PRYSMIAN GROUP | DIRECTORS’ REPORT

72

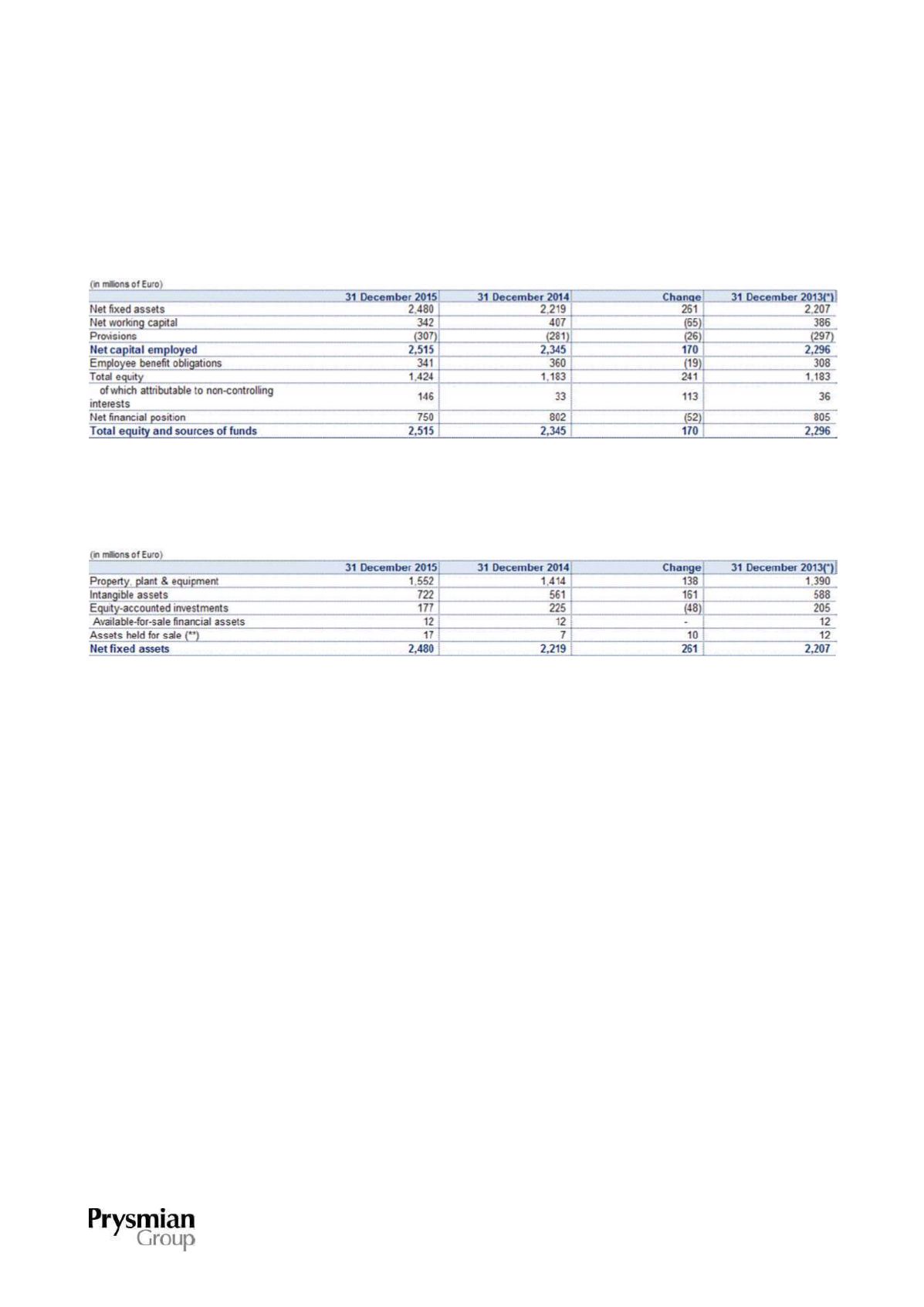

GROUP STATEMENT OF FINANCIAL POSITION

RECLASSIFIED STATEMENT OF FINANCIAL POSITION

(*)

The originally published 2013 figures have been restated following the introduction of IFRS 10 and IFRS 11.

NET FIXED ASSETS

(*)

The originally published 2013 figures have been restated following the introduction of IFRS 10 and IFRS 11.

(**)

This includes the value of Land and Buildings classified as held for sale

.

Net fixed assets amounted to Euro 2,480 million at 31 December 2015, compared with Euro 2,219 million at

31 December 2014, posting an increase of Euro 261 million mainly due to the combined effect of the

following factors:

Euro 215 million in capital expenditure on property, plant and equipment and intangible assets;

Euro 275 million in increases for business combinations completed during 2015;

Euro 171 million in depreciation, amortisation and impairment charges for the year;

Euro 10 million in decreases for disposals;

Euro 48 million in net decrease in equity-accounted investments, primarily reflecting:

o

an increase of Euro 39 million for the share of net profit/(loss) of equity-accounted companies;

o

a decrease of Euro 17 million for dividend receipts;

o

a net decrease of Euro 69 million as a result of now consolidating Oman Cables Industry (SAOG)

line-by-line.