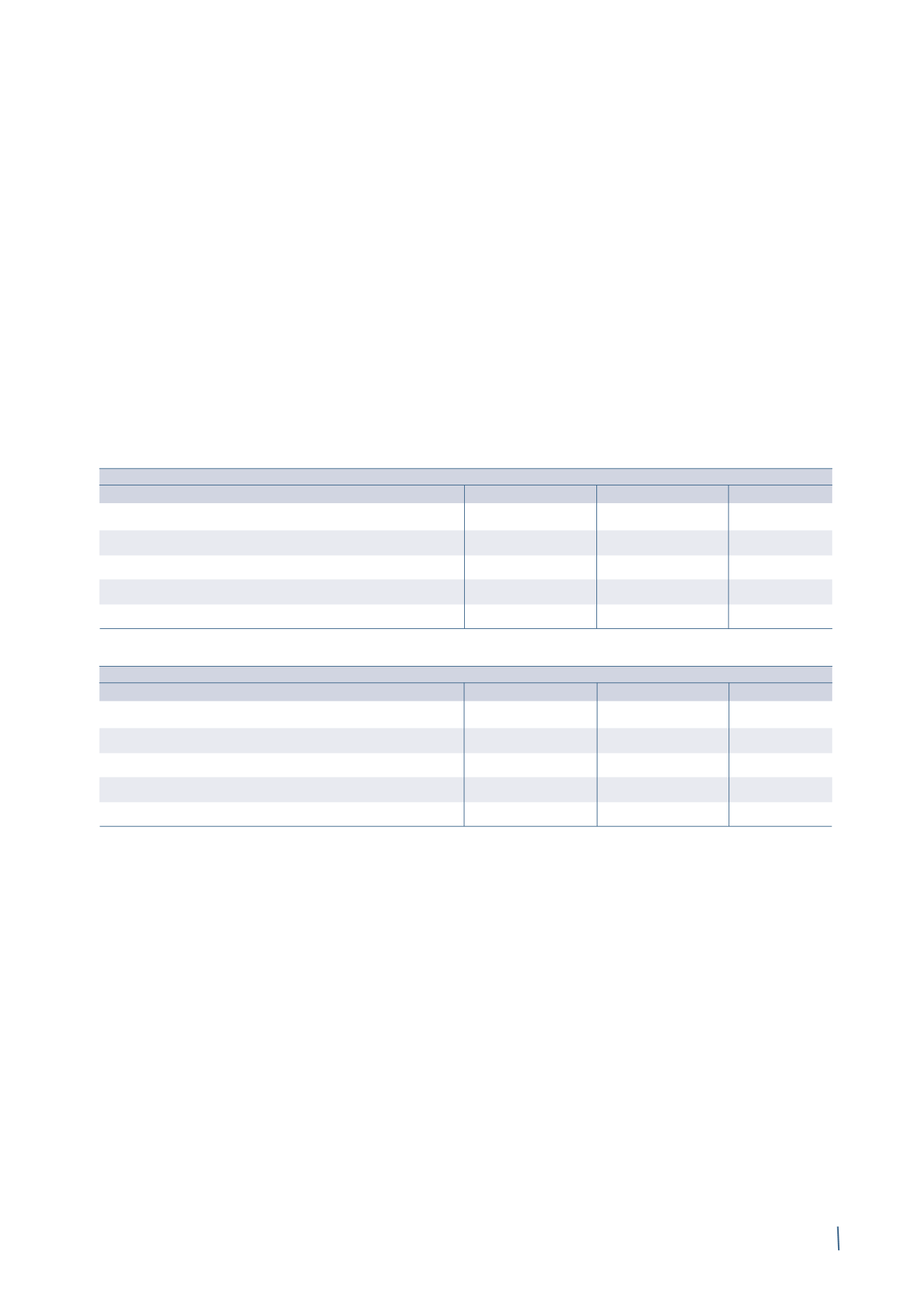

285

31 December 2013

Due within 1 year

Due between 1-2 years

Due between 2-5 years

Due after 5 years

Borrowings from banks and other lenders

140,204

418,298

672,715

-

Finance lease obligations

778

651

1,954

10,626

Derivatives

88

36

-

-

Trade and other payables

325,051

-

-

-

Total

466,121

418,985

674,669

10,626

31 December 2014

Due within 1 year

Due between 1-2 years

Due between 2-5 years

Due after 5 years

Borrowings from banks and other lenders

474,328

420,612

348,484

8,337

Finance lease obligations

699

652

1,911

9,960

Derivatives

176

-

-

-

Trade and other payables

255,320

-

-

-

Total

730,523

421,264

350,395

18,297

(d) Credit risk

The Company does not have significant concentrations of

credit risk insofar as almost all its customers are companies

belonging to the Group. There are also no significant past due

receivables that have not been written down.

(e) Liquidity risk

Prudent management of the liquidity risk arising from the

Company's normal operations involves the maintenance of

adequate levels of cash and cash equivalents, short-term

securities and funds obtainable from an adequate amount of

committed credit lines. The Company's Finance Department

prefers flexibility when sourcing funds by using committed

credit lines.

At 31 December 2014, cash and cash equivalents stood at

Euro 2,314 thousand, compared with Euro 4,600 thousand

at 31 December 2013. The Company can draw down on the

credit lines granted to the Group in the form of the Revolving

Credit Facility 2011 (Euro 400 million), the Revolving Credit

Facility 2014 (Euro 100 million) and the Syndicated Revolving

Credit Facility 2014 (Euro 1,000 million). More details can be

found in the Explanatory Notes to the Consolidated Financial

Statements (Section D. Financial risk management).

The following table presents an analysis, by due date, of the

payables and liabilities settled on a net basis. The various due

date categories refer to the period between the reporting date

and the contractual due date of the obligations.

(in thousands of Euro)

(in thousands of Euro)