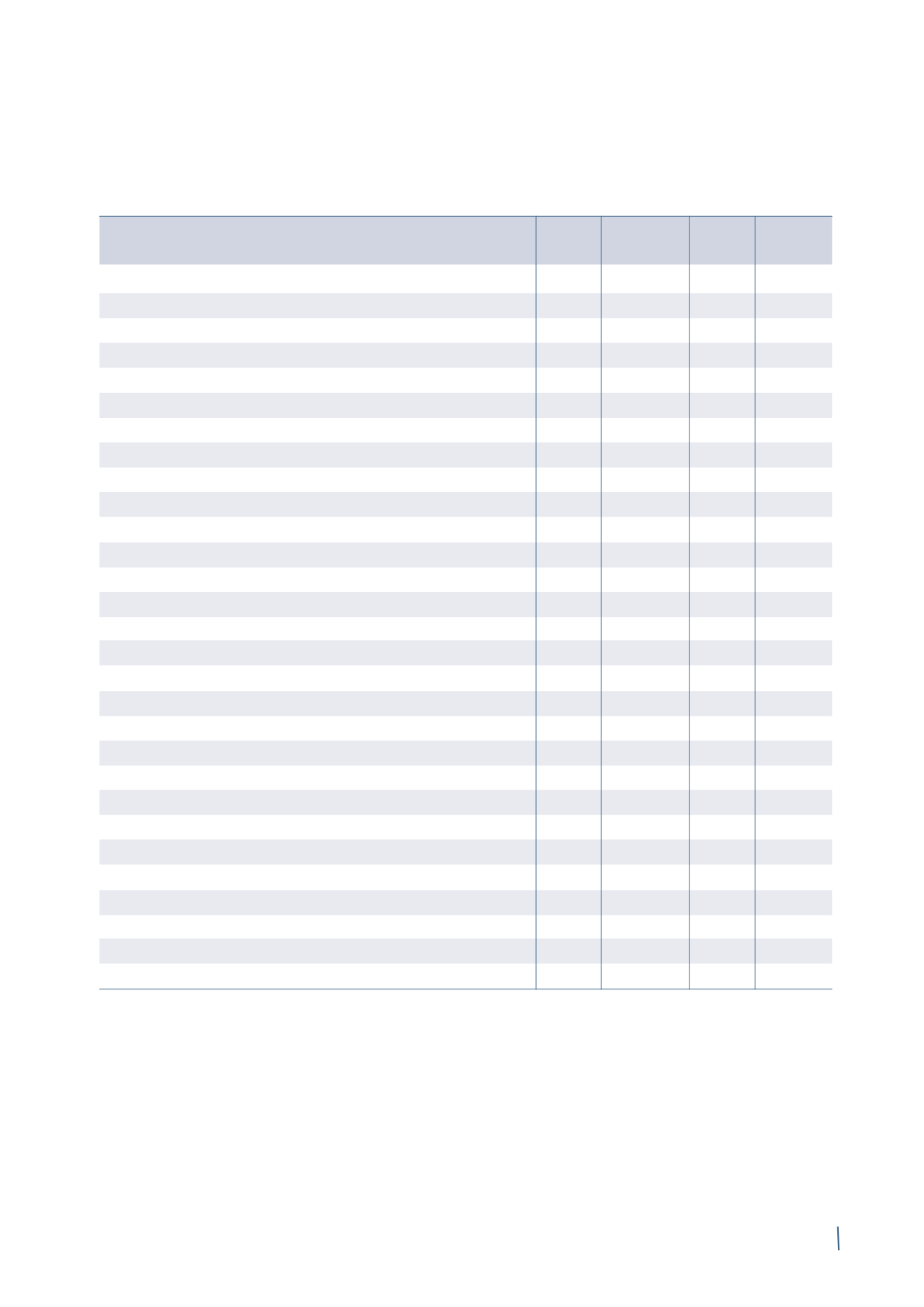

125

Note

2014

of which

2013 (*)

of which

related parties

related parties

(Note 33)

(Note 33)

Sales of goods and services

17

6,840

43

6,995

52

Change in inventories of work in progress, semi-finished and finished goods

18

28

28

Other income

19

113

3

62

6

of which non-recurring other income

36

37

10

Raw materials, consumables used and goods for resale

20

(4,303)

(20)

(4,368)

(12)

Fair value change in metal derivatives

7

(8)

Personnel costs

21

(948)

(6)

(945)

(16)

of which non-recurring personnel costs

36

(52)

(34)

of which personnel costs for stock option fair value

(3)

(14)

Amortisation, depreciation, impairment and impairment reversal

22

(188)

(173)

of which non-recurring impairment and impairment reversal

36

(44)

(25)

Other expenses

23

(1,280)

(1)

(1,258)

(1)

of which non-recurring other expenses and releases

36

2

(26)

Share of net profit/(loss) of equity-accounted companies

24

43

43

35

35

Operating income

312

368

Finance costs

25

(479)

(435)

of which non-recurring finance costs

36

(18)

(22)

Finance income

26

339

285

of which non-recurring finance income

36

4

-

Dividens from other companies

-

-

Profit/(loss) before taxes

172

218

Taxes

27

(57)

(65)

Net profit/(loss) for the year

115

153

Attributable to:

Owners of the parent

115

149

Non-controlling interests

-

4

Basic earnings/(loss) per share (in Euro)

28

0.54

0.71

Diluted earnings/(loss) per share (in Euro))

28

0.54

0.71

(*) The previously published prior year comparative figures have been restated following the introduction of IFRS 10 and IFRS 11 and a new method of classifying

the share of net profit/(loss) of associates and joint ventures. Further details can be found in Section C. Restatement of comparative figures.

CONSOLIDATED INCOME STATEMENT

(in millions of Euro)