PRYSMIAN GROUP | DIRECTORS’ REPORT

38

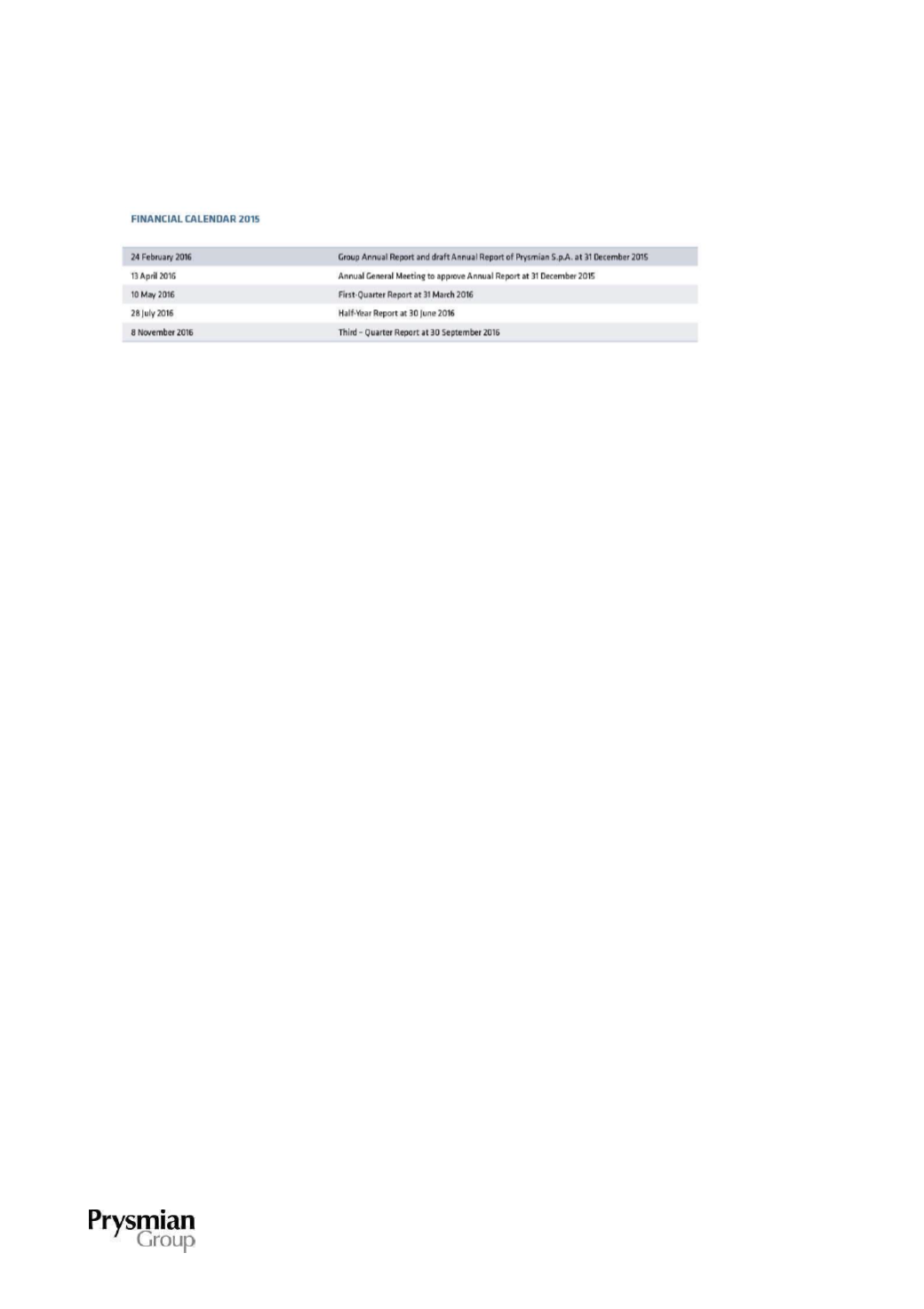

Financial Calendar 2016

FINANCIAL MARKET PERFORMANCE

The macro environment in 2015 displayed improvement in Europe and stabilisation in growth in the United

States but signs of slowdown in the principal emerging economies.

Prysmian S.p.A. has been listed on the Italian Stock Exchange on 3 May 2007 and since September 2007

has been included in the FTSE MIB index, comprising the top 40 Italian companies by capitalisation and

stock liquidity. The Prysmian stock has since entered the principal world and sector indexes, including the

Morgan Stanley Capital International index and the Dow Jones Stoxx 600, made up of the world's largest

companies by capitalisation, and the FTSE ECPI Italia SRI Leaders, composed of a select basket of stocks

of Italian companies that demonstrate excellent Environmental, Social and Governance (ESG) practice.

World economic growth rates retreated in 2015 compared with 2014; this was mainly a reflection of slower

growth by emerging economies, as partially offset by a gradual recovery in the Eurozone and stabilisation of

growth in the United States. Emerging country weakness was primarily attributable to geopolitical problems

in Russia, and the sharp downturn by the Brazilian economy, struggling with high inflation, collapse of the

local currency and falling investment. The growing signs of economic slowdown in China, combined with

steep currency devaluation, prompted the government to introduce significant stimulus measures; however,

this did not prevent the worst GDP growth in the past 25 years from being recorded. The United States

maintained a solid pace of growth in 2015, thanks to a continued rise in employment and lower energy prices,

which helped support domestic consumption, while exports were hurt by the stronger dollar. In Europe, the

economic recovery benefited from measures introduced by the European Central Bank early in the year,

especially in those areas that had suffered in 2014 (Italy, Spain, Portugal), and from the depreciation of the

euro against the US dollar, as well as lower energy costs. Nevertheless, the increasing uncertainty linked to

fears of a possible Greek exit from the Eurozone gradually dampened growth prospects over the course of

the year.

The main world equity markets generally reflected this scenario, with Eurozone indexes displaying strong

growth (FTSE MIB: +12.7%; CAC40 +8.5%; DAX +9.6%). In the US, the Dow Jones Industrial was adversely

affected by exchange rates and lost -2.2%, while the Nasdaq climbed +8.43%. In sharp contrast was Brazil (-

13.3%), hit hard by the effects of the country's economic and political crisis. In China, the Hong Kong Hang