PRYSMIAN GROUP | DIRECTORS’ REPORT

77

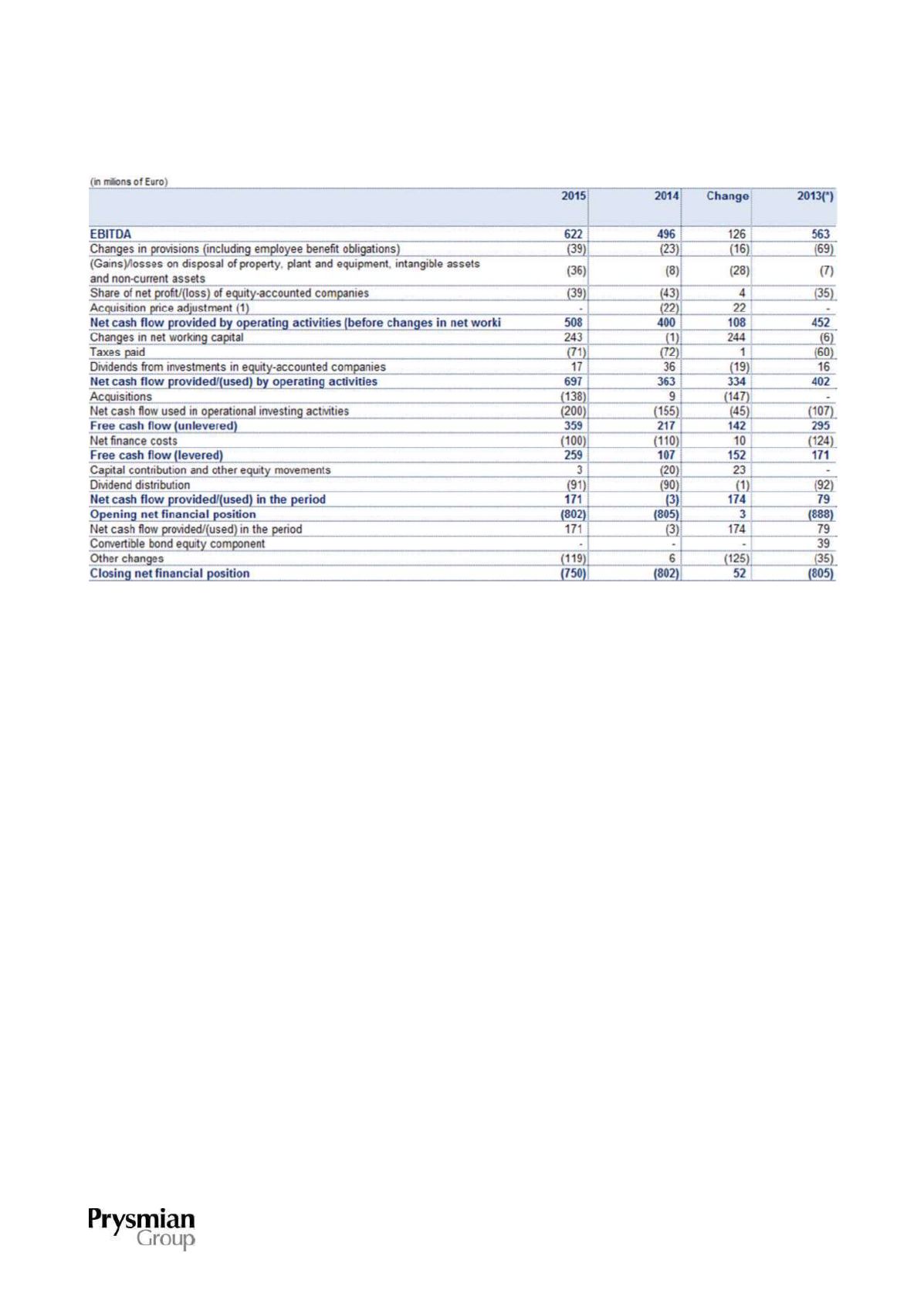

STATEMENT OF CASH FLOWS

(*)

The originally published 2013 figures have been restated following the introduction of IFRS 10 and IFRS 11 and a new method of

classifying the share of net profit (loss) of associates and joint ventures.

(1) This refers to the acquisition in November 2012 of Global Marine Systems Energy Ltd (now renamed Prysmian PowerLink Services

Ltd) from Global Marine Systems Ltd.

Net cash flow provided by operating activities (before changes in net working capital) amounted to Euro 508

million at the end of 2015. Cash flow of Euro 243 million was provided by the decrease in net working capital.

After accounting for Euro 71 million in tax payments and Euro 17 million in dividend receipts from equity-

accounted companies, net cash flow from operating activities was a positive Euro 697 million for the year.

The net outlay in the year for acquisitions and disposals of equity investments came to Euro 138 million,

mainly attributable to the acquisition of Gulf Coast Downhole Technologies for Euro 32 million and Oman

Cables Industry (SAOG) for Euro 105 million.

Net operating capital expenditure of Euro 200 million was primarily attributable to projects to increase,

rationalise and technologically upgrade production capacity and to develop new products (Euro 92 million),

to projects to improve industrial efficiency and rationalise production capacity (Euro 64 million), to structural

work related to construction of the Group's new headquarters in the Bicocca district of Milan, and to

refurbishment and other work on buildings and production lines to comply with the latest regulations (Euro 48

million).

During the year a total of Euro 100 million in net finance costs were paid as well as Euro 91 million in

dividends to shareholders.