PRYSMIAN GROUP | DIRECTORS’ REPORT

62

Adjusted EBITDA for 2015 came to Euro 243 million, up Euro 4 million (+2.1%) from Euro 239 million in 2014.

The following paragraphs describe market trends and financial performance in each of the business areas of

the Energy Products operating segment.

ENERGY & INFRASTRUCTURE

(*)

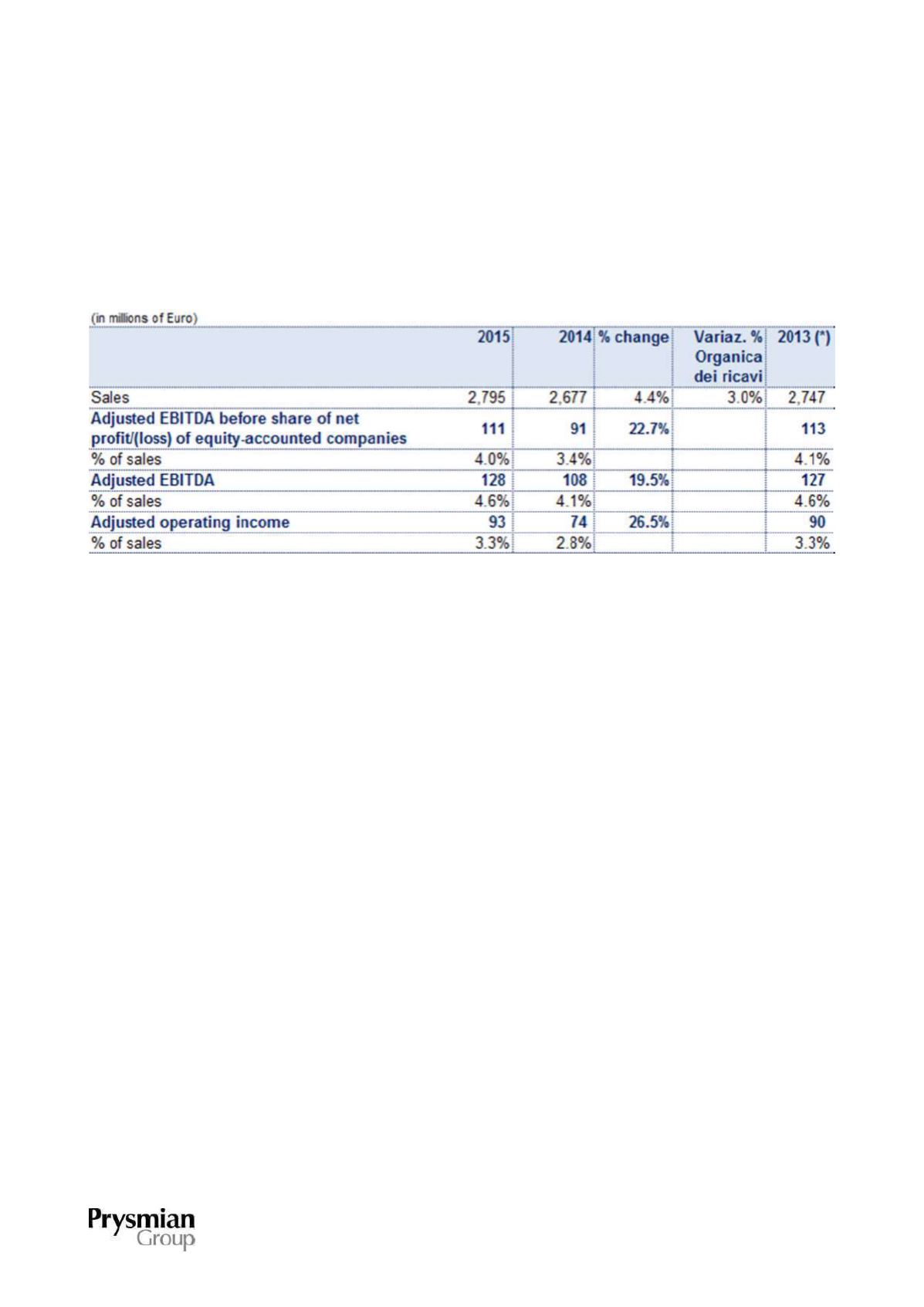

The originally published 2013 figures have been restated following the introduction of IFRS 10 and IFRS 11 and a new method of

classifying the share of net profit (loss) of associates and joint ventures.

Prysmian produces high and medium voltage cable systems to connect industrial and/or civilian buildings to

primary distribution grids and low voltage cables and systems for

power distribution

and the wiring of

buildings. All the products offered comply with international standards regarding insulation, fire resistance,

smoke emissions and halogen levels. The low voltage product portfolio includes rigid and flexible cables for

distributing power to and within

residential and commercial buildings

. The Group concentrates product

development and innovation activities on high performance cables, such as Fire-Resistant and Low Smoke

zero Halogen cables, capable of guaranteeing specific safety standards. The product range has been

recently expanded to satisfy cabling demands for infrastructure such as airports, ports and railway stations,

by customers as diverse as international distributors, buying syndicates, installers and wholesalers.

MARKET OVERVIEW

The reference markets have distinct geographical characteristics (despite international product standards)

both in terms of customer and supplier fragmentation and the range of items produced and sold.

The year 2015 witnessed some stabilisation in the construction market, uncertainty about whose future

prospects had paralysed the buying plans of the industry's main players and exacerbated the pressure on

sales prices during 2014.

This translated into a slight recovery in volumes particularly in some European markets (North Europe and

United Kingdom), while demand in the rest of the continent remained low with generally stable prices and a

sharp decline in Russia.