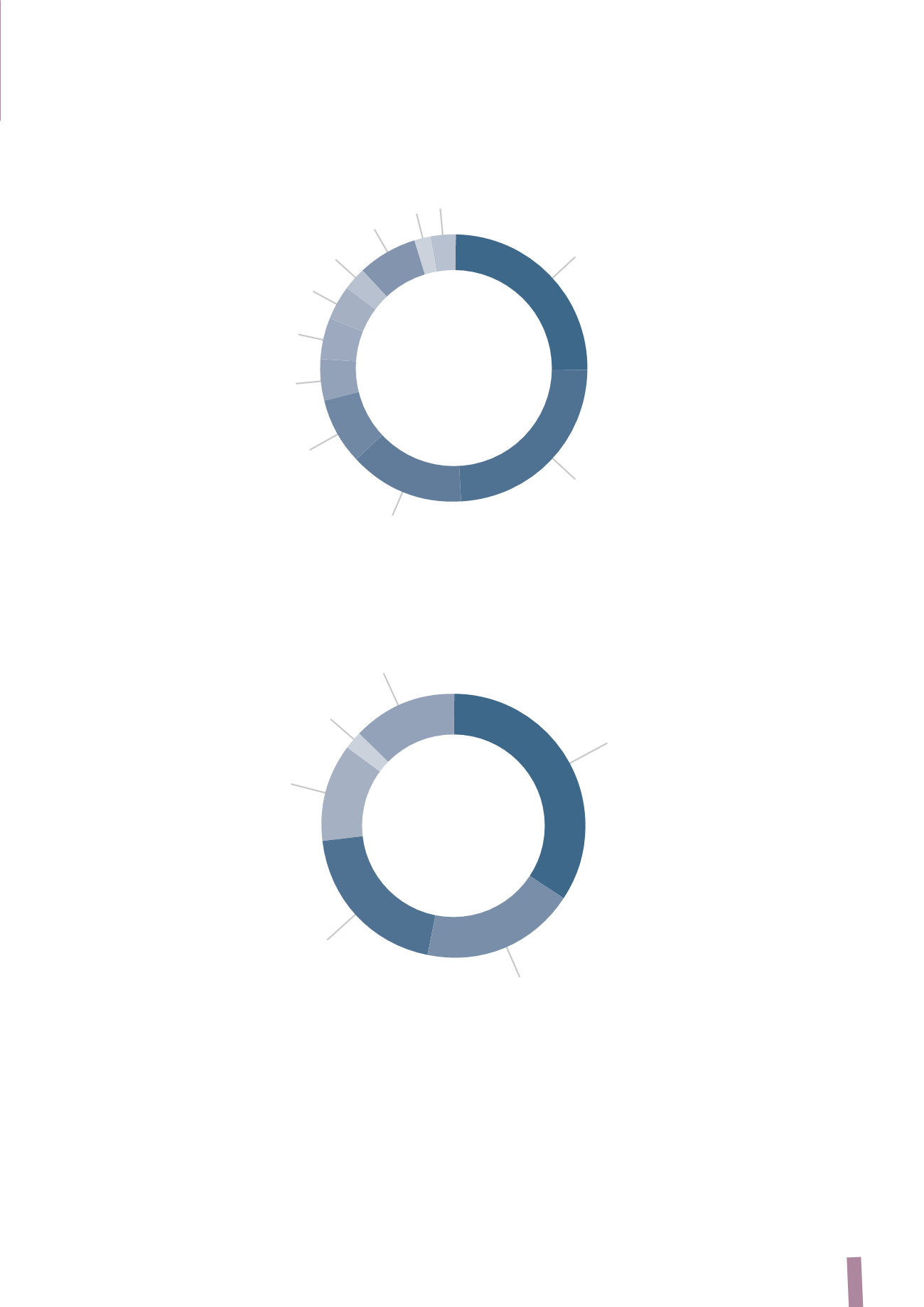

35

US

25%

UK

24%

Italy

14%

France

8%

Ireland

5%

Norway

5%

Germany

4%

The Netherlands

3%

Other European Countries

7%

Hong Kong

2%

Rest of the world

3%

INSTITUTIONAL INVESTORS BY GEOGRAPHICAL AREA

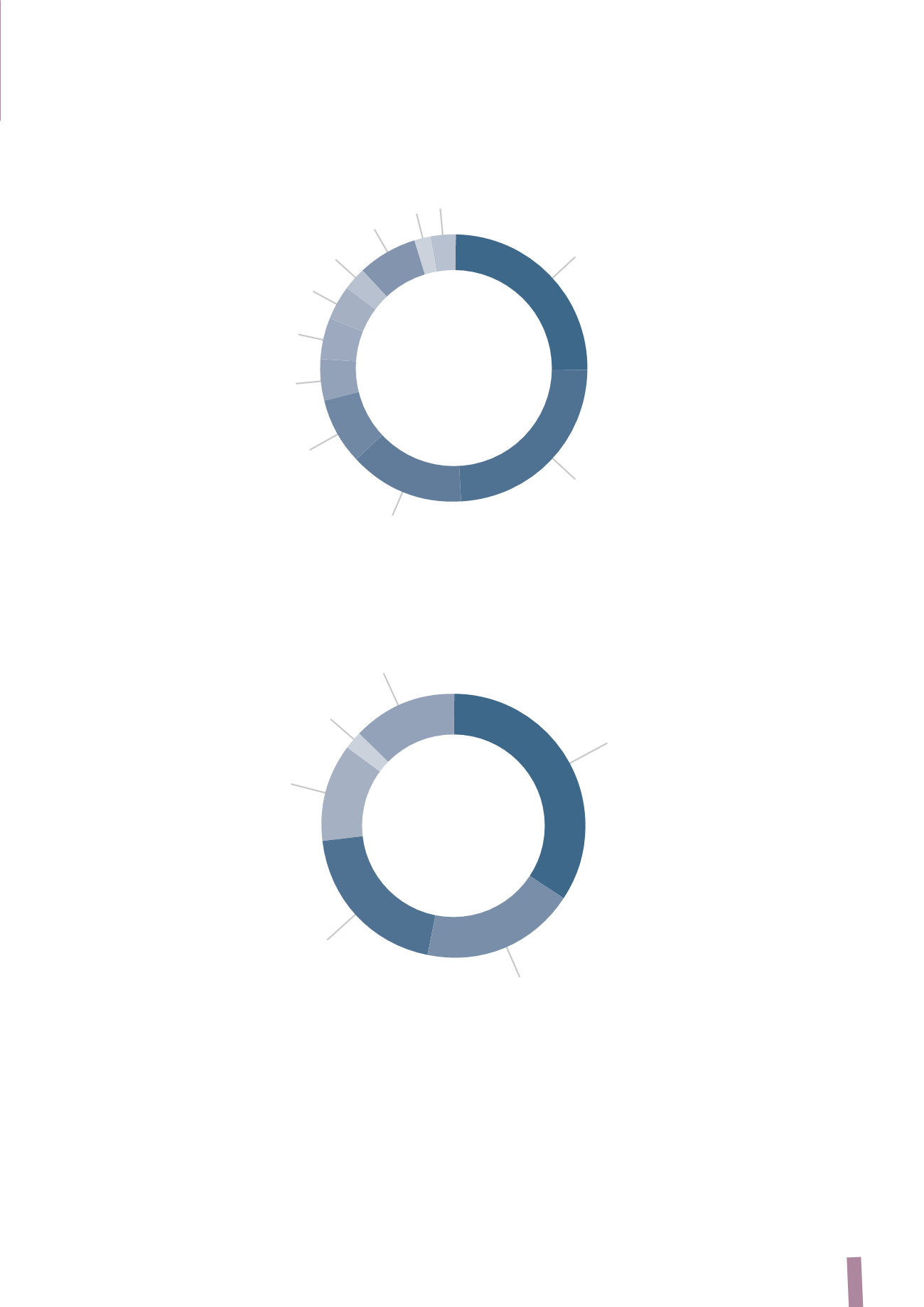

INSTITUTIONAL INVESTORS BY INVESTMENT APPROACH

Growth

34%

GARP

19%

Value

20%

Index

12%

Hedge Fund

2%

Others

13%

INSTITUTIONAL INVESTORS BY GEOGRAPHICAL AREA

INSTITUTIONAL INVESTORS BY INVESTMENT APPROACH

The ownership structure by geographical area confirms the

predominant presence of US and UK investors, who at the

end of 2013 accounted for around 50% of the capital held

by institutional investors; they were followed by Italian

institutional investors with 14% and by the French with 8%.

Lastly, worth noting is the increase in the proportion

of Asian investors since the prior year, particularly those

from Singapore and Japan.

Approximately 73% of the share capital held by institutional

investors is represented by investment funds with Value,

Growth or GARP strategies, therefore focused on a medium

to long-term time horizon. There has also been a steady

increase in the proportion of shareholders adopting an Index

investment strategy, based on the principal stock indices; in

fact, this increase is consistent with the greater weight of the

Prysmian stock within such indices.

Source: Nasdaq OMX