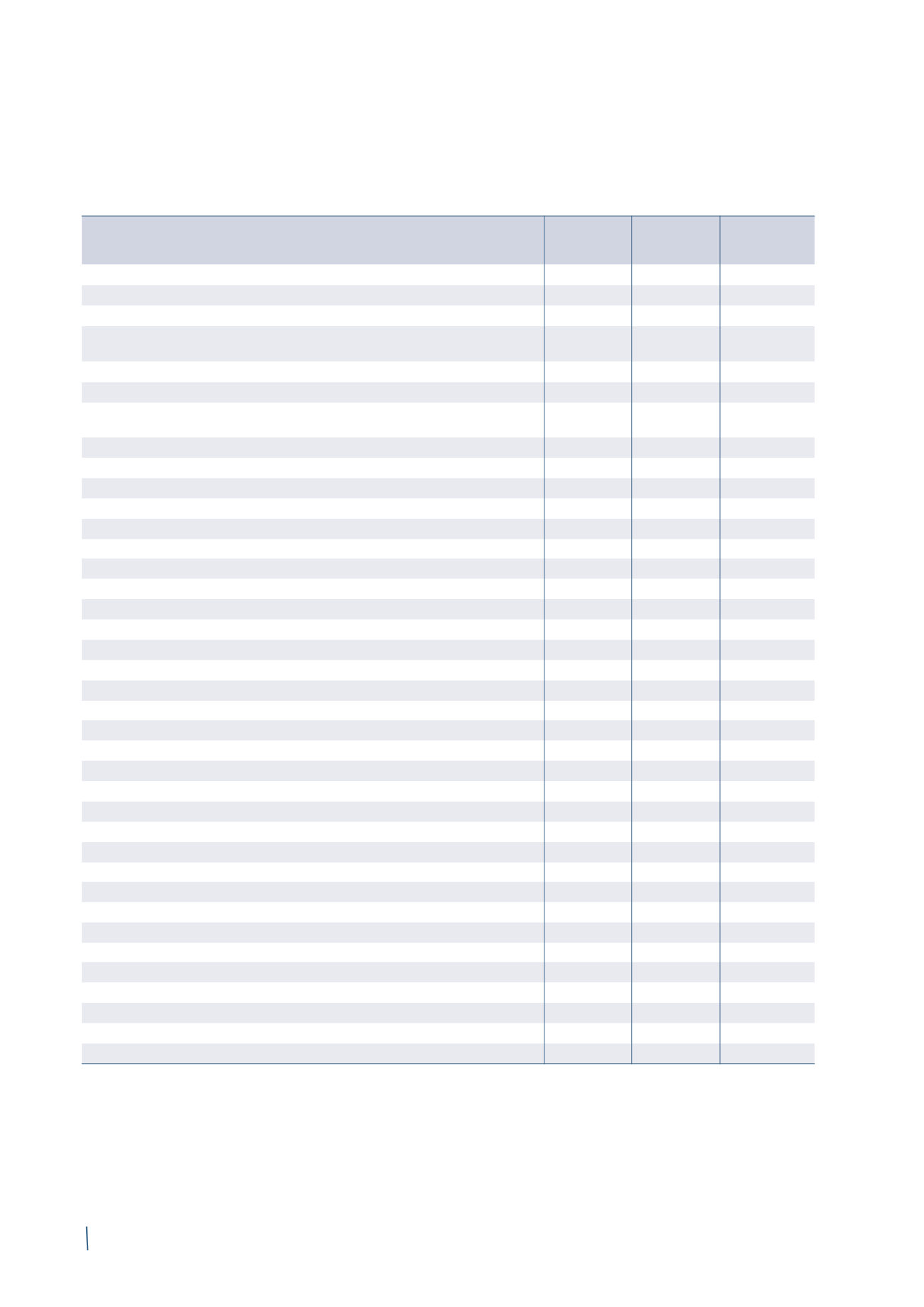

2014 Annual Report

Prysmian Group

128

Consolidated Financial Report

2014

of which

2013 (*)

of which

related parties

related parties

(Note 33)

(Note 33)

Profit/(loss) before taxes

172

218

Depreciation, impairment and impairment reversals of property, plant and equipment 137

141

Amortisation and impairment of intangible assets

51

32

Net gains on disposal of property, plant and equipment,

intangible assets and acquisition purchase price adjustment

(30)

(7)

Share of net profit/(loss) of equity-accounted companies

(43)

(43)

(35)

(35)

Share-based payments

3

14

Fair value change in metal derivatives

and other fair value items

(7)

8

Net finance costs

140

150

Changes in inventories

(76)

(58)

Changes in trade receivables/payables

(16)

4

144

7

Changes in other receivables/payables

90

(12)

(93)

12

Changes in receivables/payables for derivatives

1

1

Taxes paid

(72)

(60)

Dividends received from equity-accounted companies

36

36

16

16

Utilisation of provisions (including employee benefit obligations)

(193)

(154)

Increases in provisions (including employee benefit obligations)

170

85

A. Net cash flow provided by/(used in) operating activities

363

402

Acquisitions

(1)

9

-

Investments in property, plant and equipment

(143)

(95)

Disposals of property, plant and equipment and assets held for sale

6

6

Investments in intangible assets

(18)

(18)

Investments in financial assets held for trading

(8)

(40)

Disposals of financial assets held for trading

25

7

B. Net cash flow provided by/(used in) investing activities

(129)

(140)

Capital contributions and other changes in equity

-

-

Dividend distribution

(90)

(92)

Purchase of treasury shares

(20)

-

EIB Loan

100

-

Proceeds from convertible bond

(2)

-

296

Early repayment of credit agreement

(184)

(486)

Finance costs paid

(3)

(440)

(373)

Finance income received

(4)

330

249

Changes in other net financial payables

46

(103)

C. Net cash flow provided by/(used in) financing activities

(258)

(509)

D. Currency translation gains/(losses) on cash and cash equivalents

8

(30)

E. Total cash flow provided/(used) in the year (A+B+C+D)

(16)

(277)

F.

Net cash and cash equivalents at the beginning of the year

510

787

G. Net cash and cash equivalents at the end of the year (E+F)

494

510

(*) The previously published prior year comparative figures have been restated following the introduction of IFRS 10 and IFRS 11 and a new method of classifying

the share of net profit/(loss) of associates and joint ventures. Further details can be found in Section C. Restatement of comparative figures.

(1) This refers to the receipt of Euro 15 million for the purchase price adjustment regarding Global Marine Systems Energy Ltd (now renamed Prysmian

PowerLink Services Ltd) and to the outlay of Euro 6 million for the acquisition of the remaining 34% of the subsidiary AS Draka Keila Cables.

(2) The Bond became convertible following the resolution adopted by the Shareholders’ Meeting on 16 April 2013.

(3) Finance costs paid of Euro 440 million include Euro 53 million in interest payments in 2014 (Euro 65 million in 2013).

(4) Finance income received of Euro 330 million includes Euro 7 million in interest income (Euro 7 million in 2013).

CONSOLIDATED STATEMENT OF CASH FLOWS

(in millions of Euro)