69

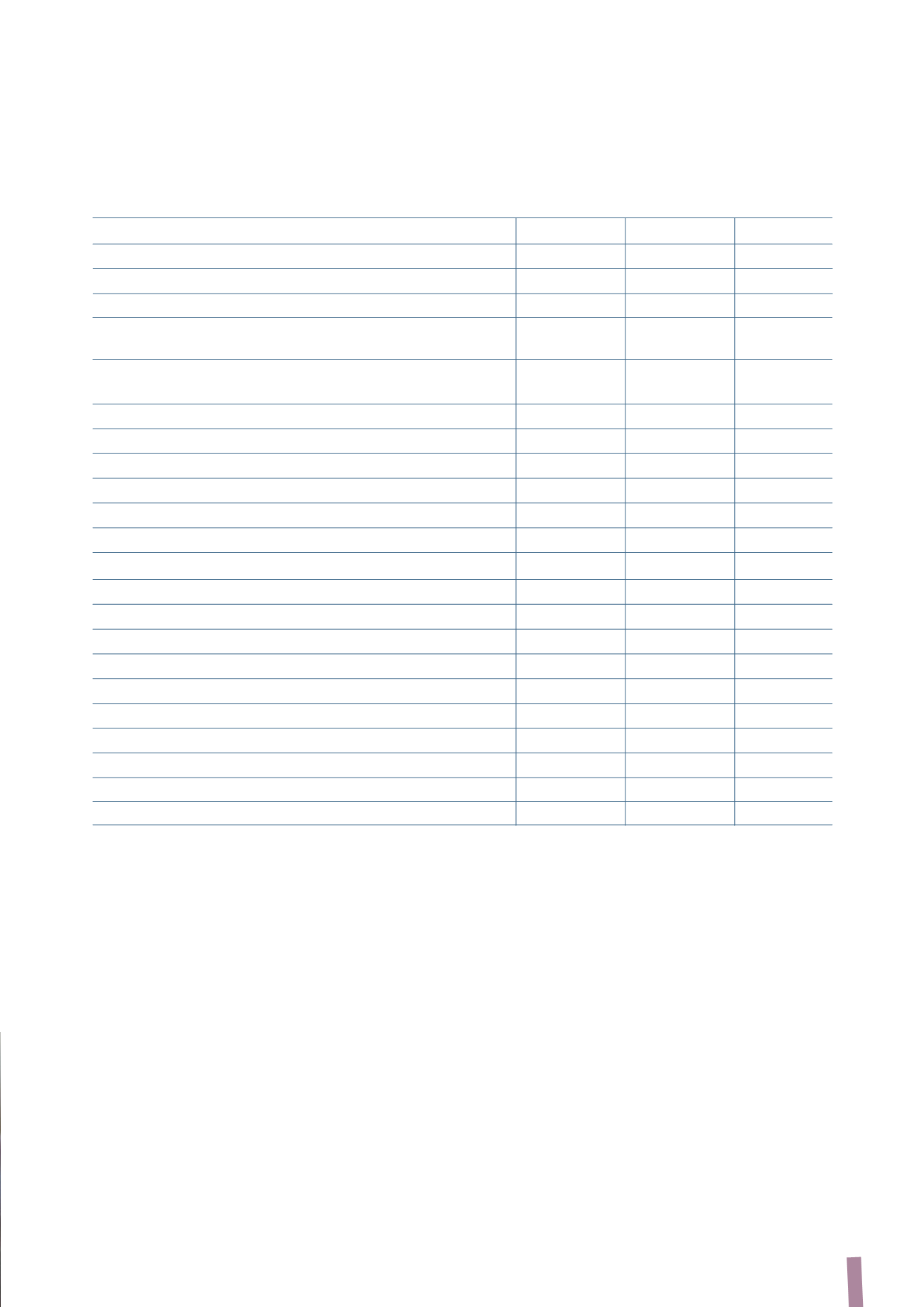

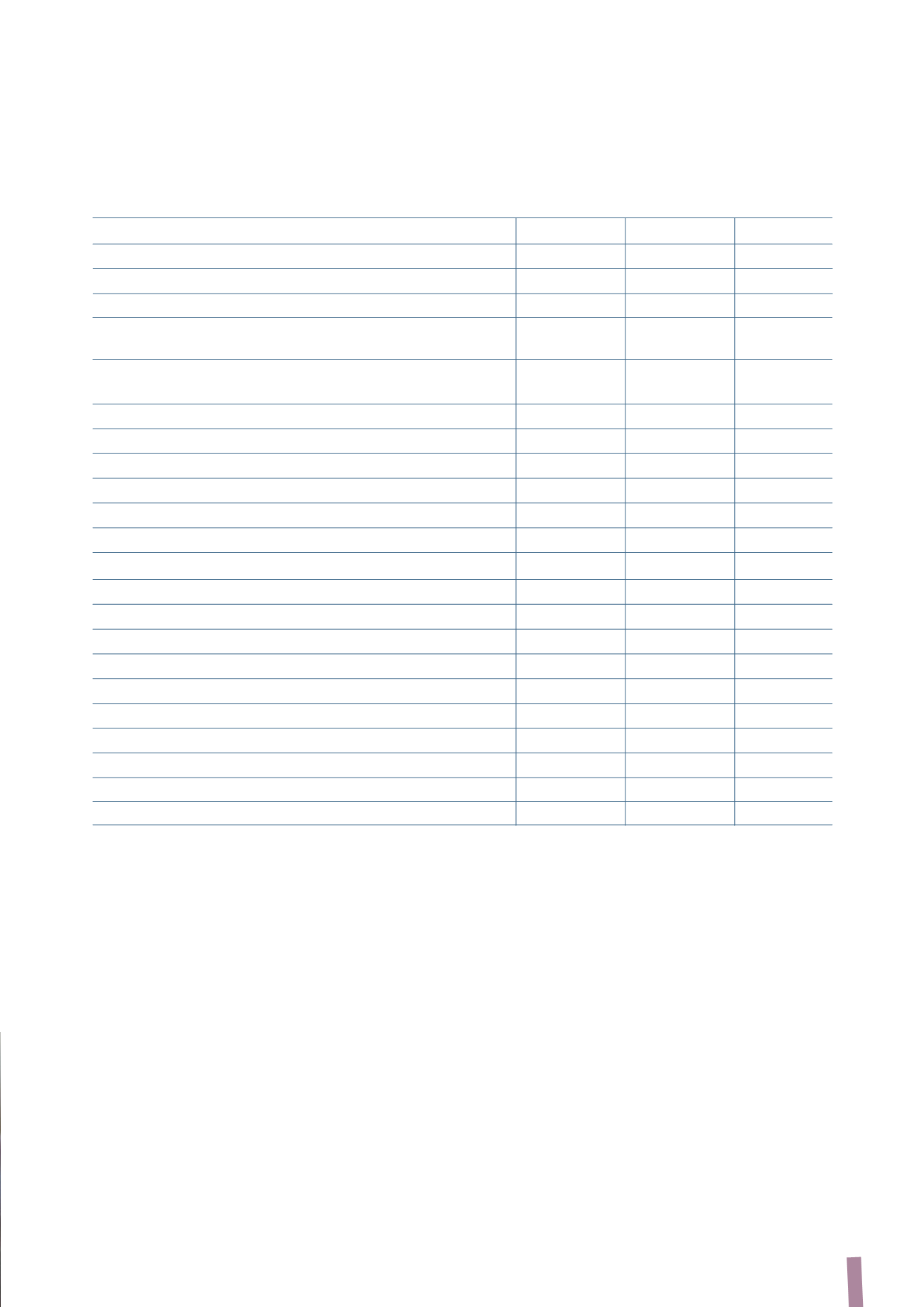

RECLASSIFIED STATEMENT OF CASH FLOWS

Net cash flow provided by operating activities (before changes

in net working capital) amounted to Euro 482 million at the

end of 2013.

The increase of Euro 19 million in working capital described

earlier absorbed only a small part of the above cash flow.

Therefore, after deducting Euro 64 million in tax payments,

net cash flow from the year’s operating activities was a

positive Euro 399 million.

Net operating investments in 2013 amounted to Euro 114

million; in the case of the Energy business, this expenditure

mainly referred to production capacity increases for High

voltage cables in Russia, for submarine cables in Italy and

Norway and for the Oil&Gas sector at the plants in Sorocaba

and Santo Andrè (Brazil). In the case of the Telecom business,

of particular importance was the investment in Romania,

which has become one of Europe’s new centres of excellence

for optical telecom cables.

Dividend payments came to Euro 92 million, of which Euro 89

million to the shareholders of the parent company Prysmian

S.p.A. and Euro 3 million to minority shareholders in some

of the subsidiaries.

(1) This does not include cash flow relating to “Financial assets held for trading” and non-instrumental “Available-for-sale financial assets”, classified in the net

financial position.

(in millions of Euro)

2013

2012

Change

2011

EBITDA

562

546

16

269

Changes in provisions (including employee benefit obligations)

(73)

13

(86)

200

Inventory step-up

-

-

-

14

(Gains)/losses on disposal of property, plant and equipment,

intangible assets and non-current assets

(7)

(14)

7

(2)

Net cash flow provided by operating activities (before changes

in net working capital)

482

545

(63)

481

Changes in net working capital

(19)

75

(94)

183

Taxes paid

(64)

(74)

10

(97)

Net cash flow provided/(used) by operating activities

399

546

(147)

567

Acquisitions

-

(86)

86

(419)

Net cash flow used in operational investing activities

(114)

(141)

27

(145)

Net cash flow provided by financial investing activities

(1)

11

8

3

4

Free cash flow (unlevered)

296

327

(31)

7

Net finance costs

(126)

(129)

3

(130)

Free cash flow (levered)

170

198

(28)

(123)

Increases in share capital and other changes in equity

-

1

(1)

1

Dividend distribution

(92)

(45)

(47)

(37)

Net cash flow provided/(used) in the year

78

154

(76)

(159)

Opening net financial position

(918)

(1,064)

146

(459)

Net cash flow provided/(used) in the year

78

154

(76)

(159)

Convertible bond equity component

39

-

39

-

Other changes

(33)

(8)

(25)

(446)

Closing net financial position

(834)

(918)

84

(1,064)