Financial reporting

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•