CONSOLIDATED FINANCIAL STATEMENTS >

DIRECTORS’ REPORT

58

| 2013 ANNUAL REPORT | PRYSMIAN GROUP

Prysmian Group strengthened its position in South America,

where it managed to increase its market share while keeping

prices at an adequate level thanks to its wide range of

products.

The combined factors described above led to an Adjusted

EBITDA of Euro 72 million in 2013, down from Euro 77 million

(-6.4%) the year before.

INDUSTRIAL

A continuous process of specialisation permits ever greater customisation of products and

solutions.

The extensive product range, developed specifically for the

Industrial market, stands out for the highly customised

nature of the solutions offered. These products serve a

broad range of industries, including Oil&Gas, Transport,

Infrastructure, Mining and Renewable Energy. The Group

offers solutions to the

Oil&Gas

industry for both upstream

hydrocarbon research and refining activities and downstream

exploration and production activities. The product range is

therefore very wide and includes low and medium voltage

power and instrumentation/control cables, as well as

multipurpose umbilical cables for transporting energy,

telecommunications, fluids and chemicals when connecting

submarine sources and collectors to FPSO (Floating,

Production, Storage and Offloading) platforms. In the

Transport

sector, the range of cables offered by Prysmian is

used in the construction of trains, ships and motor vehicles;

in the infrastructure sector, the principal applications for its

cables are found in railways, docks and airports. The product

range also includes cables for the mining industry, the

automotive industry and for elevators, cables for applications

in the renewable energy sector, cables for military

applications and for nuclear power stations, able to withstand

high levels of radiation.

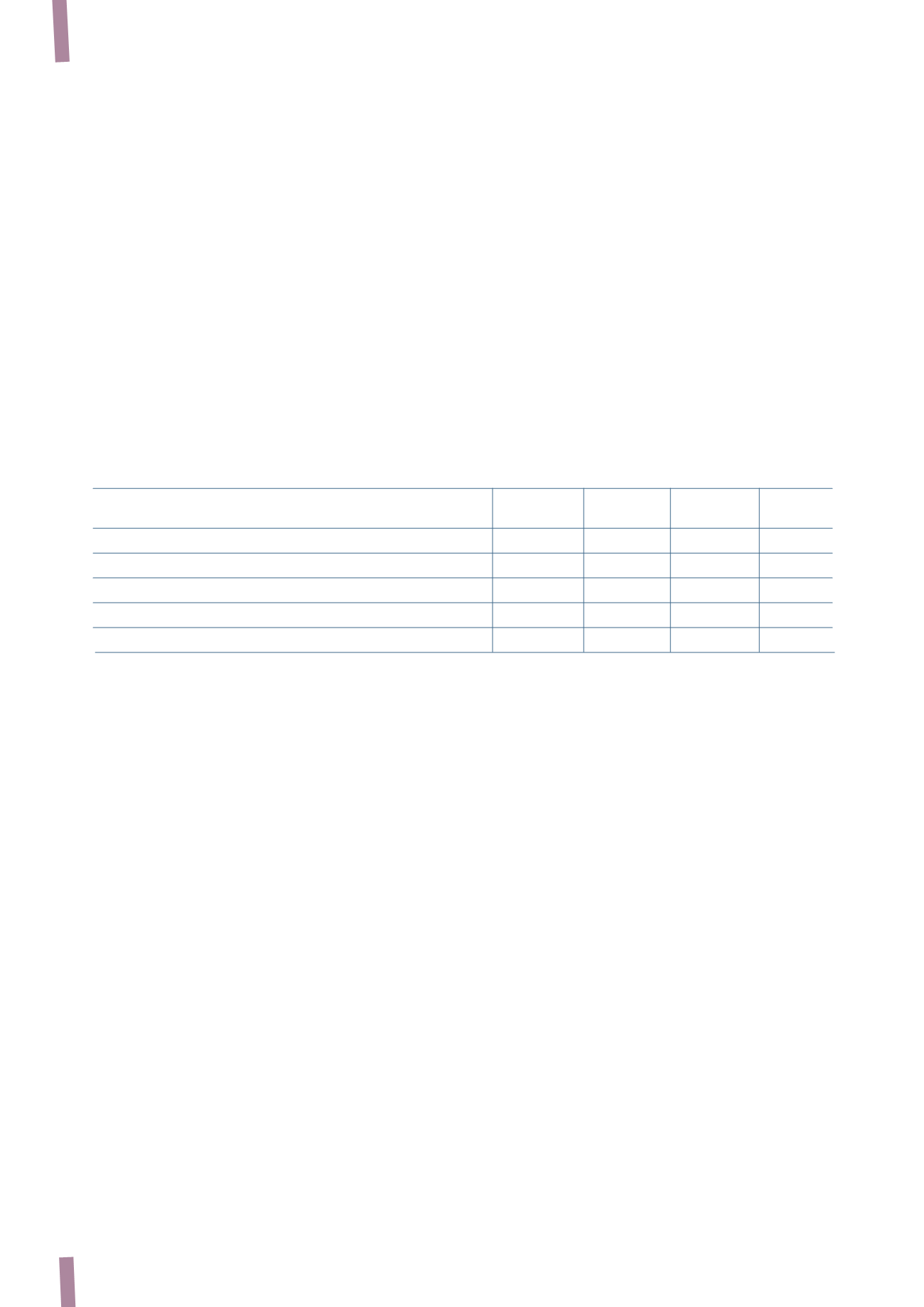

(*) The pro-forma figures are calculated by aggregating the Draka Group’s results for the two-month pre-acquisition period (January-February)

with the consolidated figures.

(in millions of Euro)

2013

2012

% change

% organic

2011 (*)

sales change Pro-forma

Sales to third parties

1,765

1,801

-2.0%

4.1% 1,824

Adjusted EBITDA

134

139

116

% of sales

7.6%

7.7%

6.4%

Adjusted operating income

99

99

79

% of sales

5.6%

5.5%

4.3%