2014 Annual Report

Prysmian Group

126

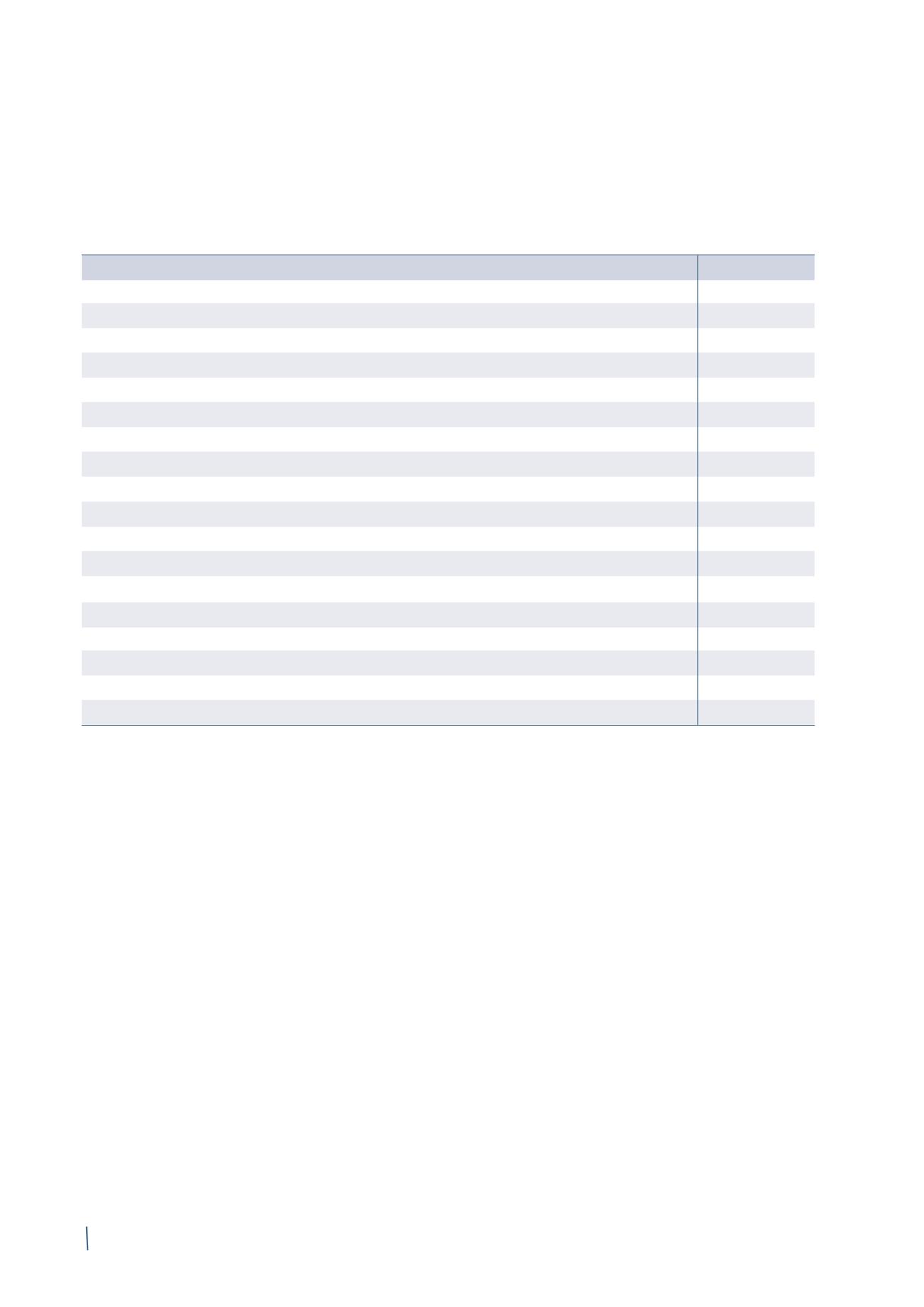

Consolidated Financial Report

2014

2013 (*)

Net profit/(loss) for the year

115

153

Comprehensive income/(loss) for the year:

- items that may be reclassified subsequently to profit or loss:

Fair value gains/(losses) on cash flow hedges - gross of tax

(8)

9

Fair value gains/(losses) on cash flow hedges - tax effect

2

(4)

Release of cash flow hedge reserve after discontinuing cash flow hedging - gross of tax

4

15

Release of cash flow hedge reserve after discontinuing cash flow hedging - tax effect

(1)

(5)

Currency translation differences

32

(96)

Total items that may be reclassified, net of tax

29

(81)

- items that will NOT be reclassified subsequently to profit or loss:

Actuarial gains/(losses) on employee benefits - gross of tax

(50)

3

Recognition of pension plan asset ceiling

8

-

Actuarial gains/(losses) on employee benefits - tax effect

11

(2)

Total items that will NOT be reclassified, net of tax

(31)

1

Total comprehensive income/(loss) for the year

113

73

Attributable to:

Owners of the parent

111

71

Non-controlling interests

2

2

(*) The previously published prior year consolidated financial statements have been restated following the adoption of IFRS 10 and IFRS 11. Further details can

be found in Section C. Restatement of comparative figures.

CONSOLIDATED STATEMENT OF

COMPREHENSIVE INCOME

(in millions of Euro)