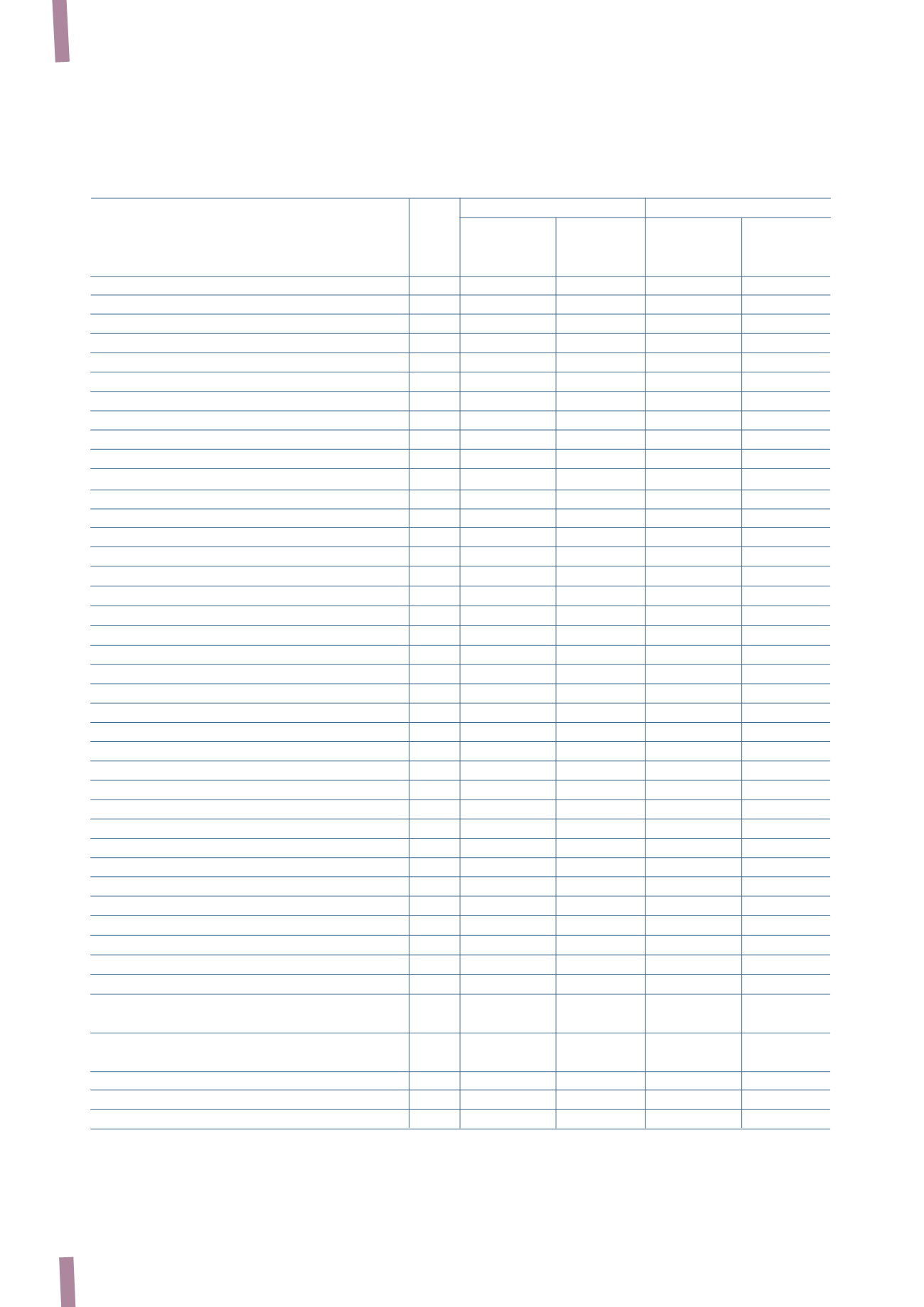

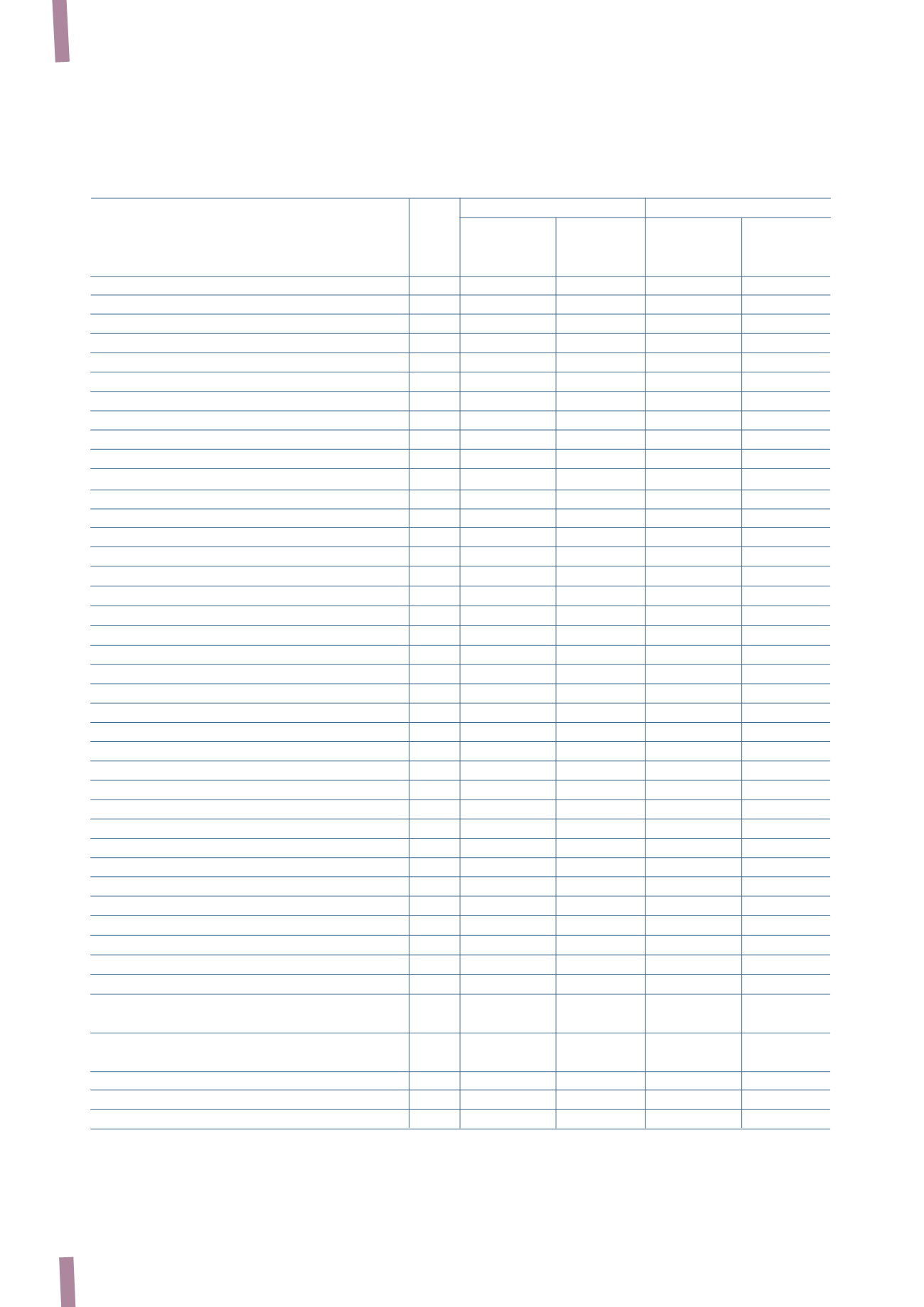

CONSOLIDATED FINANCIAL STATEMENTS >

DIRECTORS’ REPORT

72

| 2013 ANNUAL REPORT | PRYSMIAN GROUP

(in millions of Euro)

31 December 2013

31 December 2012 (*)

Note

Partial amounts Total amounts Partial amounts

Total amounts

from financial from financial

from financial

from financial

statements

statements

statements

statements

Net fixed assets

Property, plant and equipment

1,441

1,539

Intangible assets

623

644

Investments in associates

99

99

Available-for-sale financial assets

15

14

Assets held for sale

12

4

Total net fixed assets

A

2,190

2,300

Net working capital

Inventories

B

920

897

Trade receivables

C

1,010

1,163

Trade payables

D

(1,441)

(1,450)

Other receivables/payables - net

E

(39)

(121)

of which:

Other receivables - non-current

25

28

Tax receivables

5

13

18

Receivables from employees

5

2

1

Other

5

10

9

Other receivables - current

722

561

Tax receivables

5

110

100

Receivables from employees and pension plans

5

5

5

Advances to suppliers

5

17

26

Other

5

115

100

Construction contracts

5

475

330

Other payables - non-current

(24)

(27)

Tax and social security payables

13

(12)

(14)

Accrued expenses

13

(3)

(3)

Other

13

(9)

(10)

Other payables - current

(728)

(654)

Tax and social security payables

13

(101)

(96)

Advances from customers

13

(241)

(219)

Payables to employees

13

(103)

(68)

Accrued expenses

13

(137)

(137)

Other

13

(146)

(134)

Current tax payables

(34)

(29)

Total operating working capital

F = B+C+D+E

450

489

Derivatives

G

(6)

(7)

of which:

Forward currency contracts on commercial

transactions (cash flow hedges) - non-current

8

1

(2)

Forward currency contracts on commercial

transactions (cash flow hedges) - current

8

6

-

Metal derivatives - non-current

8

(1)

(3)

Metal derivatives - current

8

(12)

(2)

Total net working capital

H = F+G

444

482

Reconciliation between the Reclassified Statement of Financial Position presented in the Directors’ Report and the Statement

of Financial Position contained in the Consolidated Financial Statements and Explanatory Notes at 31 December 2013

(*) The previously published figures have been amended. Further details can be found in Section C. Restatement of comparative figures at 31 December 2012

contained in the Explanatory Notes to the Consolidated Financial Statements.