CONSOLIDATED FINANCIAL STATEMENTS >

DIRECTORS’ REPORT

66

| 2013 ANNUAL REPORT | PRYSMIAN GROUP

Net fixed assets amounted to Euro 2,190 million at 31

December 2013, compared with Euro 2,300 million at 31

December 2012, posting a decrease of Euro 110 million mainly

due to the combined effect of the following factors:

• Euro 144 million in investments in property, plant and

equipment and intangible assets;

• Euro 5 million in retirements and disposals of property,

plant and equipment;

• Euro 180 million in depreciation, amortisation and

impairment charges for the year;

• Euro 73 million in negative currency translation differences.

Net working capital of Euro 444 million at 31 December 2013

was Euro 38 million lower than the corresponding figure of

Euro 482 million at 31 December 2012, or Euro 39 million lower

excluding the impact of the fair value change in derivatives,

and was affected by the following main factors:

• a significant growth in working capital employed in multi-

year Submarine projects, linked to their stage of completion

with respect to the agreed delivery dates;

• a reduction linked to the increase of Euro 36 million in

amounts due to employees for the 2011-2013 long-term

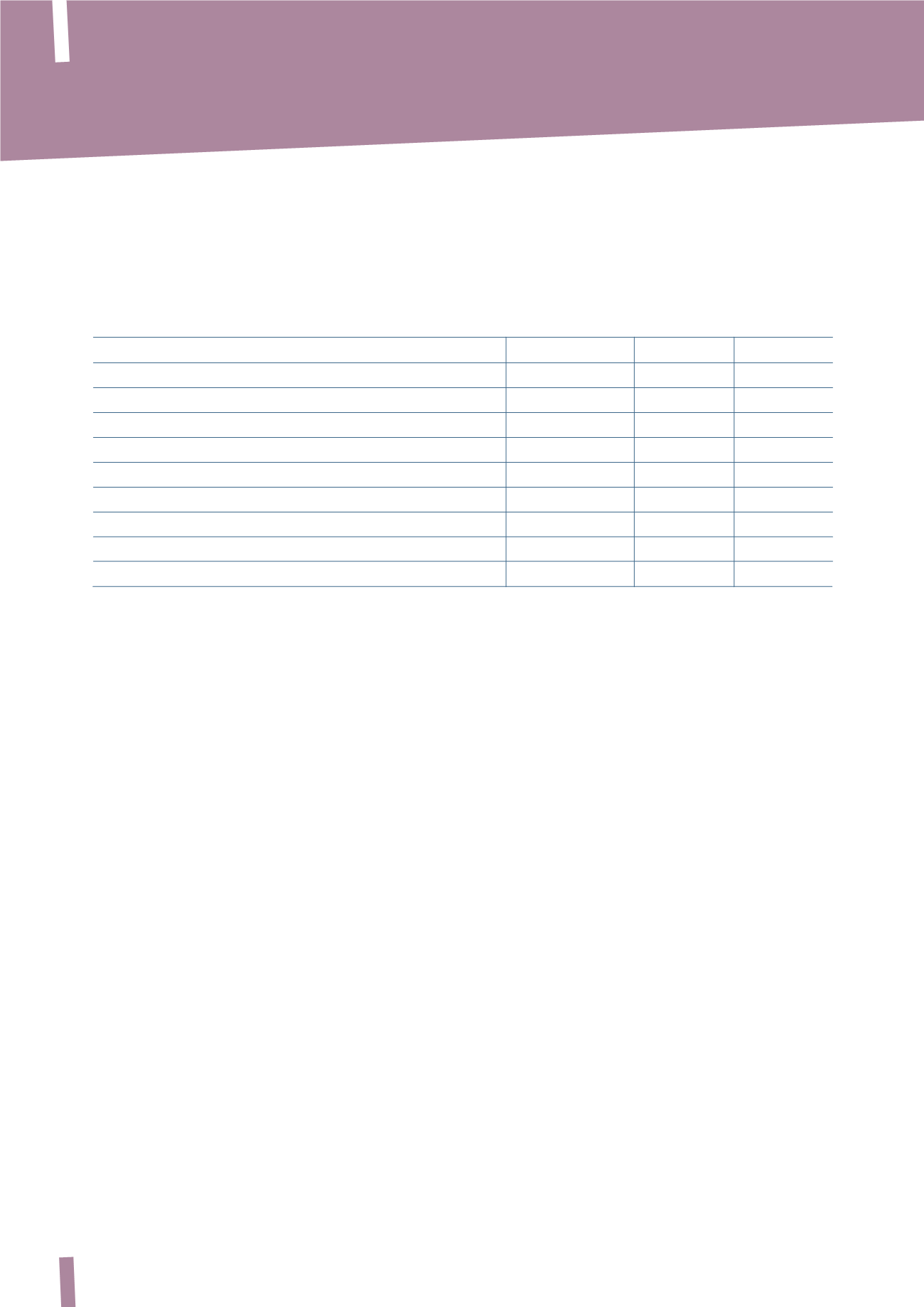

RECLASSIFIED STATEMENT OF FINANCIAL POSITION

incentive plan, previously classified in employee benefit

obligations;

• a reduction in the level of working capital related to

the decline in volumes and strategic metal price trends

compared with the previous year;

• a growth of Euro 78 million in without-recourse factoring

transactions;

• a containment in working capital due to efficiencies

implemented by the Group during the reporting period;

• a decrease of Euro 10 million for exchange rate differences.

The net financial position of Euro 834 million at 31 December

2013 has decreased by Euro 84 million since 31 December 2012

(Euro 918 million), mainly reflecting the following factors:

• positive cash flow from operating activities (before changes

in net working capital) of Euro 482 million;

• negative impact of Euro 19 million from changes in working

capital;

• payment of Euro 64 million in taxes;

• net operating investments of Euro 114 million;

• receipt of Euro 11 million in dividends;

• payment of Euro 126 million in net finance costs;

• payment of Euro 92 million in dividends.

GROUP STATEMENT OF FINANCIAL POSITION

(*) The previously published figures have been amended. Further details can be found in Section C. Restatement of comparative figures at 31 December 2012

contained in the Explanatory Notes to the Consolidated Financial Statements.

(in millions of Euro)

31 December 2013 31 December 2012 (*)

Change 31 December 2011

Net fixed assets

2,190

2,300

(110)

2,255

Net working capital

444

482

(38)

552

Provisions

(297)

(361)

64

(371)

Net capital employed

2,337

2,421

(84)

2,436

Employee benefit obligations

308

344

(36)

268

Total equity

1,195

1,159

36

1,104

of which attributable to non-controlling interests

48

47

1

62

Net financial position

834

918

(84)

1,064

Total equity and sources of funds

2,337

2,421

(84)

2,436