PRYSMIAN GROUP | DIRECTORS’ REPORT

36

Source: Nasdaq OMX December 2015

The geographical ownership structure confirms the predominant presence of the United States, whose

investors hold 31% of institutional investor total, up from 2014, followed by the United Kingdom, which

accounted for about 18% at the end of 2015. At the end of 2015 Italy accounted for around 16% of the

capital held by institutional investors, up from 2014, while France's share fell to 8%. The proportion of Asian

investors was stable.

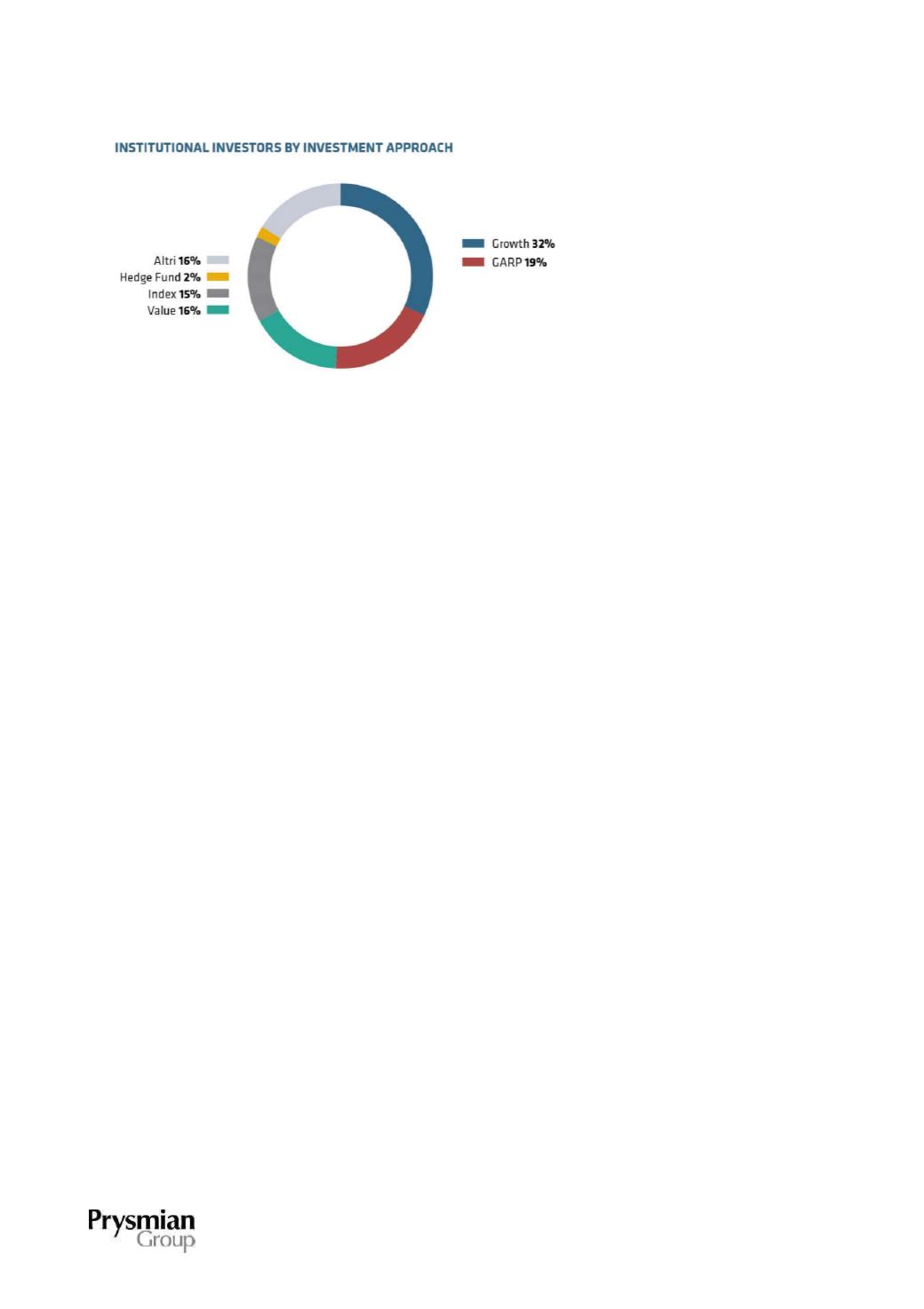

Approximately 67% of the share capital held by institutional investors is represented by investment funds

with Value, Growth or GARP strategies, therefore focused on a medium to long-term investment horizon.

The proportion of investors adopting an Index investment strategy, based on the principal stock indexes, was

slightly higher than the previous year, while the Hedge Fund component, focused on a shorter time horizon,

reduced its weight to 2% of the total.

ANNUAL GENERAL MEETING

The Annual General Meeting of shareholders confirmed its confidence in the current management team by

voting with a large majority (over 79% of voters) for the list of directors proposed by management itself.

The Annual General Meeting of the shareholders of Prysmian S.p.A. was held on 16 April 2015 in single call

to vote on several agenda items, including the approval of the 2014 financial statements, the renewal of the

Board of Directors, the conferral of the statutory audit engagement for financial years 2016 - 2024, the

authorisation of a share buy-back and disposal programme, the approval of an incentive plan for Group

employees, the authorisation of a bonus capital increase serving the incentive plan and a consultation on

remuneration policies. The meeting, which was attended by over one thousand shareholders, in person or by

proxy, representing more than 55% of the share capital, approved every item on the agenda by a large

majority (more than 95%) and it renewed its confidence in the management team by giving a wide majority

vote (over 79%) to the list of directors proposed by management itself.