CONSOLIDATED FINANCIAL REPORT | EXPLANATORY NOTES

163

Costs incurred subsequent to acquiring an asset and the cost of replacing certain parts of assets recognised

in this category are capitalised only if they increase the future economic benefits of the asset to which they

refer. All other costs are recognised in profit or loss as incurred. When the replacement cost of certain parts

of an asset is capitalised, the residual value of the parts replaced is expensed to profit or loss.

Depreciation is charged on a straight-line, monthly basis using rates that allow assets to be depreciated until

the end of their useful lives. When assets consist of different identifiable components, whose useful lives

differ significantly from each other, each component is depreciated separately using the component

approach.

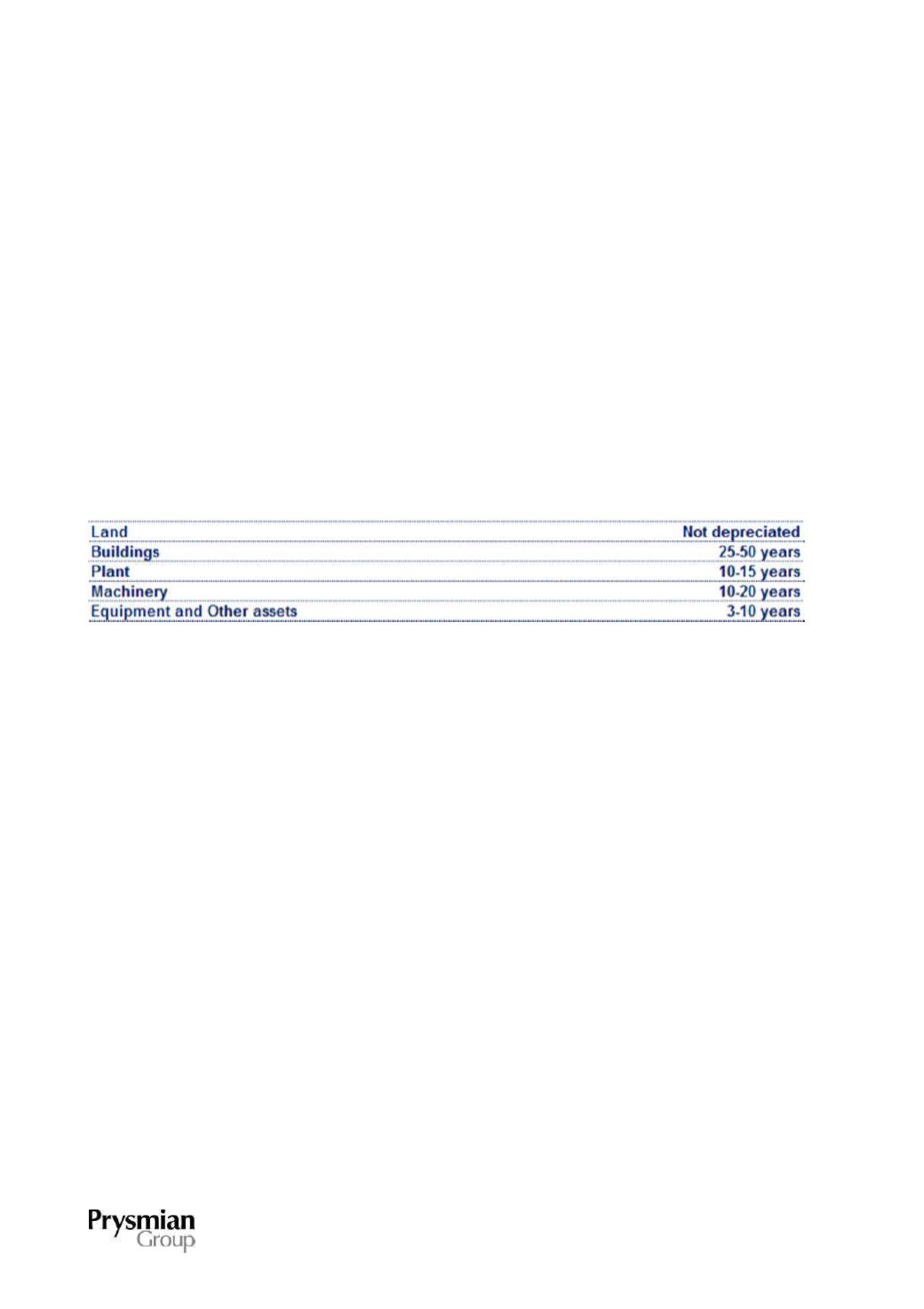

The useful indicative lives estimated by the Group for the various categories of property, plant and

equipment are as follows:

The residual values and useful lives of property, plant and equipment are reviewed and adjusted, if

appropriate, at least at each financial year-end.

Property, plant and equipment acquired through finance leases, whereby the risks and rewards of the assets

are substantially transferred to the Group, are accounted for as Group assets at their fair value or, if lower, at

the present value of the minimum lease payments, including any sum payable to exercise a purchase option.

The corresponding lease liability is recorded under financial payables. The assets are depreciated using the

method and rates described earlier for "Property, plant and equipment", unless the term of the lease is less

than the useful life represented by such rates and ownership of the leased asset is not reasonably certain to

be transferred at the lease’s natural expiry; in this case the depreciation period will be represented by the

term of the lease. Any capital gains realised on the disposal of assets which are leased back under finance

leases are recorded under liabilities as deferred income and released to the income statement over the term

of the lease. Leases where the lessor substantially retains all the risks and rewards of ownership of the

assets are treated as operating leases. Payments made under operating leases are charged to the income

statement on a straight-line basis over the term of the lease.

Non-current assets classified as held for sale are measured at the lower of carrying amount and fair value

less costs to sell from the moment they qualify as held for sale under the related accounting standard.