CONSOLIDATED FINANCIAL STATEMENTS >

DIRECTORS’ REPORT

52

| 2013 ANNUAL REPORT | PRYSMIAN GROUP

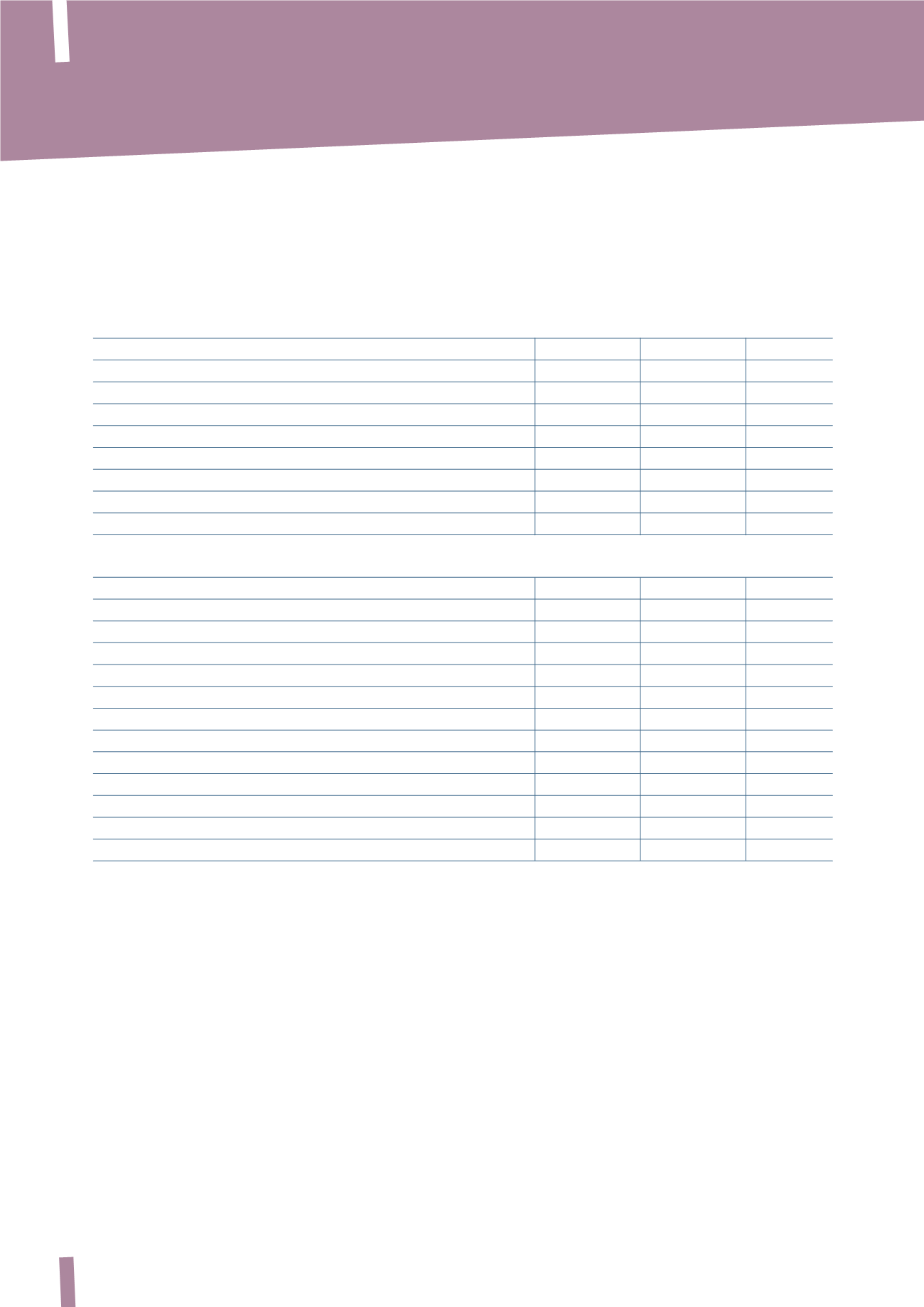

SEGMENT PERFORMANCE: ENERGY BUSINESS

Slightly higher profitability despite lower sales.

(*) Includes the Draka Group’s results for the period 1 March – 31 December 2011.

(in millions of Euro)

2013

2012

% change

2011 (*)

Sales to third parties

6,018

6,382

-5.7%

6,268

Adjusted EBITDA

492

487

1.0%

447

% of sales

8.2%

7.6%

7.1%

EBITDA

469

417

12.5%

186

% of sales

7.8%

6.5%

2.9%

Amortisation and depreciation

(105)

(108)

-2.9%

(99)

Adjusted operating income

387

379

2.1%

348

% of sales

6.4%

5.9%

5.5%

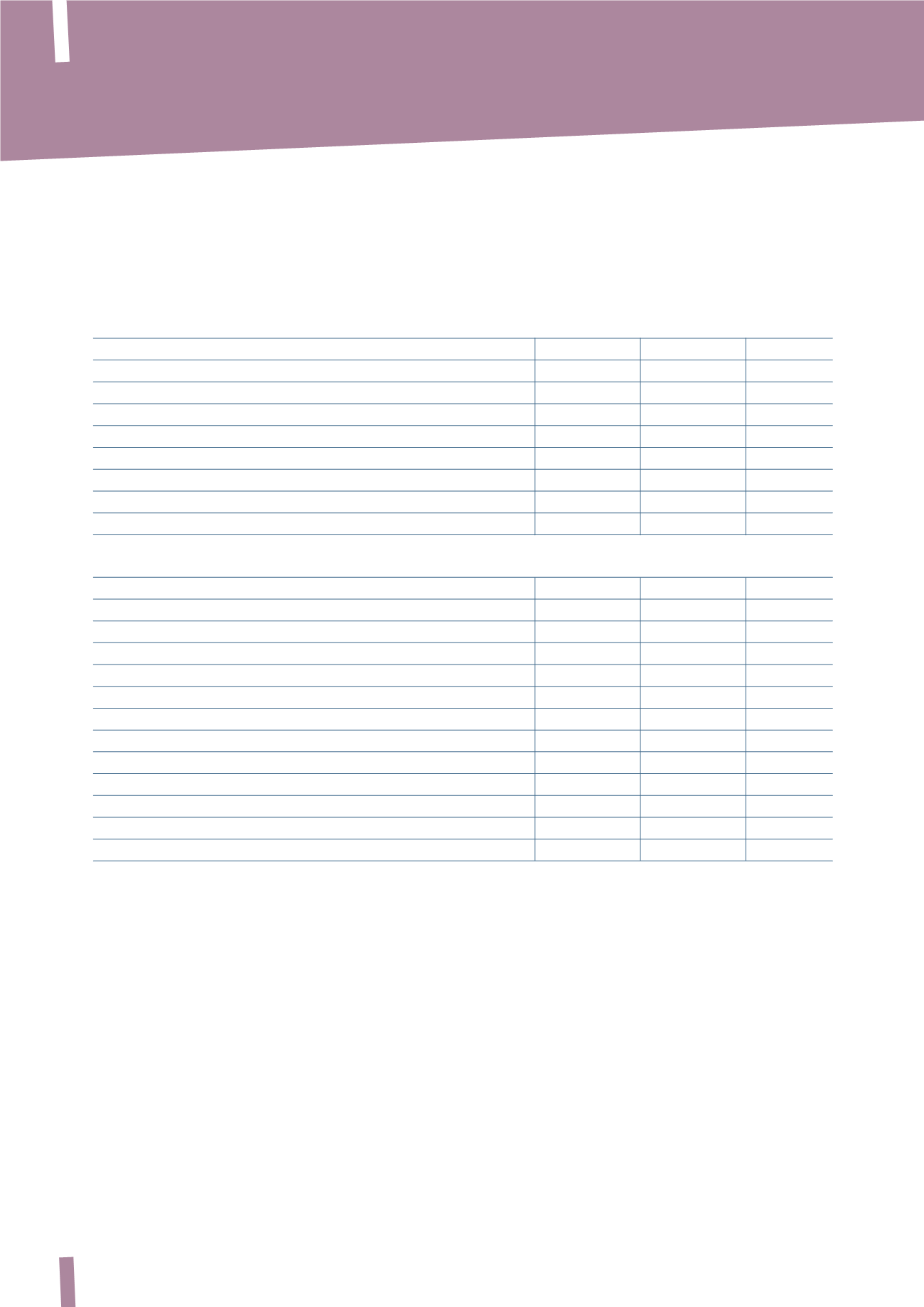

RECONCILIATION OF EBITDA TO ADJUSTED EBITDA

EBITDA (A)

469

417

12.5%

186

Non-recurring expenses/(income):

Company reorganisation

33

53

42

Antitrust

(6)

1

205

Draka integration costs

-

4

2

Tax inspections

-

1

-

Environmental remediation and other costs

(3)

3

5

Italian pensions reform

-

1

-

Release of Draka inventory step-up

-

-

8

Gains on asset disposals

(4)

(3)

(1)

Other net non-recurring expenses

3

10

-

Total non-recurring expenses/(income) (B)

23

70

261

Adjusted EBITDA (A+B)

492

487

1.0%

447

Energy business sales to third parties amounted to Euro 6,018

million in 2013, compared with Euro 6,382 million in 2012,

posting a negative change of Euro 364 million (-5.7%).

This negative change is attributable to the following principal

factors:

• negative exchange rate effects of Euro 209 million (-3.3%);

• negative organic growth of Euro 65 million (-1.0%);

• negative change of Euro 134 million (-2.1%) in sales prices

due to fluctuations in metal prices;

• negative change of Euro 20 million (-0.3%) due to non-

consolidation of the results of Ravin Cables Limited

(India) and Power Plus Cable CO LLC (Middle East – 49%

consolidated), both of which deconsolidated since

1 April 2012;

• positive change of Euro 64 million (+1.0%) due to

consolidation of Prysmian Powerlink Services Ltd (formerly

Global Marine Systems Energy Ltd) as from November 2012.

Adjusted EBITDA for 2013 came to Euro 492 million, posting an

increase of Euro 5 million (+1.0%) on the corresponding figure

of Euro 487 million in 2012.

The following paragraphs describe market trends and financial

performance in each of the Energy segment’s business areas.