67

EQUITY

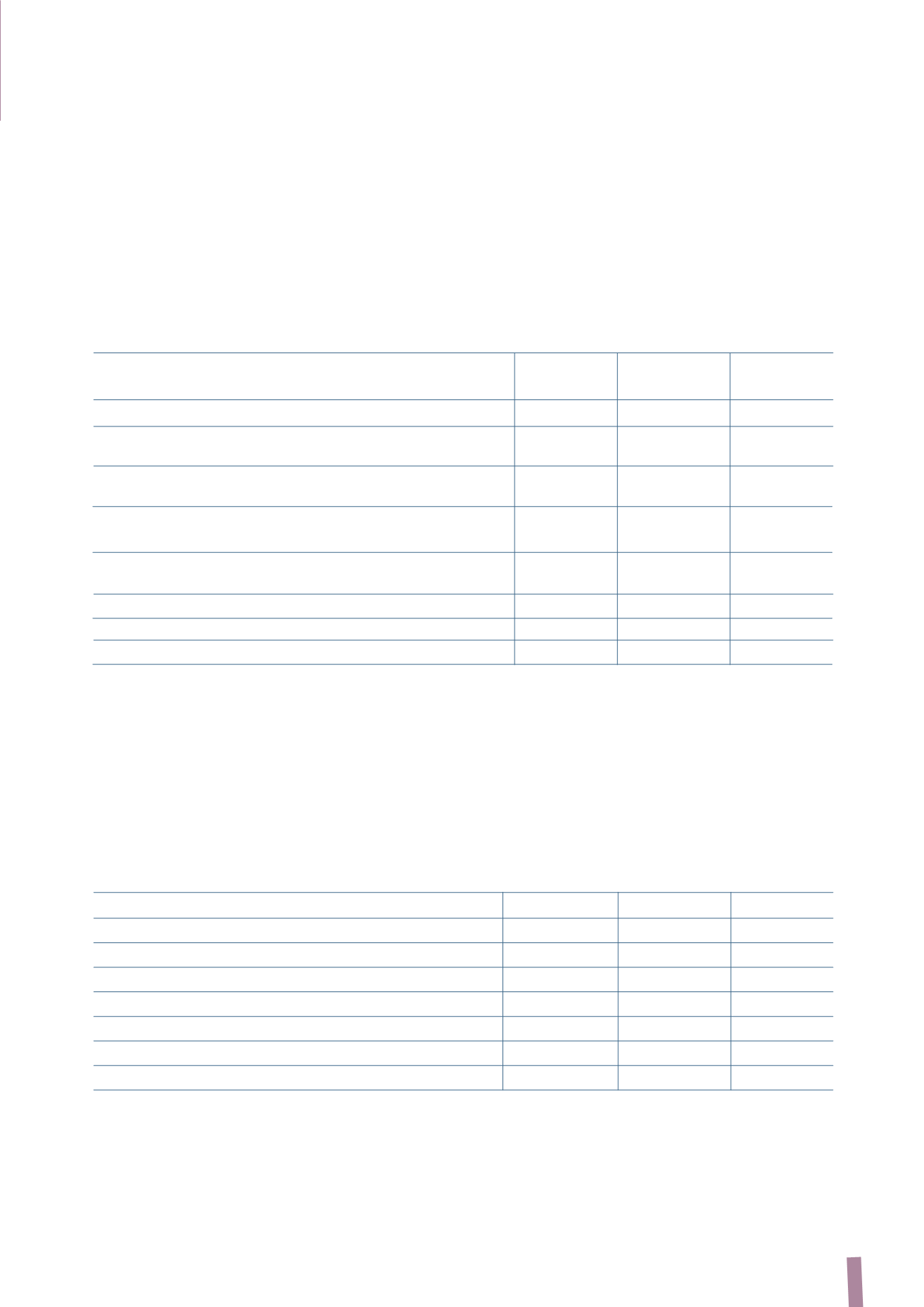

The following table reconciles the Group’s equity at 31 December 2013 and net profit/(loss) for 2013 with the corresponding

figures reported by Prysmian S.p.A., the Parent Company:

(in millions of Euro)

Equity Net profit/(loss)

Equity Net profit/(loss)

31 December 2013

for 2013 31 December 2012 (*)

for 2012 (*)

Parent Company Financial Statements

1,021

184

872

112

Share of equity and net profit of consolidated subsidiaries,

net of the carrying amount of the related investments

207

198

309

208

Reversal of dividends distributed to the Parent Company

by consolidated subsidiaries

-

(220)

-

(150)

Deferred taxes on earnings/reserves distributable

by subsidiaries

(18)

(1)

(18)

(4)

Elimination of intercompany profits and losses included

in inventories

(35)

(9)

(35)

1

Net effect of other consolidation journals

20

2

31

2

Non-controlling interests

(48)

(5)

(47)

(3)

Consolidated Financial Statements

1,147

149

1,112

166

(*) The previously published figures have been amended. Further details can be found in Section C. Restatement of comparative figures at 31 December 2012

contained in the Explanatory Notes to the Consolidated Financial Statements.

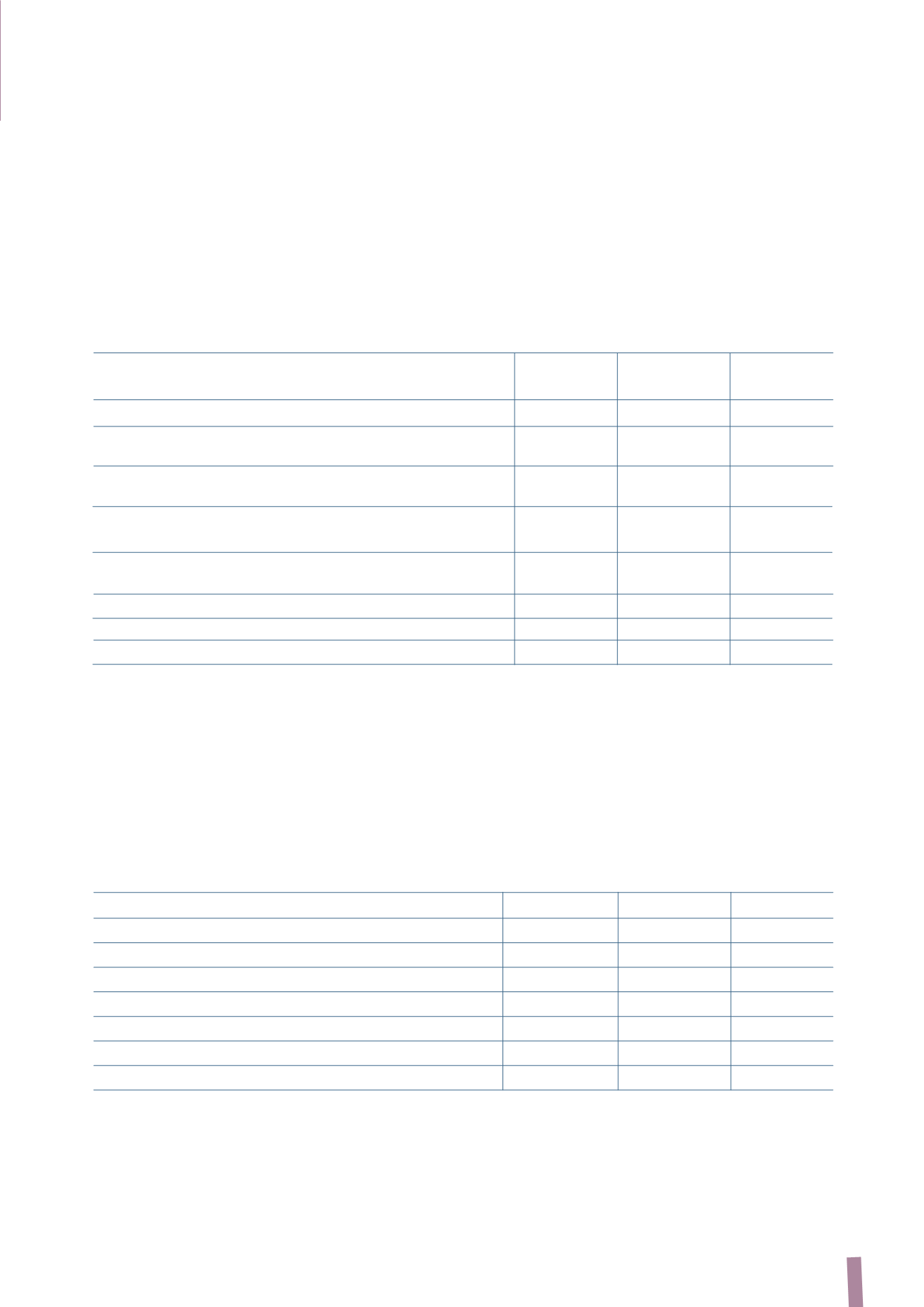

NET WORKING CAPITAL

The main components of net working capital are analysed in the following table:

Net operating working capital amounted to Euro 450 million (6.3% of sales) at 31 December 2013, compared with Euro 489

million (6.4% of sales) at 31 December 2012.

(*) The previously published figures have been amended. Further details can be found in Section C. Restatement of comparative figures at 31 December 2012

contained in the Explanatory Notes to the Consolidated Financial Statements.

(in millions of Euro)

31 December 2013 31 December 2012 (*)

Change 31 December 2011

Inventories

920

897

23

929

Trade receivables

1,010

1,163

(153)

1,197

Trade payables

(1,441)

(1,450)

9

(1,421)

Other receivables/(payables)

(39)

(121)

82

(126)

Net operating working capital

450

489

(39)

579

Derivatives

(6)

(7)

1

(27)

Net working capital

444

482

(38)

552