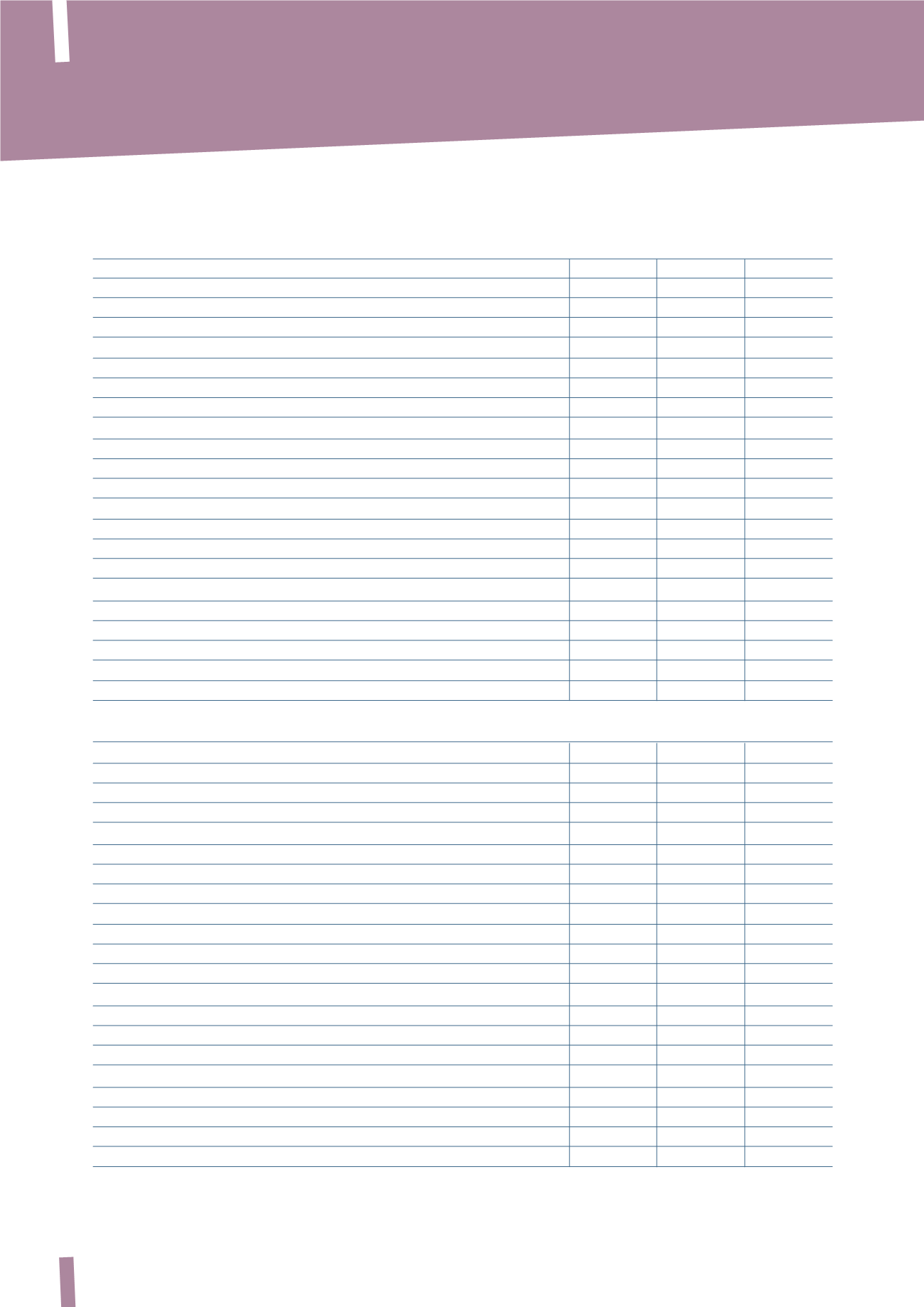

CONSOLIDATED FINANCIAL STATEMENTS >

DIRECTORS’ REPORT

48

| 2013 ANNUAL REPORT | PRYSMIAN GROUP

GROUP PERFORMANCE AND RESULTS

(in millions of Euro)

2013

2012 (**)

% change

2011 (*)

Sales

7,273

7,848

-7.3%

7,583

Adjusted EBITDA

612

647

-5.5%

568

% of sales

8.4%

8.2%

7.5%

EBITDA

562

546

2.9%

269

% of sales

7.7%

7.0%

3.4%

Fair value change in metal derivatives

(8)

14

(62)

Remeasurement of minority put option liability

-

7

(1)

Fair value stock options

(14)

(17)

(7)

Amortisation, depreciation and impairment

(180)

(188)

-4.3%

(180)

Operating income

360

362

-0.8%

19

% of sales

4.9%

4.6%

0.3%

Net finance income/(costs)

(153)

(137)

(129)

Share of net profit/(loss) of associates and dividends from other companies

15

17

9

Profit/(loss) before taxes

222

242

-8.4%

(101)

% of sales

3.1%

3.1%

-1.3%

Taxes

(68)

(73)

(44)

Net profit/(loss) for the year

154

169

-8.6%

(145)

% of sales

2.1%

2.2%

-1.9%

Attributable to:

Owners of the parent

149

166

(136)

Non-controlling interests

5

3

(9)

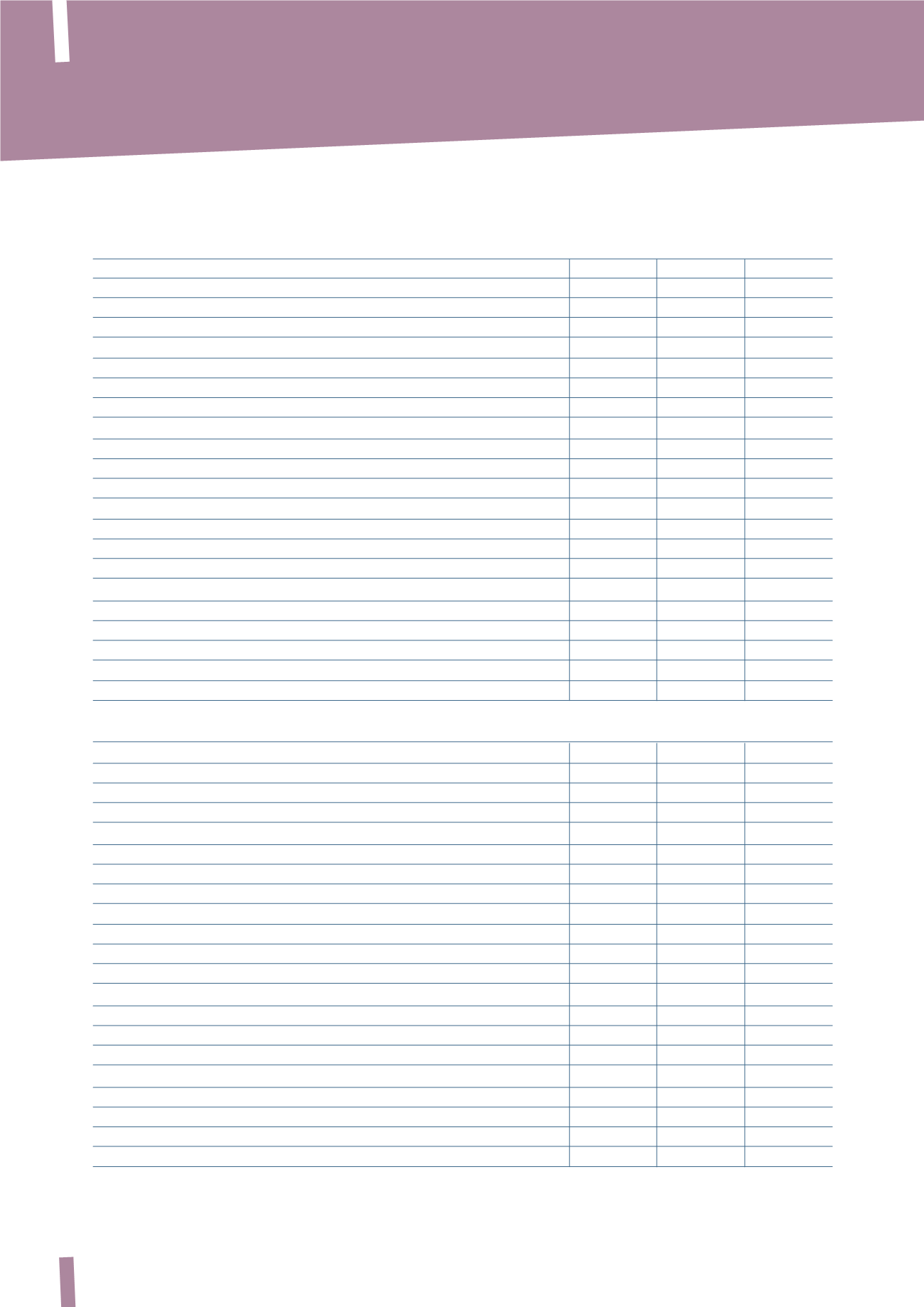

RECONCILIATION OF OPERATING INCOME / EBITDA TO ADJUSTED OPERATING INCOME / ADJUSTED EBITDA

Operating income (A)

360

362

-0.8%

19

EBITDA (B)

562

546

2.9%

269

Non-recurring expenses/(income):

Company reorganisation

50

74

56

Antitrust

(6)

1

205

Draka integration costs

-

9

12

Tax inspections

-

3

-

Environmental remediation and other costs

(3)

3

5

Italian pensions reform

-

1

-

Gains on asset disposals

(5)

(3)

(1)

Draka acquisition costs

-

-

6

Effects of Draka change of control

-

-

2

Release of Draka inventory step-up

-

-

14

Other net non-recurring expenses

14

13

-

Total non-recurring expenses/(income) (C)

50

101

299

Fair value change in metal derivatives (D)

8

(14)

62

Fair value stock options (E)

14

17

7

Remeasurement of minority put option liability (F)

-

(7)

1

Impairment of assets (G)

25

24

38

Adjusted operating income (A+C+D+E+F+G)

457

483

-5.4%

426

Adjusted EBITDA (B+C)

612

647

-5.5%

568

(*) Includes the Draka Group’s results for the period 1 March – 31 December 2011.

(**) The previously published figures have been amended. Further details can be found in Section C. Restatement of comparative figures at 31 December 2012 in

the Explanatory Notes to the Consolidated Financial Statements.