PRYSMIAN GROUP | DIRECTORS’ REPORT

66

(Maintenance, Repair and Operations) and offshore. The business's overall profitability was adversely

affected by the sharp drop in higher-margin MRO volumes, particularly in the North Sea and the United

States, and by the reduction in offshore projects; this trend reflects the reduction in investments, especially in

more capital intensive sectors like offshore, as a result of the collapse in oil prices.

The strategy of technological specialisation of its solutions allowed Prysmian Group to consolidate its

Elevator market leadership in North America and to expand into the Chinese and European markets; its

exposure to the European market in particular was still marginal although significantly greater than in the

previous year.

The Automotive business reported a slowdown in activity as a result of the increasing competitive pressure

being put on the Prysmian Group at the lower end of the market by countries with lower labour costs and by

cable installers tending to intercept the market upstream. During 2015, the Group embarked on a process of

focusing on the high-end segments of its business portfolio in order to secure medium-term margin growth,

which has permitted a gradual recovery of market share, particularly in the last few months of the year.

Lastly, although the Network Components business area reported positive results on the Chinese market,

also supported by local production at the Suzhou plant, and an improvement in demand in North America,

these were offset by the weakness in Brazil and in the High Voltage sector in Europe.

Given the factors described above, Adjusted EBITDA for 2015 came to Euro 113 million, down from Euro

126 million in the previous year.

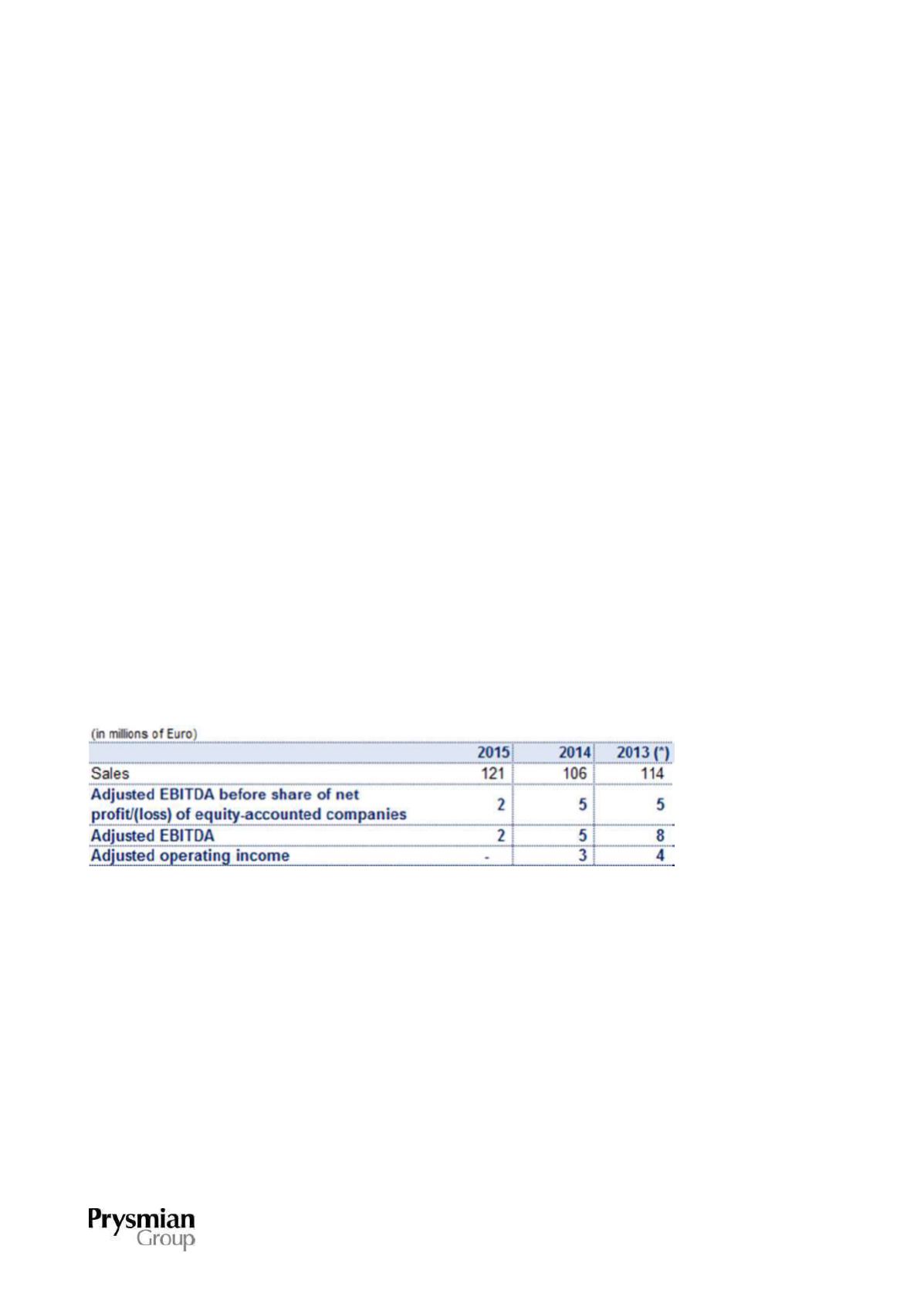

OTHER

(*)

The originally published 2013 figures have been restated following the introduction of IFRS 10 and IFRS 11 and a new method of

classifying the share of net profit (loss) of associates and joint ventures.

This business area encompasses occasional sales by Prysmian Group operating units of intermediate goods,

raw materials or other products forming part of the production process. These sales are normally linked to

local business situations, do not generate high margins and can vary in size from period to period.