CONSOLIDATED FINANCIAL STATEMENTS >

DIRECTORS’ REPORT

60

| 2013 ANNUAL REPORT | PRYSMIAN GROUP

FINANCIAL PERFORMANCE

Organic growth in sales, thanks to increased demand in high value-added businesses.

Sales to third parties by the Industrial business area amounted

to Euro 1,765 million in 2013, compared with Euro 1,801 million

in 2012. The reduction of Euro 36 million (-2.0%) is due to the

following factors:

• positive organic growth of Euro 75 million (+4.1%),

largely due to the growth in volumes in high value-added

businesses (Specialties&OEM, Oil&Gas and Elevator) despite

the slowdown in the renewable energy sector; positive

results for the Automotive business;

• negative change of Euro 5 million (-0.2%) due to non-

consolidation of the results of Ravin Cables Limited

(India) and Power Plus Cable CO LLC (Middle East – 49%

consolidated), both of which deconsolidated since 1 April

2012;

• negative exchange rate effects of Euro 69 million (-3.9%);

• negative change of Euro 37 million (-2.0%) in sales prices

due to fluctuations in metal prices.

In Europe, Prysmian Group benefited from a solid order book

for the top-end OEM sector (cables for Cranes and Mining for

South American and Asian markets) and continued to focus

its commercial efforts on the Oil&Gas industry, where it was

able to benefit from the growth in demand by the North Sea oil

industry, served by the Norwegian and British markets, despite

a steep downturn in exports to energy-producing nations in

the Middle East.

However, this managed to offset only in part the dramatic

decline in volumes in the renewable energy sector, most

evident in Southern Europe.

The strategy of technological specialisation of the solutions

offered allowed Prysmian Group to consolidate its Elevator

market leadership in North America and to expand into the

Chinese and European markets, where it is still underexposed.

As for SURF products, sales of umbilical cables and flexible

pipes, manufactured for the South American market at

the Vila Velha plant, were in line with 2012 despite the

rescheduling of investment projects requiring flexible pipes.

The Down-Hole-Technology (DHT) business performed

particularly well in North America, thanks to the renewed

contract with Schlumberger.

Asia Pacific and Brazil were the regions that offered the

Group the most attractive growth opportunities, thanks to

consolidation of its market share in Australia and the award

of major international projects in Brazil.

Adjusted EBITDA came to Euro 134 million in 2013, down

Euro 5 million (-3.6%) on Euro 139 million in 2012, mainly

due to lower volumes in the renewable energy sector and the

postponement of onshore and offshore projects in the Middle

and Far East.

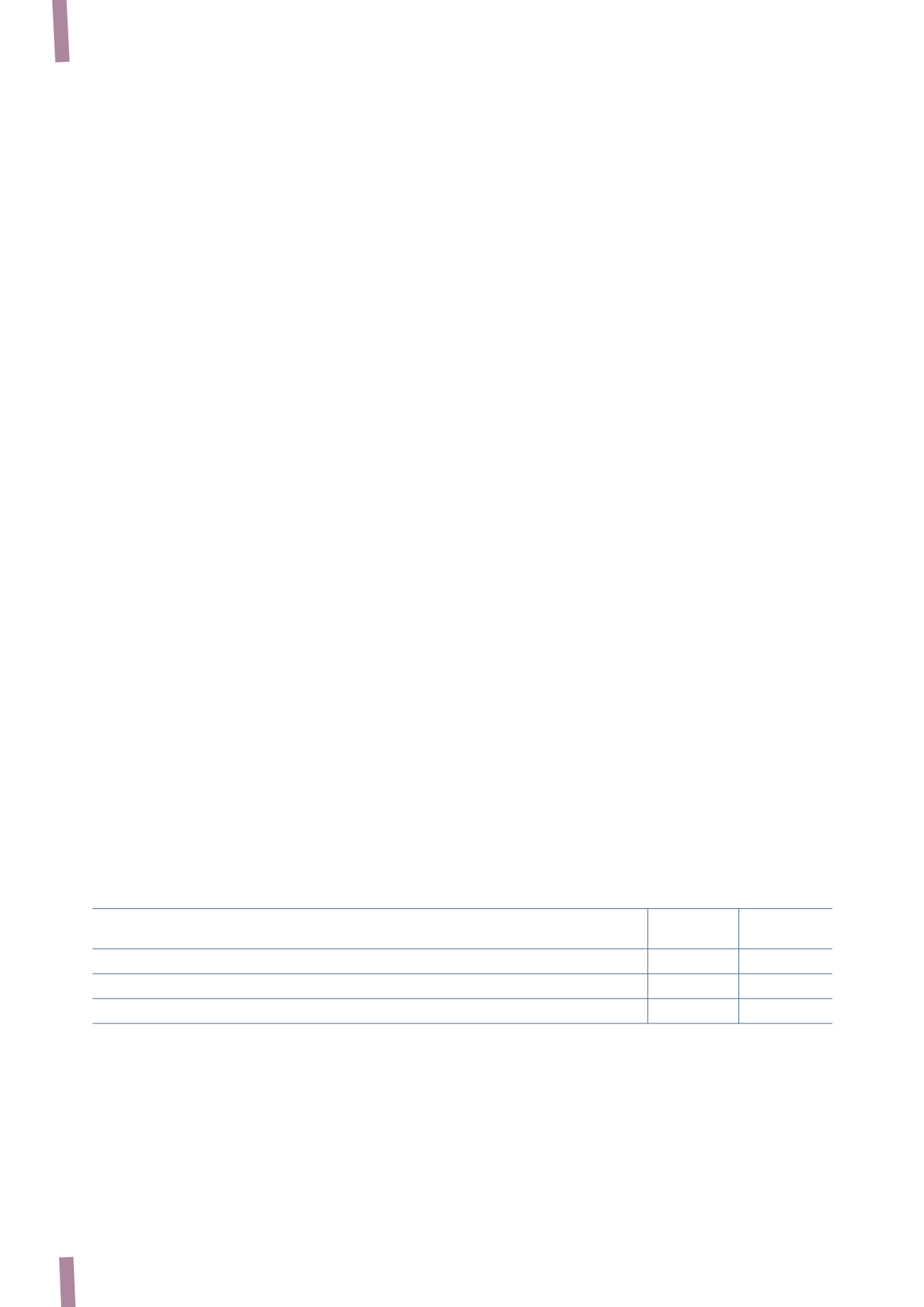

OTHER

This business area encompasses occasional sales by Prysmian

Group operating units of intermediate goods, raw materials or

other products forming part of the production process. These

sales are normally linked to local business situations, do not

generate high margins and can vary in size from period to

period.

(*) The pro-forma figures are calculated by aggregating the Draka Group’s results for the two-month pre-acquisition period (January-February) with the

consolidated figures.

(in millions of Euro)

2013

2012

2011 (*)

Pro-forma

Sales to third parties

115

135

167

Adjusted EBITDA

5

1

5

Adjusted operating income

1

(3)

2