39

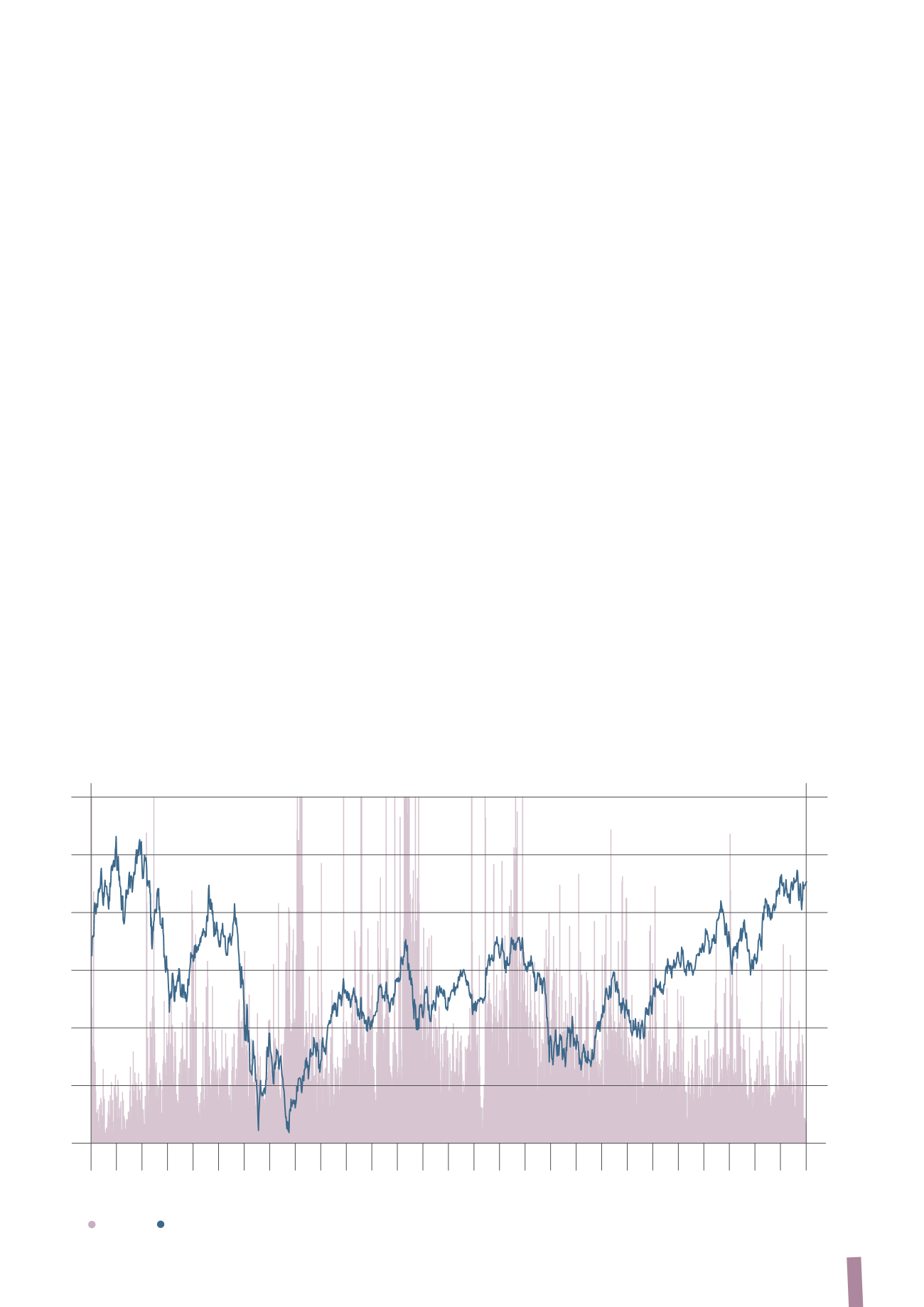

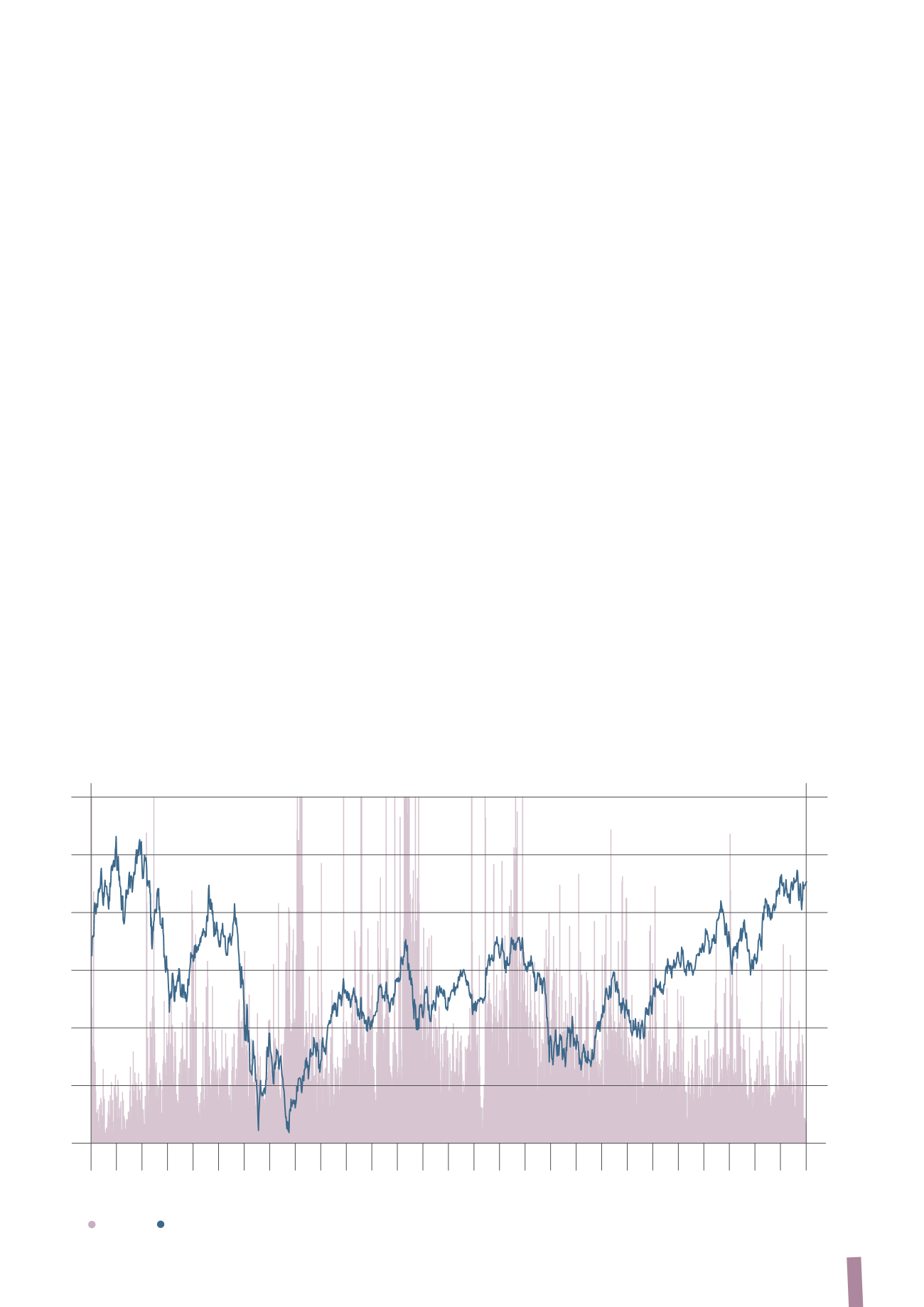

PERFORMANCE OF PRYSMIAN STOCK SINCE IPO

May 2nd-07

Jul 31st-07

Oct 29th-07

Jan 29th-08

Apr 29th-08

Jul 28th-08

Oct 24th-08

Jan 26th-09

Apr 24th-09

Jul 23rd-09

Oct 21st-09

Jan 20th-10

Apr 20th-10

Jul 19th-10

Oct 15th-10

Jan 13th-11

Apr 13th-11

Jul 12th-11

Oct 10th-11

Jan 6th-12

Apr 5th-12

Jul 4th-12

Oct 2nd-12

Dec 31st-12

Mar 29th-13

Jun 27th-13

Sept 25th-13

Dec 24th-13

Volume - Mln shares

Price - Euro

23

20

17

14

11

8

5

6.0

5.0

4.0

3.0

2.0

1.0

0

PERFORMANCE OF PRYSMIAN STOCK SINCE IPO

Volumes

Prysmian

even the European stock markets recorded an overall positive

performance: in particular, the German stock market rose by

25%, the French one by 18%, the Italian one by 17% and the

British one by 14%. Even the Spanish index, which recorded a

negative performance in 2012, was up 21%. In contrast, Asian

and emerging markets had a mixed performance: strong

progress by the Japanese stock market (+57%) and stable or

slightly positive performances in Korea (+1%) and India (+3%)

contrasted with decidedly negative performance by markets

in Brazil (-15%) and China (-13%).

In this context, the Prysmian stock increased its value by

approximately 25% over the course of 2013, rising well

above its initial listing price (Euro 15 on 3 May 2007), and

significantly outperforming its competitors and benchmark

indices, thereby increasing its weight within such indices.

The stock’s performance, including dividend pay-outs (total

shareholder return), was a gain of +27% over the course of

2013 and +38% since its listing date. The MSCI Europe Capital

Goods index reported a rise of 23% over the year and a fall of

-6% since Prysmian’s listing date, while the FTSE MIB was

up 17% from the start of the year but down -57% since the

date of the Company’s IPO. By way of reference, the principal

financial markets performed as follows in 2013: FTSE MIB

(Italy): +17%; CAC 40 (France): +18%; IBEX (Spain): +21%;

FTSE 100 (UK): +14%; DAX (Germany): +25%; Dow Jones

(US): +26%; S&P 500 (US): +30%; Nikkei (Japan): +57%; MSCI

Europe Capital Goods: +23%.

During the first quarter of 2013, the Prysmian stock steadily

strengthened in the wake of the company’s good FY 2012

results, passing the Euro 17 mark, partly mirroring the positive

trend in the major European indices. However, from the

month of March, there were fresh pressures on European

stock exchanges and sovereign debt markets following

renewed uncertainties about growth in Europe, the outcome

of the Italian general election and especially the crisis in

Cyprus, which highlighted the difficulties of coordination

between European and national authorities. The Prysmian

stock was affected by the bearish trend, falling in April

back to its level at the start of the year. In May and June,

global financial markets reflected the emergence of investor

uncertainty about the future duration of the quantitative

easing policy in the United States and the spread of concerns

about the credit outlook in China; in this high volatility period,

the stock reached its low for 2013 of Euro 14. Starting from

July, conditions in international financial markets and the

Eurozone slowly improved, thanks to a slight but steady

recovery in global economic activity and the maintenance

of expansionary monetary policies by the central banks. In

this context, the Prysmian stock entered a bullish phase,

supported by the improvement in its quarterly results

and the positive recommendations of financial analysts,

outperforming all the main stock indices and returning above

the Euro 19 mark, close to its historic post-flotation high in

2007; it stabilised at this price in the last few months of the

year, eventually closing the year at Euro 18.71, up 25% from

Euro 15.01 at the end of 2012.