CONSOLIDATED FINANCIAL REPORT | EXPLANATORY NOTES

197

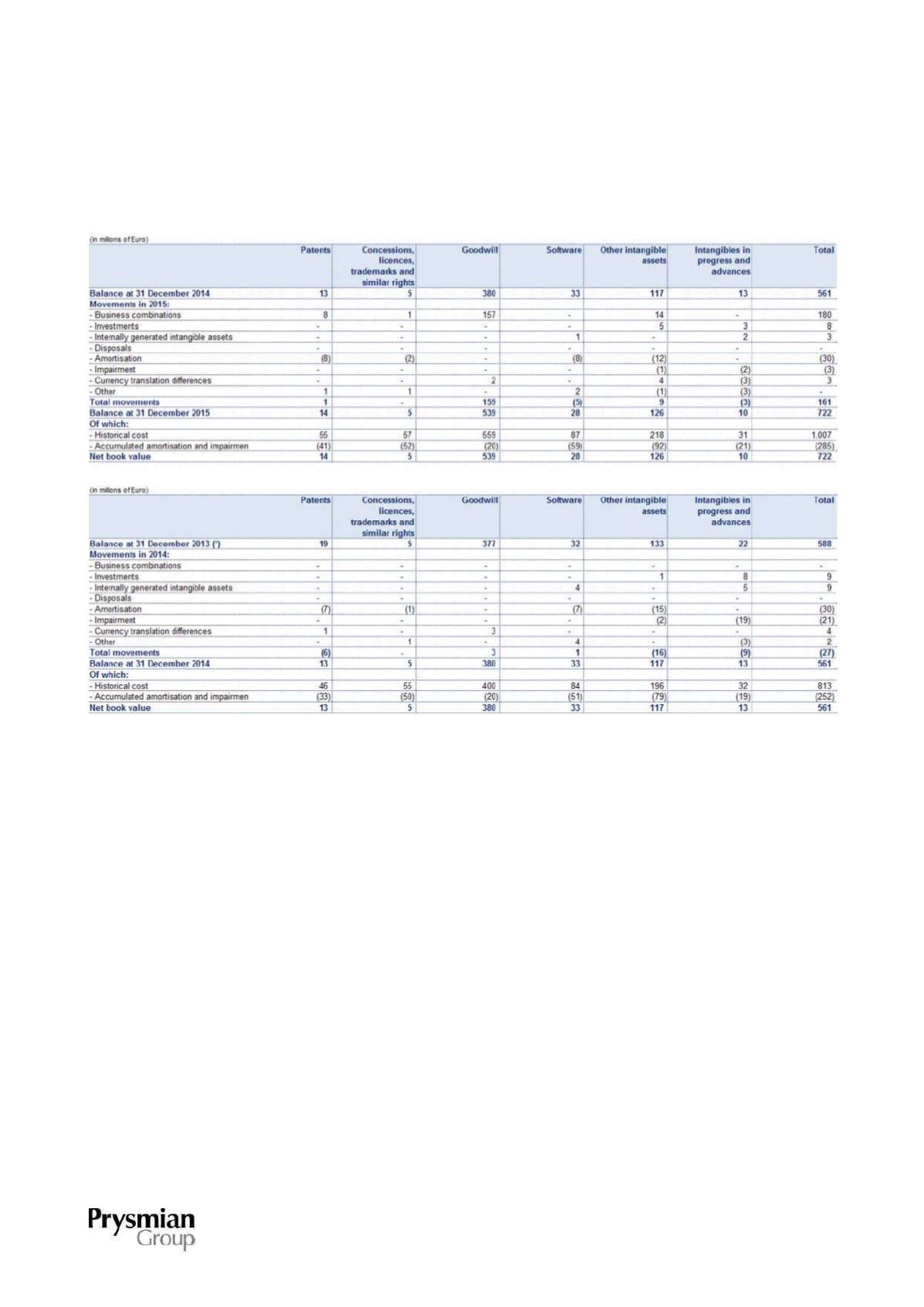

2. INTANGIBLE ASSETS

Details of this line item and related movements are as follows:

(*)

The previously published prior year consolidated financial statements have been restated following the adoption of IFRS 10 and IFRS

11.

Gross capital expenditure on intangible assets came to Euro 11 million in 2015, and primarily referred to:

Euro 3 million for continuation of the SAP Consolidation project, aimed at standardising the

information system throughout the Group;

Euro 5 million finite-life intangible assets acquired separately from but in connection with the

acquisition of an additional equity interest in Oman Cables Industry SAOG;

the remainder for specific Research and Development projects.

As at 31 December 2015, the Prysmian Group had capitalised Euro 539 million in Goodwill. As described

earlier, the acquisition in 2015 of the US company Gulf Coast Downhole Technologies has resulted in the

recognition of Euro 18 million in goodwill, while the acquisition of the majority stake in Oman Cables Industry

(SAOG) has resulted in the recognition of Euro 139 million in goodwill.